Presented by:

Hey everyone,

Dealership M&A activity is on fire right now. In just the last week:

AutoCanada sold a Toyota dealership in Chicago to Murgado Automotive Group

Giles Automotive acquired its first Kia dealership

And Penske Automotive purchased two Lexus dealerships in Florida

See those deal announcement and many more throughout the entire year, by visiting the CDG Buy/Sell tracker powered by the Presidio Group at CDGbuysell.com.

— CDG

First time reading a CDG Newsletter?

Welcome to The Breakdown, an analysis of auto retail’s top trends, moves, and insights—in under 5 minutes.

The U.S. is now surrounded by Chinese cars on all sides.

This month, Canadian Prime Minister Mark Carney announced that tariffs on Chinese EV imports would drop from 100% to 6.1% for 49,000 units per year. By 2031, the annual quota grows to 70,000 units.

It's an extreme pivot from the previous Chinese tariff agreement Canada struck in solidarity with the United States. And President Trump, along with his advisers, have bashed the move, calling it a "back door" for Chinese EVs into the U.S.

No, this doesn't mean BYD Seagulls will start popping up in driveways across the country later this year. But the analysts I spoke with this week all agree: the genie is out of the bottle and Chinese vehicles are bound for the U.S. market.

The only thing left to decide is how the U.S. dealer body fits into that future.

China is the world's No. 1 auto exporter.

Forty years ago, China produced 5,200 cars per year. By 2010, production ballooned to 13.9 million and in 2015, it reached 21 million. As of 2025, the country has made over 34.5 million vehicles, much more than the U.S., Japan, India, Germany, and South Korea combined.

The key: A forced joint venture structure allowed foreign automakers to enter China's market if companies gave their Chinese partners at least 51% control. It was a steep price, but GM, Ford, and Volkswagen were willing to pay to reach China's growing middle class.

But in the last 20 years, Chinese manufacturers really came into their own and pushed the joint ventures to the side. Chinese brands now dominate domestic sales, instead of Volkswagen, Toyota, and Audi.

China also introduced a sweeping industrial plan with "new energy vehicles" (NEVs) as a core vertical. And since the industry was so heavily backed by government subsidies and easy access to capital, a flock of Chinese carmakers built factories all over China.

"Their growth has been stellar," Sam Fiorani, vice president of AutoForecast Solutions, told us. "By any measure, their numbers are incredible. But they're running out of sales in China. There's only so many people who can afford to buy a vehicle and they're nearing that top.

Sam Fiorani

AutoForecast Solutions

“So all this excess capacity that they've built over the last 10, 15, 20 years is going to the export push," he added.

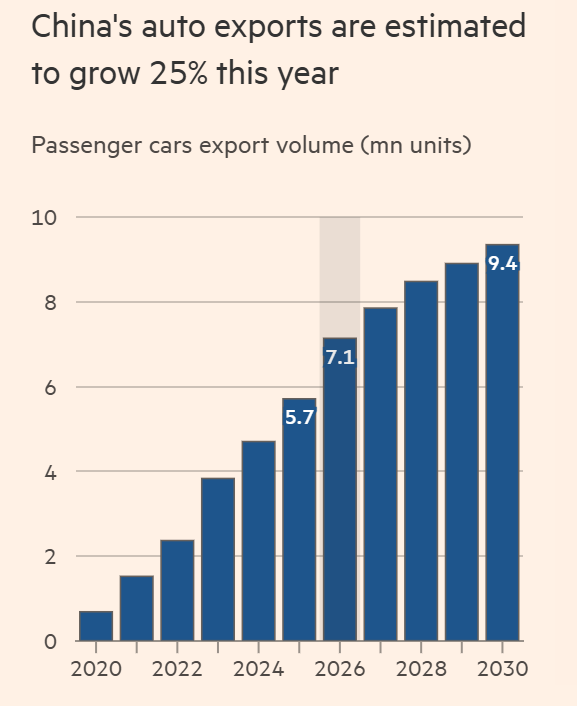

Big picture: China is now expected to export more than 7.1 million vehicles. And that number is only going up.

A quick word from our partner

Lotlinx is changing the way dealers move vehicles—

From promotion to follow-up, Lotlinx is the industry’s only true VIN Performance Platform powered by machine learning and trained on the industry’s most robust data.

It gives dealers the insights, precision targeting and re-engagement tools to move every vehicle more efficiently and profitably. No unnecessary ad spend, premature price cuts or wasted leads.

Schedule a demo at the NADA Show to see for yourself and you’ll have a chance to win a $148K Jetson ONE personal aircraft (pre-schedule to double your chances): Lotlinx.com/NADA2026

China has too many cars to sell and must export massive volumes.

The main direction for Chinese vehicles is the primary economies like Western Europe, North America, Japan, and South Korea.

But here's the thing: John Murphy, managing director at Haig Partners, told me the increase in net exports out of China over the last five or six years has exploded from essentially nothing.

UBS estimates, CPCA, S&P Global Mobility via Financial Times

"It effectively is about a 10% increase in supply relative to demand in that 5-year period," Murphy said. "Which means that the global markets have gotten insanely more competitive from a price standpoint than they've been otherwise."

John Murphy

Haig Partners

And that's vital for U.S. dealers to understand. Their OEM partners are under extreme pressure globally, which means they have to lean more heavily into the U.S. market.

"China builds high quality vehicles that are ripping into sales of legacy automakers in many markets outside the U.S., like Australia, UK, Mexico, Brazil, UAE, and Spain—taking up to 20% of new car sales overnight," Michael Dunne, CEO of Dunne Insights, wrote to us. "Honda, Nissan, Ford, VW, Chevy, and Stellantis brands are taking a beating in those markets."

The actions dealers are working with from their OEM partners may be surprisingly aggressive as a result.

Still, Chinese automakers are more vertically integrated than traditional automakers, creating significant cost advantages and lower-priced vehicles. And they are desperate to tap into the U.S.

The big question: How long will geopolitical gridlock keep Chinese automakers at bay? (I mean, if TikTok can get around it, they probably can too).

In all likelihood, U.S. dealers will eventually have a decision to make.

First, it's important to understand that this is much bigger than EVs. There's an increasing level of ICE and hybrid vehicles being exported out of China, and it's only a matter of time before they shift more heavily in that direction.

"As the Chinese OEMs become more competent and grow their ICE portfolio, that's the way they'll come in," Murphy said. "Given the opportunity for a consumer to own a new, relatively low-priced, high-quality ICE vehicle—which the Chinese are increasingly producing—that's where the market will develop for them, quite like it did for Hyundai, Kia, Toyota, Honda, and Nissan."

Translation: Legacy OEMs will probably lose market share post-Chinese entry.

But the twist is almost every Chinese automaker opts for the U.S. franchise model in overseas markets. Only NIO goes direct, according to Dunne.

Michael Dunne

Dunne Insights

That means dealers will have opportunities to buy into these franchises. Remember 50 years ago when Subaru was selling franchises to anyone who had a corner lot? Today, Subaru is one of the biggest brands in the U.S.

"Dealers are not immune to jumping into a new brand," Fiorani said. "The first ones in are likely to make money on it."

As far as dealership valuations, Murphy said in the initial stages there would be a lot of guesswork and retrenchment to look back at how dealerships were valued as the Japanese and Koreans entered the U.S. market. But there's at least some precedent to go off of.

The companies at biggest risk? Probably the Koreans and Japanese that are still serving the sedan and small crossover market.

Bottom line: Owning a Chinese brand might end up being an offensive move for growth, but it could also coincide with consolidation pressure on some of the franchises dealers already have.

What’s next?

The wall will hold... until it doesn’t.

Chinese automakers are hunting for stable, politically connected retail partners everywhere they go. And when they eventually make it south of the Canadian border, some U.S. dealers will be in a position to negotiate from strength.

Missed yesterday’s episode of Daily Dealer Live?

Presented by:

Wyler on acquisition, Rohrman on tariffs, Owens on reviews, Painter on TrueCar

Featured guests:

David Wyler, President and CEO of Jeff Wyler Automotive Family

Ryan Rohrman, CEO of Rohrman Auto Group

Cuyler Owens, CEO of Widewail

Scott Painter, Founder and CEO of TrueCar