Used vehicle wholesale prices were up ever so slightly in November, after dipping a bit in October. Although most vehicle segments trended lower year over year, the luxury segment outperformed the market, as partially influenced by increased EV prices.

By the numbers: Cox Automotive’s Manheim Used Vehicle Value Index (MUVVI) rose from October, while it remained mostly unchanged year over year.

The MUVVI rose to 205.4 points, representing a 1.3% boost to November wholesale used-vehicle pricing. These results were adjusted for mix, mileage, and seasonality.

Cox also says the Index was nearly unchanged from November 2024, while the long-term average monthly move for November landed at a decrease of 0.6%.

Non-adjusted wholesale vehicle pricing fell 0.3% from October, becoming flat year over year, with some of the strength observed earlier this year having rebounded.

What they’re saying: “As November progressed, both new and used retail sales lifted from October levels, and the longest government shutdown in history came to an end,” says Jeremy Robb, Interim Chief Economist at Cox Automotive. “While consumer sentiment remains subdued, early reads suggest confidence is recovering.”

Why it matters: The Index highlights improving vehicle sales from declining APR rates, while price depreciation began leveling out as values were slightly higher than usual. Cox also expects to see additional tailwinds hit the market in the coming months, as lower tax withholding rates may contribute to additional consumer confidence in 2026.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

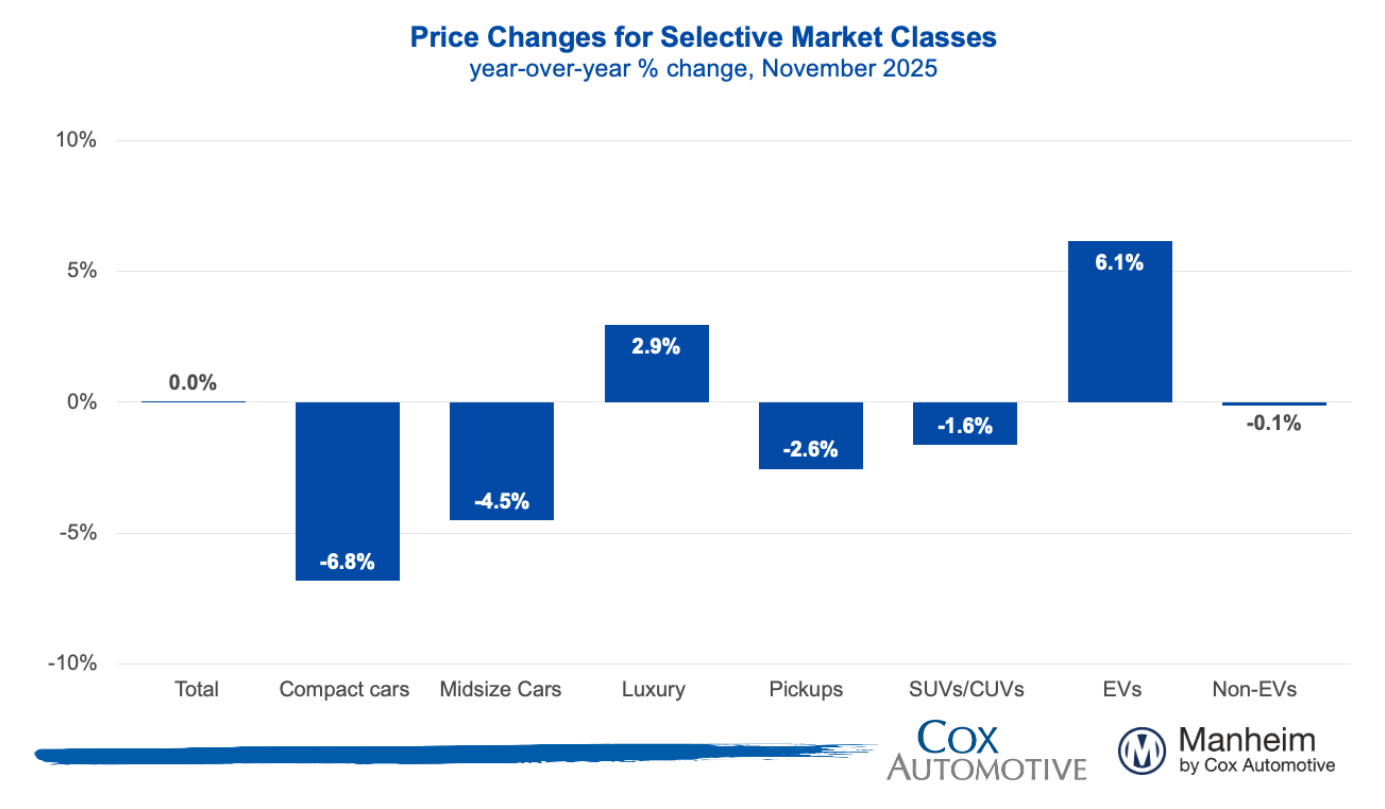

Zooming in: The majority of vehicle segments were lower year over year in November, while the luxury segment continued to outperform the market as a whole. Additionally, the expiration of the federal EV tax credit contributed to the luxury and overall EV segment prices trending upward.

Via Manheim

Luxury segment used vehicle pricing was up 2.9% year over year, with overall used EV pricing jumping 6.1%.

Compact cars saw the biggest pricing decline from last November, dropping 6.8%. Midsize cars, pickups, and SUVs were down 4.5%, 2.6%, and 1.6%, respectively.

The EV Index was up 2.3% from October and up 6.1% from the same month last year, following the expiration of the federal EV tax credit and leasing opportunities.

The non-EV Index was up 1.3% from October, while it was down 0.1% year over year.

Bottom line: Despite some continued uncertainty in the market, and wholesale supply increasing slightly to 30.1 days (up 2.2 days from October), customer confidence appears to be returning as APR rates began to drop and price depreciation started leveling out in November. As used vehicle prices trend upward, dealers will want to keep a close eye on holiday season inventory and pricing, and particularly within the EV and luxury segments.

A quick word from our partner

Identity Fraud is hurting auto dealers.

Experian Automotive found that nearly 90% of dealers are concerned about rising fraud, with 75% reporting a measurable impact on their operations. In the past year, 85% have suspected or confirmed fraud cases, primarily due to income fabrication and forged documents.

The fix? Experian Automotive's Fraud Protect.

Fraud Protect quickly and easily validates customer identities and documents with zero disruption to your sales flow or the consumer journey.