Presented by:

Hey everyone,

Big day today!

25+ new CDG Circles groups are live.

Circles is our modern peer group—strictly for car dealers. It includes a private dealer chat packed with real insights. It's confidential, compliant, and no travel is required.

If you still haven’t joined, don’t miss this launch.

Join today at cdgcircles.com.

First time reading a CDG Newsletter?

Welcome to The Breakdown, an analysis of auto retail’s top trends, moves, and insights—in under 5 minutes.

"The U.S. EV market is dying."

That's a real headline I read this morning...

Don't get me wrong, I'm no EV crusader, but it's clickbait titles like these that capture attention while totally missing the nuance.

But reality, as usual, is much more complicated than it appears.

Past the doomscroll narratives, I see a market that's sorting itself out in real time.

And dealers are adjusting in the only direction that matters: toward profit.

Looking at EVs through that lens, the next 18 months start to break into three very different stories.

Here's how both analysts and dealers see the short-term crash out, the medium-term crossroads, and what happens when the market actually "stabilizes."

Short-term cliff: EV sales are plunging as expected.

The EV comedown seems brutal from the outside looking in. But nobody in the auto retailing space is surprised.

After a record Q3, with EVs pushing close to 13% market share in September, volumes snapped back hard once the federal tax credit disappeared. And by October, EV share had been cut in half, landing around 6%, reports J.D. Power.

On top of that, average new EV transaction prices are up roughly $6,500 YoY to the low $50Ks, higher than both ICE and hybrid vehicles, despite carrying some of the richest OEM incentives in the showroom.

But on the used side, things look very different. While sales also fell from September to October, volume was actually up year-over-year, while average listing prices dropped.

Alex Lawrence, CEO of EV Auto, an independent used EV group, expects slow month-over-month gains as the market digests the hangover. His October and November were both profitable despite lower volume. "None of it's scary, none of it's unexpected," he told me.

Alex Lawrence

EV Auto

Meanwhile, Joel Bassam, president of Easterns Automotive (both independent used stores and new franchises for Nissan and Hyundai), cut his EV inventory in half—from 300 units to around 150 (out of 1,800 vehicles total).

Not because he's bearish long-term, but because he's managing exposure while wholesale prices adjust.

"We've feathered the throttle, but we have no intention of leaving the space at all," he said.

The consensus: The big dip is here—now it's about riding out the adjustment period.

A quick word from our partner

Stop wasting ad dollars on poorly targeted automotive campaigns.

fullthrottle.ai® helps dealers, OEMs, and automotive agencies deliver laser-sharp, household-level omnichannel targeting with the first generative-AI powered automotive DSP — enabling identity-based reach and real-time bidding efficiency.

We’re also a proud partner of the Automotive Media Marketplace, bringing smarter, tierless activation to the industry.

Meet our team at NADA 2026 at the Auto Media Marketplace Booth #1915W or at the V20 Booth #2001W.

Medium-term crossroads: 2026 is rife with uncertainty.

Analysts see the next six to nine months as mostly flat. Market share hovering, maybe inching up, but nothing dramatic.

But the dealers selling EVs are more bullish about it, especially on the used side.

Alex is specifically eyeing lease returns.

About 123,000 EVs are expected to come off lease in 2025, according to J.D. Power.

And next year that number jumps over 200% to as many as 330,000 units hitting wholesale actions, mostly 2022-2023 models with low miles and battery warranty intact.

That supply wave is dropping Alex’s acquisition costs, which trickles down to retail prices, and he expects things to pick up from there.

Joel is gearing up for refund season. Average used EV prices are now just $900 above comparable ICE vehicles, per Cox Auto. "The more flooded the wholesale market, the better. Because at this stage, the drumbeat in the last three years hasn't changed,” he said. “The biggest struggle is affordability.

Joel Bassam

Easterns Automotive

But new EV models could help in the affordability department too. Recurrent's Liz Najman noted that in 2026, there will be about 16 EV models available under $42,000 new. That’s more than double the amount this year.

The takeaway: Curves and projections can only tell us so much. And many dealers suspect used EVs will quietly become the segment’s primary growth engine.

Long-term horizon: EV adoption will keep trudging along.

Analysts are betting on economics to do the heavy lifting.

Gartner expects EV production costs to undercut internal combustion within this decade. And that means true price parity on the lot without credits or rebates to close the gap.

Meanwhile, total cost of ownership studies already show EVs coming out ahead for higher-mileage drivers and fleets once you factor in lower fuel and maintenance.

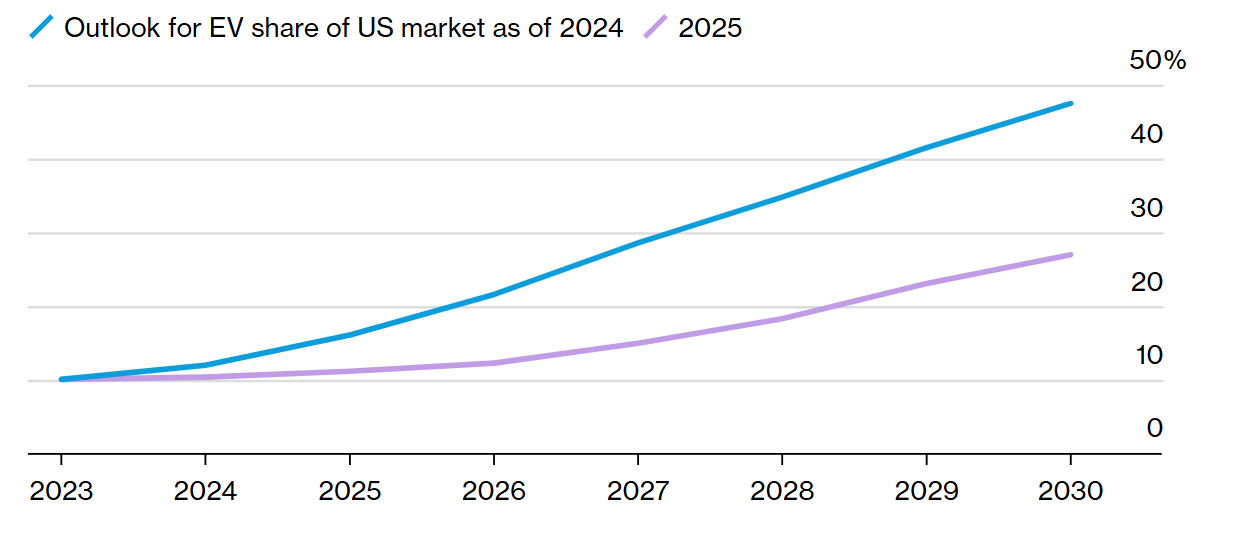

The prediction: Hard economics will eventually pull adoption forward. Policy and OEM behavior just controls how fast or slow it might go. BloombergNEF’s latest U.S. outlook for EVs puts market share around 27% by 2030.

Via BloombergNEF

But Alex never bought into the steep adoption story anyway. The Biden administration's mission was to get more EVs on the road and normalize them—and that mission worked. Word of mouth is positive. Momentum is real. But it's grinding, not explosive.

Joel is steering toward the same horizon from a different angle. His long-term plan is to lean into affordability (regardless of powertrain) but he sees used EVs as one of the cleaner paths.

From here, the outlook gets clearer. National EV share may undershoot the most ambitious forecasts, but the segment is certainly not going away.

Bottom line: Dealers follow the money, not headlines. And EVs still profit when the price is right and the customer fits. As lease returns drop wholesale costs and OEMs push deeper incentives, those profitable deals will most likely multiply eventually. Now, it’s just about navigating the ebbs and flows to get there.

Missed yesterday’s episode of Daily Dealer Live?

Presented by:

Miller on alleged breach, O'Hara on Chicago market, Davila on buying used cars

Featured guests:

Brad Miller, CEO of ComplyAuto

Will O’Hara, General Manager at Zeigler Auto Group

Roy Davila, Variable Ops Director at Steele Auto Group

Three opportunities hitting the CDG Job Board right now:

Gregg Young Auto Group: Automotive Technician (Iowa)

North Knox CDJR: Business Development Representative (Tennessee)

Mark Miller Subaru: Service Advisor (Utah)

Looking to hire? Add your roles today—it’s 100% free.