Presented by:

Hey everyone,

As we close the book on 2025, CDG’s Daily Dealer Live show is taking a look back at the year with a very special New Year’s Eve edition featuring:

Brian Benstock, vice president and general manager of Paragon Honda and Paragon Acura

Doug Horner, general sales manager at Mercedes-Benz of North Olmsted

And Grant Cardone, CEO of Cardone Capital

Catch all the insights today at 1 p.m. EST on any CDG channel.

— CDG

First time reading a CDG Newsletter?

Welcome to the Market Pulse—your no-fluff cheatsheet to auto retail, built to help dealers price right, stock smart, and stay ahead.

Used car inventory: After years of thin off-lease supply due to COVID-era new car production shortages, 2026 will bring an estimated ~400,000 additional newer used vehicles back into the market.

Used car pricing: The average used vehicle transaction price is hovering near what it was last year (~$25,700). But several key segments, including SUVs, pickup trucks, and hybrids continue to fall by hundreds of dollars through the Winter months.

Dealer profitability: Both of these conditions could continue to pressure the bottom line. From Q3 2024 to Q3 2025 (the latest data available), gross profit per used vehicle retailed dropped 9.2% to $1,306 as margins tighten on the variable side.

(Source: Edmunds / CarFax / The Presidio Group / NCM)

Used car inventory is starting to climb out of its post-pandemic hole.

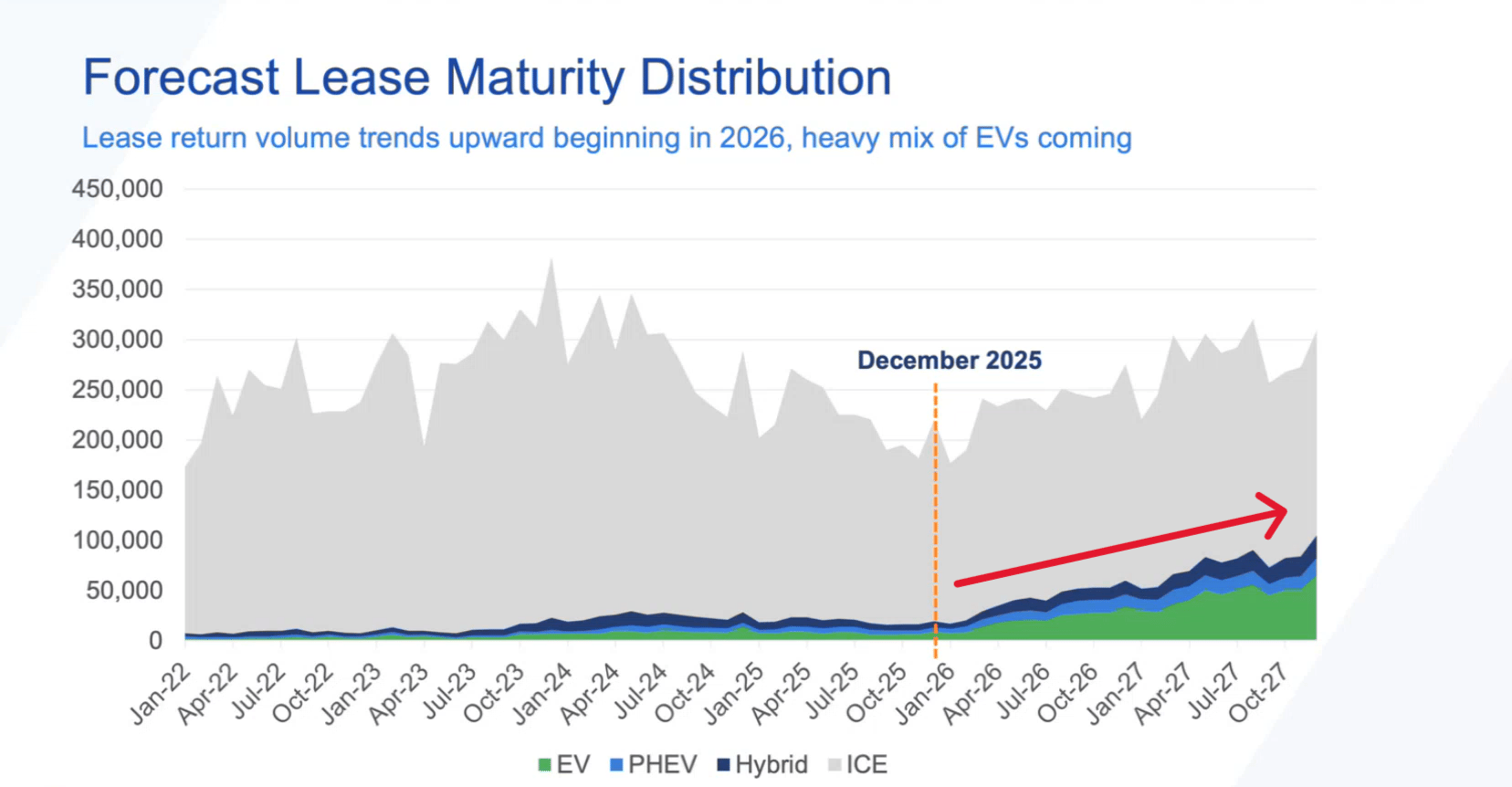

The COVID-era new car production crunch caused leasing penetration to fall to only 16% in late 2022, according to Cox Automotive. From 2023 onward, leasing has recovered to around 25% of vehicle transactions today.

But since most leases mature after 36 months, the used car market is nearing the tail end of that off-lease shortfall which has been depressing the amount of 1-to-3-year-old cars available for a couple of years.

From here on out, off-lease supply is projected to grow, with an additional ~400,000 units being added in 2026.

The catch: A meaningful amount of these off-lease returns will be electric vehicles.

Right now, gas-powered vehicles command 90% of lease maturities. By 2027, that will drop to 72%.

via Cox Automotive

NOTE TO DEALERS:

Whether operators like it or not, used EVs will flood supply. And over time, those who opt out of selling these vehicles will likely have to give up market share and profits to the dealers who don’t.

Of course, this won’t be the case in every market or region, especially where adoption is low.

But the key for dealers is to sell the vehicle’s economics, not its politics.

The best way to do that: "All the most successful EV stores in America have one thing in common at the retail level. They make the sales consultants drive EVs as their personal vehicles for a few months. It's sink or swim,” said Mike Murphy, GOP political strategist and founder of EVs for All America.

Used vehicle listing prices are still elevated, but softening.

As the year comes to a close, the average used vehicle transaction ($25,730) price is essentially flat against the end of 2024 ($25,721).

Yes but, used car listing prices have been falling across key segments in recent months as wholesale values return to normal seasonal depreciation patterns (or at least closer to them).

Luxury SUVs dropped more than $1,200 over the last 5 months.

After the end of federal EV tax credits, hybrid and EV prices are down more than $1,100.

SUV and cars are continuing a 4-month decline, down $500 and $300, respectively.

And even pickup truck prices have fallen more than $400 since the beginning of October.

The caveat: October through December are typically the months with the best discounts on used vehicles. And the growing off-lease supply will likely create more downward pressure on prices. However, as consumers receive their tax refund checks in the Spring, demand typically increases and prices could reverse course (at least for a few months).

WHY IT MATTERS:

Dealers know the margin for inventory pricing errors is shrinking. And with each passing quarter, gross profit per used vehicle is dwindling.

So, many dealers today are pricing their used car inventory on overall risk, not just age. And their appraisal and merchandising decisions are based on data instead of gut-feeling (no matter how dialed in it is).

A quick word from our partner

Maximize profits with Ikon Technologies—the connected vehicle program built for dealers.

Boost front-end PVR and drive an average of 50 additional ROs monthly to your service bays.

Visit us at NADA Stand 1763 West to demo our platform and roll for a chance to win a Rolls Royce!

Plus, mention “Car Dealership Guy” when you sign up to waive your entire installation fee.

Terms & Conditions Apply. Sign up for a demo to roll the dice at our booth! No purchase or demo necessary, alternative method of entry available.

Even though dealers aren’t feeling too hot about the immediate future of the used car market…

Via Cox Automotive

They’re preparing with some essential Dos and Don’ts:

Do: Treat reconditioning speed as a measurable profit driver.

“We focus on two things,” said Tully Williams, parts and service director at the Niello Company. “When we buy the car, how many days until it gets to the shop? And then how many days in the shop? If that’s over two days, we have a serious problem.”

Tully Williams

Niello Company

To achieve the 2-day target, Williams created a dedicated internal advisor and technician team, paid based on days in shop rather than gross profit. Each store can choose its own reconditioning tool as long as they hit their goal.

Don’t: Let a service drive customer leave without an appraisal.

“You're going to pay more for that car if you go to auction. Why wouldn't we give it to the customer while they're here or in the service drive,” said Eric Barbosa, vice president of variable operations at Cavender Auto Group.

Eric Barbosa

Cavender Auto Group

To operationalize this, Cavender has launched the “Cavender Comparison” a tool that provides instant offers. The goal is to make every service visit a live appraisal opportunity without relying on a traditional salesperson pitch.

New car prices remain elevated, incentives are limited, and monthly payments are still stretching buyers thin. At the same time, the supply of late-model used vehicles is only beginning to recover after years of production shortfalls.

This imbalance is reshaping the market. Good used cars are still harder to replace, and the ones that surface are commanding real money.

That’s why 2026 is shaping up to be the year of the used car.

Agree, or disagree? Let me know you thoughts by hitting Reply to this email.

The latest updates to the CDG Buy/Sell Tracker.