Rolling into 2026, the story for automotive retail is not just “more of the same.” Tariffs, EV whiplash, the hybrid renaissance, and tougher state rules massively shifted how dealers make money and manage risk in the foreseeable future.

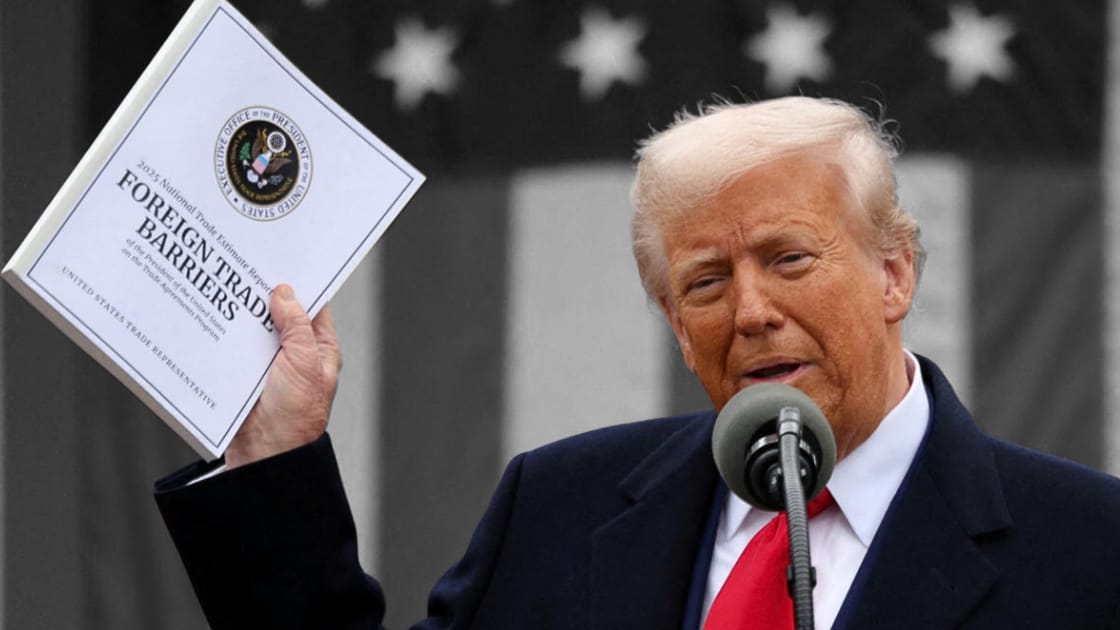

1. President Trump's trade war and tariffs reshape the auto industry.

Few things shook up the automotive sector to the degree that tariffs did in 2025. And President Donald Trump’s seemingly never-ending on-and-off, up-and-down trade negotiation tactics have become tough to keep straight.

The 25% global tariff on imported passenger vehicles and auto parts, imposed under a national security finding and layered on top of existing duties, raised the floor on landed costs for import-heavy brands. Chinese-built vehicles and key components were hit even harder, with combined duties on some Chinese autos approaching roughly 50%.

In Europe and Japan, late‑2025 deals dialed auto tariffs down to around 15%, still higher than pre‑trade‑war norms but well below the 25% threat that had spooked OEMs. South Korea landed a similar agreement, easing tensions further.

2. An EV surge turns into an EV hangover.

Pull-ahead demand created meaningful sales gains in the EV sector. But once President Trump eliminated federal EV tax credits, momentum practically came to a screeching halt in 2025. EV sales in October plummeted to around 5% market share, down from a record high of 12% in September, according to S&P Global Mobility.

The pain fell heaviest on mass‑market EV crossovers and entry models, where higher monthly payments and lingering charging concerns pushed shoppers back toward ICE and hybrid options. Dealers carrying deep, high‑MSRP EV inventory watched days’ supply balloon and had to lean on discounting, OEM cash, and subvented financing.

3. Hybrids become the safety valve.

As fully electric demand cooled, hybrids quietly became the pressure‑release valve that kept many automakers’ electrification plans from fully stalling out. In Q3 2025, hybrids accounted for roughly 15% of U.S. sales, outpacing pure EVs by about five points and capturing shoppers who liked lower fuel spend and fewer emissions but were unwilling to bet their daily routine on public charging.

For dealers, hybrids offered a more balanced equation. They turned faster than over‑stocked EVs, carried less incentive drama, and appealed to rural and suburban customers who wanted better fuel economy without re‑engineering their lives around charging infrastructure.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

4. Strong 2025 sales despite the headwinds.

For all the volatility, 2025 ended as the best new‑vehicle sales year since 2019, underscoring just how much underlying demand was still in the system. Cox Automotive forecasts new‑vehicle sales of roughly 16.3 million in 2025, up nearly 2% from 2024, with compact crossovers and SUVs leading December segment sales at around 250,000 units.

Lingering pent-up demand from earlier supply shortages, fleet and commercial catch-up purchases, and consumers willing to stretch on term length and monthly payments kept the market moving. Q4 softened as shoppers became more payment-sensitive and pulled back on higher prices and policy uncertainty.

5. State regulatory scrutiny fills the federal gap.

After the FTC’s CARS Rule was struck down by the Fifth Circuit Court in February, California moved ahead with its own version, giving one of the country’s largest auto markets a clear, state‑driven compliance framework that other jurisdictions are already studying.

California’s rule, set to take effect on October 1, 2026, tightens disclosure demands around pricing, add‑ons, and return rights in ways that could ultimately cost non‑compliant dealers millions in penalties, chargebacks, and process re‑work. Stores now face a multi‑year sprint to standardize menus, disclosures, and payment presentations so every customer gets the same, defensible experience.

Because once one large state sets the bar, copy‑and‑paste legislation and enforcement are likely to spread.

A quick word from our partner

A 10-Minute Demo That Unlocks the Best Night at NADA

If you’re already going to the 2026 NADA Show, you might as well get invited to the best night of the week.

DAS Technology is hosting a private party at Allegiant Stadium in Las Vegas, and the only way to get a pass is by booking a short demo at Booth #1311W.

You’ll see how DAS uses AI and data to improve lead response, service retention, and marketing ROI, then enjoy a night with Daymond John, DJ Jazzy Jeff, and NFL legends Tim Brown and Brandon Marshall.

Don’t miss once-in-a-lifetime experiences like attempting a field goal and ziplining across a professional football field!