Presented by:

Hey everyone,

Results from the CDG Q4 2025 Dealer Outlook Survey are in, and the delta from Q2 is hard to ignore.

Sentiment, priorities, and risk tolerance all moved in meaningful ways, especially around used inventory, staffing, and margin pressure.

Find the biggest takeaways and forward-looking signals in this week’s Market Pulse.

— CDG

First time reading a CDG Newsletter?

Welcome to The Breakdown, an analysis of auto retail’s top trends, moves, and insights—in under 5 minutes.

It's no secret… making money selling cars is getting harder.

As margins compress on the variable side of the dealership (car sales, finance, insurance), the fixed ops side of things (car service and parts) is still the hero of the P&L sheet.

But service business for the majority of dealers I’ve spoken to is already pretty phenomenal right now.

So, how do those stores grow another 10-15% in 2026 without burning out their staff or over booking their bays?

The answer for many dealers lately, is a compliance nuisance turned profit lever: vehicle recalls.

And after talking with several operators, analysts, and even the NHTSA, I've distilled three key ways dealers are outsmarting the recall mess and letting the money print itself...

Many dealers are aggressively mining their own data for recall work instead of waiting on OEM mailers.

Snail mail recall notifications have been the default for decades.

And while the NHTSA is working with OEMs to onboard digital alerts, there's still around 60 million cars on U.S. roads today with unfixed recalls—a 16% jump over recent years.

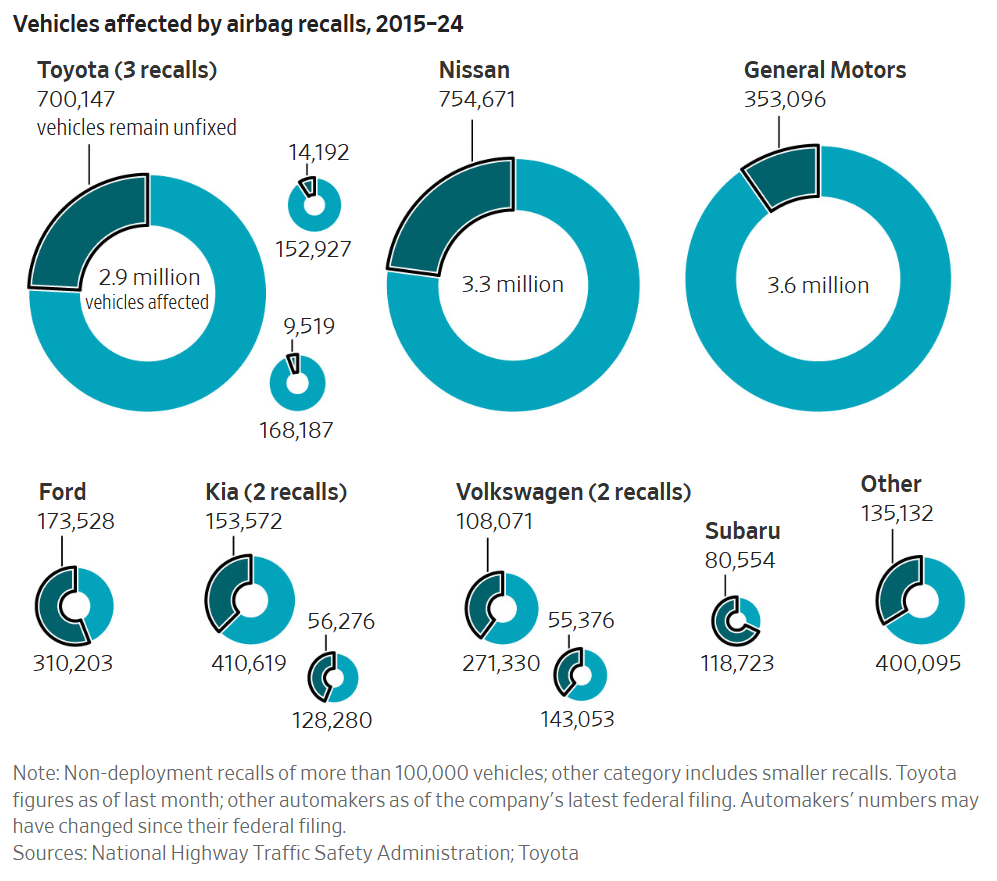

If we zoom into just airbag defects from 2015 to 2024, about 12 million vehicles were recalled and roughly 22% remain unfixed, according to a WSJ analysis.

via WSJ

That's a massive amount of manufacturer-paid repair orders just sitting in the wild for dealers to grab.

The problem: Steve Ward, general manager at Hyundai of Venice, told me that the overwhelming majority of customers have no idea there's an open recall until they contact the dealership.

"Manufacturers are going to do the bare minimum to satisfy the government. Beyond that, they put the burden on the dealer," he told me.

Steve Ward

Hyundai of Venice

But that's not an issue for Jay Tiniacos, service director at Sandy Sansing CDJR.

Jay is using AI-driven recall tools like BizzyCar, to scrub his customer database every night, flagging customers who haven't been in for 497 days, 900 days, over 1,000 days.

Then his team reaches out directly through text, email, and calls, explaining what the recall is, how long it takes, and when they can fit them in, reintroducing "dormant" customers back into the retailing lifecycle and strengthening those relationships.

The results: A 15% lift in revenue across the fixed ops department from 2024 to 2025.

A quick word from our partner

Seal the Service Revenue Cracks

Fixed ops can’t grow when only 3 in 10 customers return — and when 41% won’t return if their first call goes unanswered.

Impel’s Service AI with Voice AI seals the cracks by delivering proactive VIN-specific outreach automatically, capturing every missed call, and booking appointments by text and email in real time.

Your advisors stay focused on customers in front of them while AI ensures every customer gets answers fast.

One platform. Zero missed opportunities.

Mobile service is becoming a recall engine.

A year or two ago, mobile service was more or less considered a nice perk.

But in 2025, mobile service became the next logical evolution to make recall work just as convenient as Amazon or DoorDash.

"There's a reason two-thirds of consumers service at independent shops versus dealers—independents make it easy. Dealers have to start winning with customer experience. That means mobile service, service valet—offering all those options," Ryan Maher, CEO of BizzyCar told me.

Ryan Maher

BizzyCar

Jay experienced this firsthand when he launched mobile service operations this year. But the real unlock wasn't servicing individual retail customers in their driveways, it was going after commercial fleets.

Jay's team aggressively courts rental operations and auto auctions to knock out ROs in bulk.

The reason: It's easier revenue. The van handles mass recall volume without touching the main shop's bay capacity, and Jay's techs hand out cards and flyers everywhere they go to capitalize on that word-of-mouth marketing.

This reminded me of my recent podcast with Ed Roberts, COO of Bozard Ford Lincoln. Ed runs a monster mobile operation: 165 technicians and 37 service advisors servicing roughly 2,000 customers a month in the field.

"I love recalls because recalls are an opportunity to reintroduce ourselves to our customers," he explained.

Ed Roberts

Bozard Ford Lincoln

“And nationally, less than 31% of our customers end up servicing with the brand dealer after their warranty period. Less than 31%. And so that means 70% is going somewhere else.”

Enough said.

Smart dealers are positioning recalls as the bait, not the prize.

Recent data from CDK Global found that 40% of customers who completed recall work bought additional services during that same visit.

Via CDK Global

So, the recall reimbursement itself might be thin. But when a customer who hasn't been done business with the store for 900 days finally returns to the ecosystem, dealers get their current mileage and vehicle condition, a chance to run a real inspection, and a shot at starting a trade-in conversation if the equity is right.

Jay's approach to maximizing these recall visits? He runs his service lane "like an ER."

Jay Tiniacos

Sandy Sansing CDJR

They never turn away a walk-in—appointment or not. Every car gets pulled in for a quick look and then they triage:

Is this a "today" job? Can they knock it out right now?

Is it a drop-off? Will the customer leave the car and pick it up later?

Or is it a two-weeks-out situation?

That triage approach means Jay's team never loses a recall opportunity. They assess, assign, and execute—or they schedule it so it actually gets done instead of falling through the cracks.

And this ties back to Ed’s philosophy at Bozard.

When stores focus on the ownership experience, they create loyalty. And when there's loyalty, there's no need for a big hook or a call to action. The customer is already top-of-mind with the brand.

The takeaway: Recalls are the cheapest reacquisition channel most dealers have and the only one the OEM is legally required to help generate.

Bottom line: Over the next few years, recall volume is likely to stay elevated as vehicles get more complex and OEMs keep “recalling in arrears” on past shortcuts. And the operators who accept that reality and industrialize recalls as a standing workflow, not an ad hoc campaign, are the ones who will win.

Missed yesterday’s episode of Daily Dealer Live?

Presented by:

Toothman on fleet focus, Waishampayan on new ad tech, Lundy on sales/BDC split

Featured guests:

JR Toothman, Owner of Toothman Ford

Amol Waishampayan, Co-founder of Fullthrottle.ai

Glenn Lundy, President of 800% Elite Auto

Three opportunities hitting the CDG Job Board right now:

North Knox CDJR: Business Development Representative (Tennessee)

Mark Miller Subaru: Service Advisor (Utah)

Gregg Young Auto Group: Automotive Technician (Iowa)

Looking to hire? Add your roles today—it’s 100% free.