Presented by:

Hey everyone,

Plan on attending the upcoming 2026 NADA Show in Las Vegas?

Our editorial team is busy lining up conversations that go beyond booth demos and press releases.

Let us know if you want to grab some time. See ya there.

— CDG

First time reading a CDG Newsletter?

Welcome to The Breakdown, an analysis of auto retail’s top trends, moves, and insights—in under 5 minutes.

Third-party vehicle listing sites are still the dominant players in vehicle search…

Many dealers might try to imagine life without them. And some have even attempted to leave them behind. Although typically, the traffic's too big (and valuable) to replace.

However, as margins tighten and competition heats up, dealers are getting louder about a problem that's been building for years:

“Misleading” or “conditional” vehicle pricing from bad actors that creates a fun car buying experience for no one.

To understand where the friction is the hottest, I spoke with dealers, reps from some of the biggest platforms out there, and operators navigating the gaps in between.

Here's what they told me...

Dealers are demanding more accountability from third-party sites, but enforcement is complex.

Most major listing sites rank or label vehicles using proprietary methodologies. Consumers see “Great Deal” or “Fair Deal,” and those badges carry real influence.

But dealers like Andy Wright, managing partner at VINART Automotive Group, told me the badge often reflects the headline price rather than the car’s actual history.

For example: Andy listed a 2022 Honda Accord LX with 30K miles.

CPO, full reconditioning, and transparent documentation… the works.

But it was only rated “Fair Deal.”

Meanwhile, a competitor who listed a similar car (with frame damage and no CPO) was rated “Great Deal,” and Andy thinks this was because that car was listed for $4K less (with buried conditions).

“We take for granted that the consumer knows what they’re looking at,” Wright told me. “In reality they’re just seeing seemingly the same car for $4,000 less and asking, ‘Why is that?’”

Andy Wright

VINART Automotive Group

Once conditional pricing becomes common in listings, it can start to distort market signals and make reasonably advertised prices look uncompetitive.

Andy’s POV: Platforms should either stop rating deals, or enforce real pricing transparency so the listed price is the price anyone can buy the car for. Period.

When I reached out to the folks at CarGurus $CARG ( ▲ 3.32% ), Autotrader, and Cars.com $CARS ( ▲ 1.68% ) for their responses to Andy, I gleaned some insight… but it wasn’t as much as I hoped for.

Cars.com didn’t have anything to add about Andy’s claims, but said it plans on making a broader update on this topic early next year. I also tried CarGurus, but never got a response.

Meanwhile, Erin Lomax, VP of Operations for Consumer Marketplaces at Cox Auto (owner of Autotrader) said that the company’s policies “require that advertised vehicle prices be clear, accurate, and not misleading, with any material conditions clearly disclosed…”

Erin Lomax

Cox Automotive

“When we identify non‑compliant listings, we work with sellers to correct them and may remove listings that do not meet our standards,” she added.

Basically, no one denies misleading pricing exists in certain pockets. The disagreement is really about enforcement—how hard it should be pushed, and what it would break if pushed too far.

But for most dealers, that debate doesn’t change the underlying reality... walking away isn’t always a viable option.

A quick word from our partner

Close the Gaps Costing You Service Revenue

When follow-up falls through or inbound calls go unanswered, fixed ops growth stalls. It’s not pricing that’s hindering your retention—it’s friction.

Impel’s Service AI with Voice AI changes that with proactive, VIN-specific outreach based on individual driving behavior, missed call capture, and instant appointment scheduling by text and email.

Advisors stay focused on the drive. Customers get fast, personalized service.

One complete platform. No missed moments. No missed revenue.

Many dealers need third-party listing sites to operate at full tilt.

Brett Sutherlin tested that reality firsthand.

In 2023, the CEO of Sutherlin Automotive pulled his group off third-party listing services, saving nearly $200,000 per month. He redirected the money into paid and organic search and social.

Seemed like a win.

Then, in November 2025, he reversed course. “We tried that. It didn’t work,” he wrote on LinkedIn. “With decades under their belts and large teams dedicated to dominating search, dealers will need 10x the budget they currently spend on third-parties to come close to competing with [them].”

Brett Sutherlin

Sutherlin Automotive

The issue came down to scale.

Together, these marketplaces command tens of millions of visits every month. And competing with that level of internet search authority needs more than reallocating budget.

It requires time, consistent investment, and tolerance for risk, all of which become harder to justify as margins compress.

That’s why many dealers opt to consolidate, negotiate, and adjust rather than jump ship.

Big picture: When platforms become essential infrastructure for dealers, that dependency creates more obligation for platforms to get their policies aligned, not less.

The obvious question is whether new AI shopping tools actually change any of this.

CarGurus, Cars.com, and Autotrader now operate their own proprietary, AI-driven search tools designed to make car shopping more intuitive and consumer-friendly.

In theory, this could be the moment where misleading/conditional pricing finally gets filtered out.

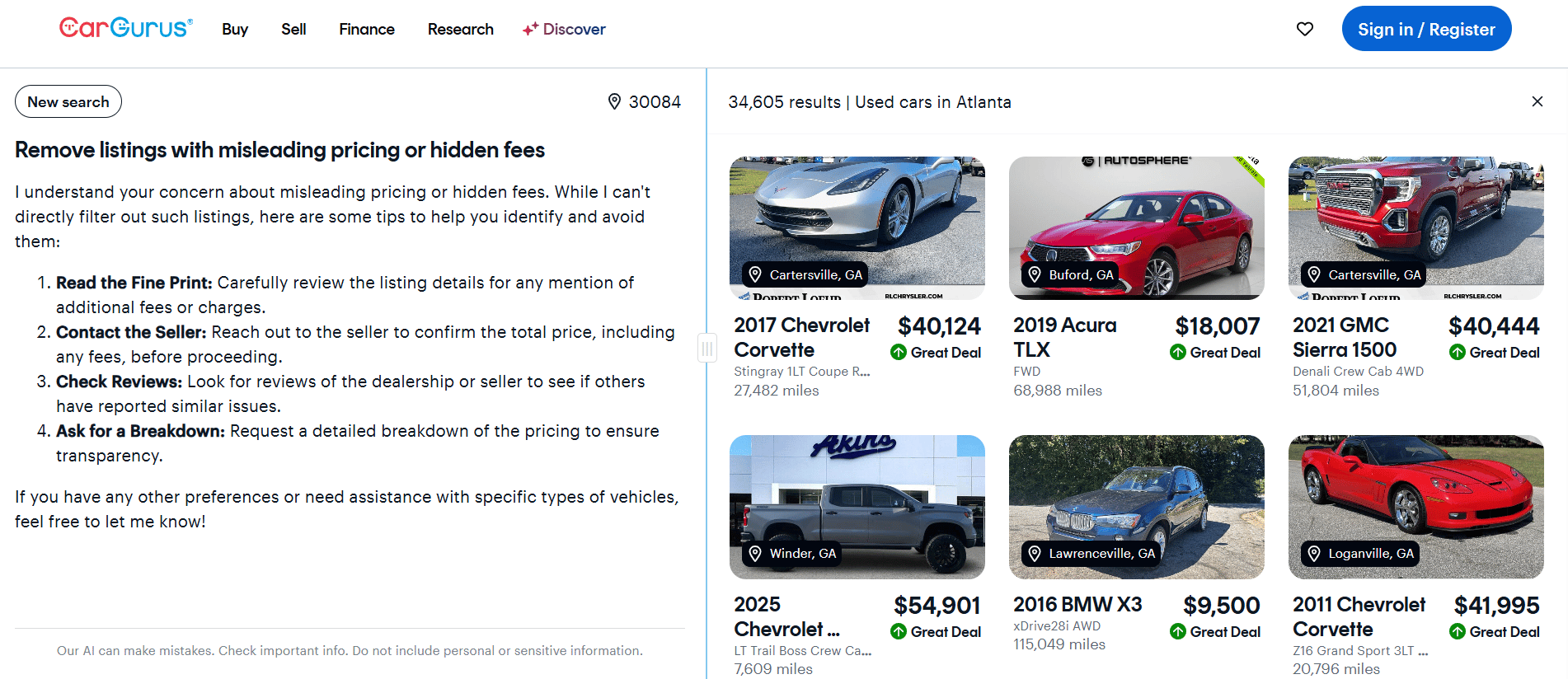

So I tried an imperfect (and very non-scientific) stress test.

After launching used-car searches in fixed markets, I gave the AI tools the same request 5 times: remove listings with misleading pricing or hidden fees.

On CarGurus’ AI search (and similarly on Autotrader’s) the AI assistants acknowledged the concern, gave a disclaimer, and then explicitly declined to act on the request. The results did not change and no filter was applied.

The likely reason: The minute an AI tool labels a specific listing or dealer as “misleading” or suppresses it, the platform is now directly responsible for those judgments. And that can be a much bigger legal and advertising problem than letting consumers fight it out at the store.

But Cars.com’s AI assistant, Carson, behaved differently. After issuing the same query inside a live used-car search, the visible “Good Deal” and “Fair Deal” filters disappeared from the results. There was no explanation of what changed or why.

This doesn’t prove any platform is acting in bad faith. But it does establish the AI tools currently won’t help shoppers weed out any shady players.

The signal: As AI layers drive more of the search experience, what rises to the top is increasingly governed by an interpretive model whose logic is partially hidden.

At the end of the day: No one I spoke with thinks third-party platforms are inherently malicious. But at what point does competition stop sharpening the market, and start distorting it?

Platforms will likely change incrementally, not dramatically. Dealers know that. Which is why the smartest ones stop waiting for policy perfection and start building advantages with processes that convert skeptical marketplace shoppers into trusting dealership customers.

Three opportunities hitting the CDG Job Board right now:

Capital Automotive Group: Lead Automotive Technician (North Carolina)

Emich Kia: Sales Professional (Colorado)

Metro Nissan of Dallas: Service Drive Manager (Texas)

Looking to hire? Add your roles today—it’s 100% free.