Presented by:

Hey everyone,

Happy holidays from the CDG team.

As we head into 2026, our goal is simple: Get 1% better every day—our content, our sources, how we deliver it, and how useful it is to you on the ground.

If there’s something we should do more of (or less of), we want to hear it.

— CDG

First time reading the CDG Newsletter?

Welcome to the Market Pulse—your no-fluff cheatsheet to auto retail, built to help dealers price right, stock smart, and stay ahead.

Affordability is shrinking the buyer pool: Fewer shoppers can realistically transact at ~$50K prices, ~6.6% rates, and $750+ payments.

Credit friction is slowing deals in the middle of the funnel: Approvals are taking longer, borderline deals are stalling, and more deals are being decided by how well stores manage momentum during delays.

EV policy volatility is raising the cost of inventory mistakes: Heading into 2026, OEM direction is still shifting, off-lease EV supply is coming back, and overcommitting to any one mix carries more downside than before.

(Source: Cox Automotive, Experian, Federal Reserve, Point Predictive, S&P Global Mobility)

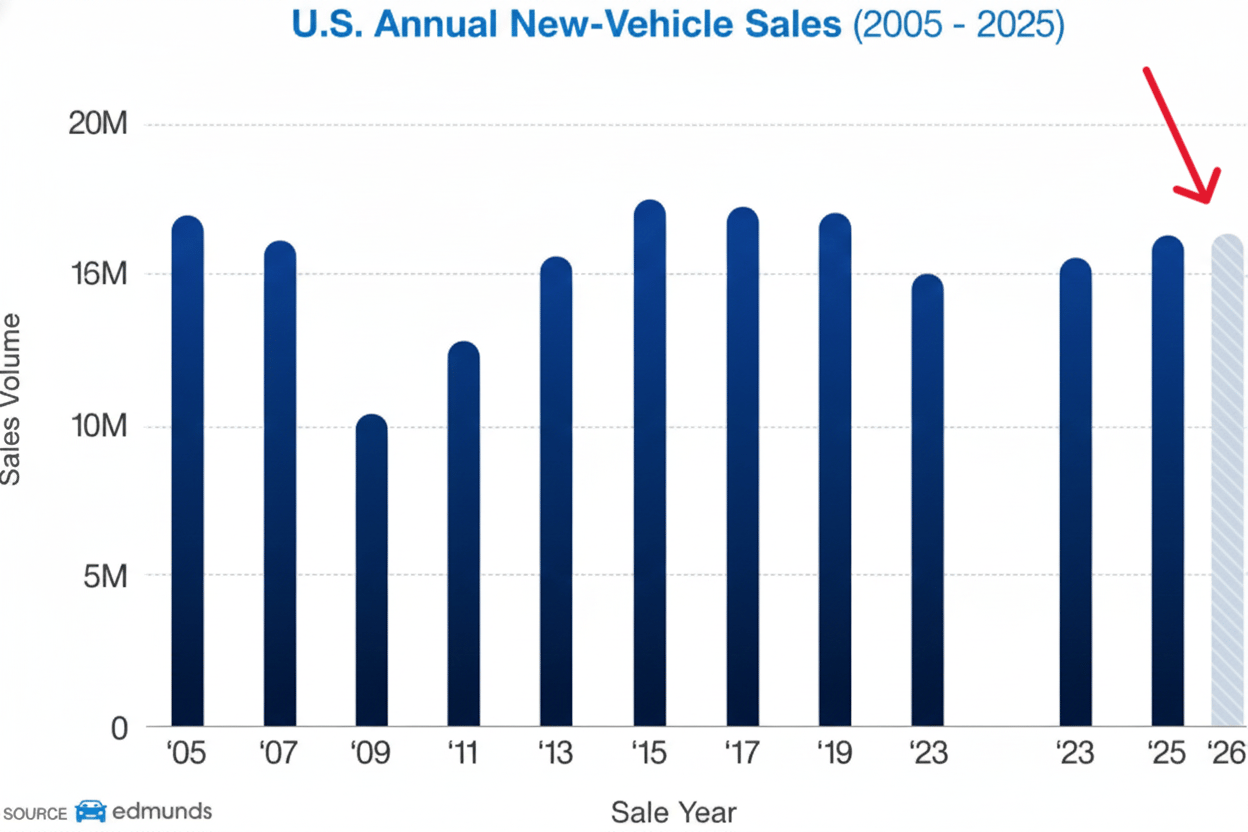

Affordability limits are capping how many buyers can transact in 2026.

This year, we saw new-vehicle prices hover near $50,000, loan rates stay around 6.6%, and monthly payments stick near $750–$770.

Sales volume held up, largely because buyers stretched terms, leaned harder on trade-ins, or had the income to absorb the payment.

With that, though, delinquencies climbed to a 15-year high, and subprime buyers fell out of the market faster as payments caught up with them.

Heading into 2026, most dealers don’t expect that picture to meaningfully improve.

And neither does Edmunds, which forecasts new-vehicle sales to remain essentially flat next year at ~16M units, with affordability still the biggest constraint, even as interest rates ease slightly.

via Edmunds

NOTE TO DEALERS:

Most operators we talk to are planning for a smaller, more polarized buyer pool in 2026.

What that looks like in practice:

Dealers like JR Toothman are leaning harder into used, CPO, and off-lease mix as price-sensitive buyers redirect

Others, meanwhile, are pushing leases where the monthly math works, rather than stretching terms

And being more selective about which deals get desked aggressively, and which don’t.

Tighter credit and verification rules are slowing approvals across the sales funnel.

In 2025, auto lenders faced a record $9.2B in fraud exposure, driven by first-party misrepresentation, credit washing, and synthetic identities.

At the same time, roughly 5% of auto borrowers were 90+ days past due on their auto loans.

Source: Federal Reserve Bank of New York via YCharts

Unsurprisingly, that combination changed lender behavior.

More verification became standard. Documentation increased. And borderline deals (especially near-prime and subprime) started taking longer to resolve or getting kicked back entirely.

Much like on the affordability side, most dealers aren’t expecting that friction to ease much.

Because even if rates drift lower, lenders are unlikely to loosen standards quickly, given that fraud risk hasn’t softened, and while delinquency growth has recently slowed, overall levels remain elevated enough to keep lenders cautious.

WHY IT MATTERS:

For dealers, 2026 approvals are likely to feel more predictable than 2024, but not meaningfully easier than 2025.

That stability creates a second shot at fixing what slowed deals down this year.

And it’s why some operators, like Marcello Sciarrino, are simplifying the parts of the deal they can control:

Think pricing and trades. Fewer conditions. Fewer “gotchas.” Clearer all-in numbers upfront.

A quick word from our partner

If you're struggling to acquire quality used cars off the street, you need to hear this.

BuyCenter.com helps dealers tap into a private network of millions of sellers actively querying their vehicle just before selling, sourced from three leading vehicle history report websites.

Your offer appears seconds after a seller completes an appraisal form during the funnel.

Reach motivated sellers before they go anywhere else.

Get started with a simple integration and pay only when you acquire a car.

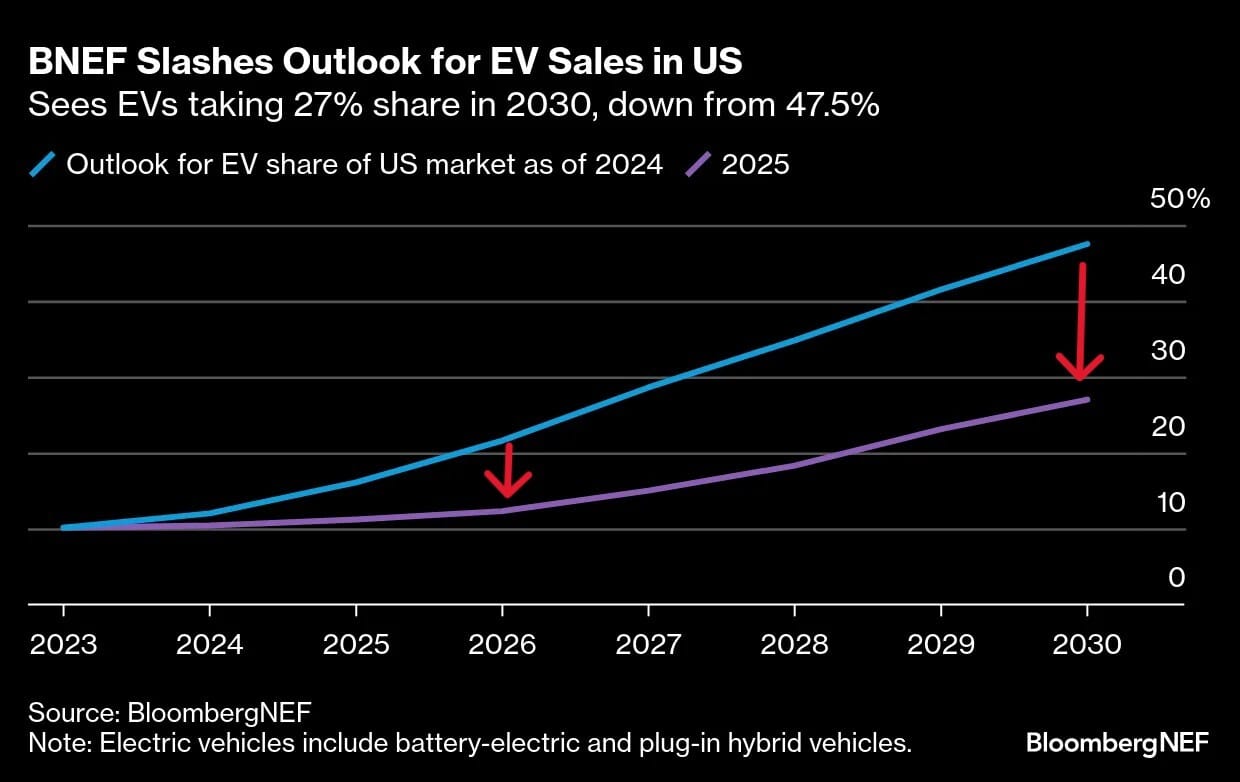

Policy-driven EV demand swings are complicating inventory and incentive planning.

Fred Emich, partner at Emich Automotive, described 2025 as “wartime” for EV planning, and that framing fits how the year actually unfolded.

That tension showed up most clearly around incentive timing.

Ahead of the federal $7,500 tax credit expiration, buyers pulled purchases forward aggressively, pushing EVs to roughly 10.5% of new-vehicle sales in Q3.

Once incentives rolled off, however, demand reset just as fast, falling back toward ~5% by late Q4.

Now, that pressure is carrying into 2026 and beyond.

Just look at this revised 5-year forecast from Bloomberg:

But with more off-lease and used EVs expected to return to the market, dealers will be managing not just new EV exposure, but downstream pricing, remarketing, and service implications as well.

NOTE TO DEALERS:

Jimmy Douglas, CEO of Plug, once told me the biggest EV bottleneck is actually framing. And with fewer incentives to lean on in 2026, that matters a lot.

“For some reason, electric vehicles have gotten wrapped up into an ideological debate, and some of the discourse is pretty far away from rational or data-driven, and that’s hurting the industry,” he said.

The upside: Dealers who can sell EVs (especially used ones) like any other option—based on use case, payment, and performance—are better positioned for whatever the next 12–18 months bring.

December has a way of stripping things down because you can see where operations held up, and where they didn’t.

That clarity matters heading into 2026, not because the market resets, but because it doesn’t.

Affordability stays tight. Credit stays selective. And new variables like vehicle tax policy changes, refund timing, tariffs, and USMCA negotiations can move buyer behavior just as quickly as incentives and rates did in 2025.

What does shift, though, is how dealers respond to the new year.

And right now, there’s a major push toward tighter operations taking hold: Fewer handoffs, cleaner integrations, and more dealer-owned or dealer-built solutions replacing loose vendor stacks.

With that in mind, I’d say 2026 could land slightly better than 2025, even if only at the margins. But only time will tell.

How do you expect your store/group to perform in 2026?

Missed yesterday’s episode of Daily Dealer Live?

Presented by:

Thomas on Dealership Security, Wise on Recruiting

Featured guests:

Karianne Thomas, Director of Security at Zeigler Auto Group

Brad Wise, Executive Manager at Ferman Chevrolet Mazda

The latest updates to CDG’s Recall Tracker, powered by BizzyCar.