Despite many headlines that claim consumers are pulling back and used car prices are on the brink of collapse, Jeremy Robb, interim chief economist at Cox Automotive, says his data tell us a different story.

Driving the news: "We've seen better trends through most of November than we had in October," Robb told Daily Dealer Live hosts Sam D'Arc and Uli de' Martino. "They're nothing to write home about. I wouldn't call it that. But up from where we were in October, both on the new car side and on the used car side."

By the numbers: Every week, Robb tracks a basket of the top 50 three-year-old vehicles sold at retail.

Prices declined for seven consecutive weeks through late November, then went flat.

However, that basket is running 3.5% higher than last year on a weighted basis.

Wholesale used car prices, on the other hand, hit their seasonal low in September and October (which they usually always do).

But this year, they depreciated slightly more than usual.

"Our data says that we have seen prices come down a little bit, but nothing out of what we would usually have expected anyway,” Robb explained.

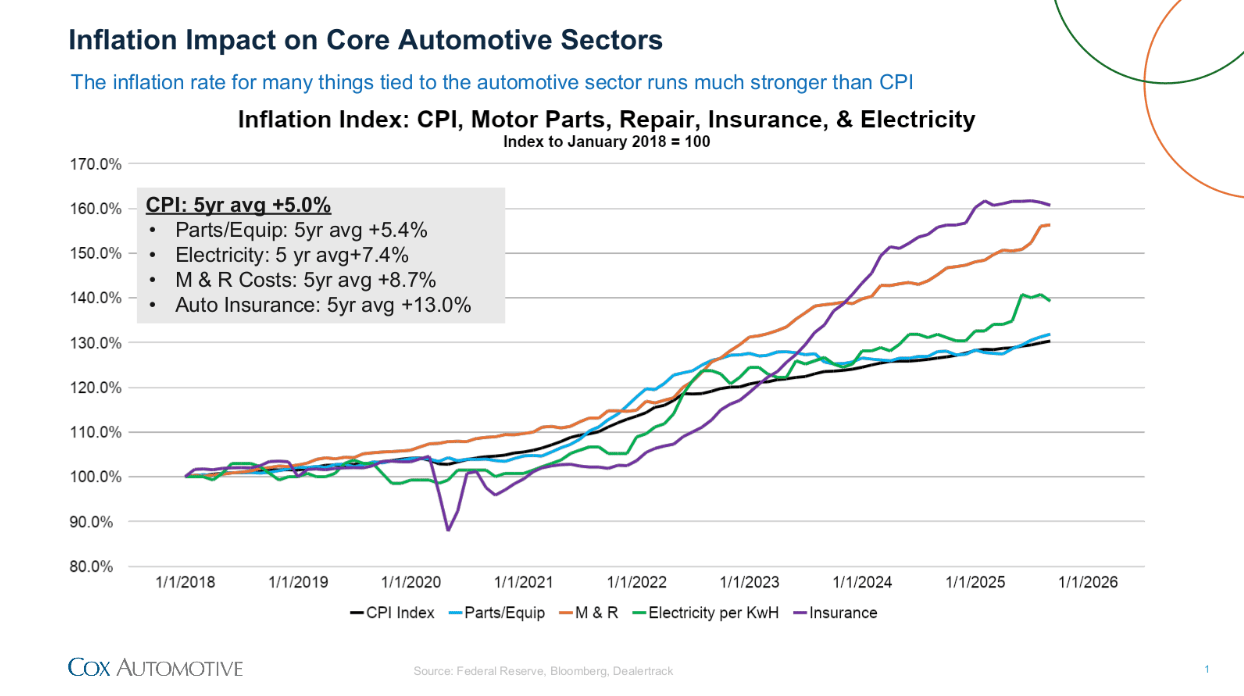

The inflation picture: Over the past five years, the Consumer Price Index has increased 5% on average every year, but the expenses affecting car ownership directly ran much hotter:

Auto insurance: +13% average on an annual basis over five years

Maintenance and repair costs: +8.7% annual average

Electricity: +7.4% annual average

Parts and equipment: +5.4% annual average

Via Cox Automotive

Follow the money: When the COVID-19 pandemic hit, insurance costs actually dropped as people drove less. But starting in 2022, insurance companies had to catch up. New and used vehicle prices were growing too, which then ratcheted up premiums.

"Starting in 2022, when the impact of inflation really got going, it moved much more up and to the right than any other sector there," Robb said.

Why it matters: Consumers feel maintenance, repair, and insurance costs deep in their wallets right now. And these recurring bills are compounding affordability pressure beyond the purchase price and monthly payment.

The silver lining: Tax code changes for 2026 will deliver consumers a double benefit starting January 1.

First, withholding rates on paychecks drop immediately. Meaning, many consumers get more take-home pay starting early January.

Second, average tax refunds are projected to hit $3,700—the highest ever. (Last year's average refund was just over $3,000).

"We know the spring market bounces there. A lot of people use those tax refunds as down payments to come out and buy cars," Robb said. "You would expect that unless there's something else precluding them from doing that, they would do that and those metrics would look to be pretty strong."

Wall Street banks have issued research confirming the tax refund season should be strong, but media coverage remains focused on negative narratives, Robb adds.

"There's a lot of media that are really caught up on things that are negative," Robb said. "You've got to not only look at the rear view mirror, but have a little bit of a view towards the future."

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

The elephant in the room: The Federal Reserve has cut benchmark interest rates multiple times this year. But auto loan rates haven't fully followed suit… yet.

Top-tier borrowers saw rates drop 60-80 basis points. But overall average rates stayed higher than expected.

Part of that comes from consumer credit shifts—more people moved from prime to near-prime or subprime tiers as student loan repayments resumed.

And the psychological impact of lower rates matters as much as the mathematical benefit.

"It matters at the margin. It's not a huge incremental pickup for a consumer," Robb said. "I think it matters almost as much psychologically as it does on paper."

The EV factor: Used EV prices dropped through Q3, then lifted significantly, and now they're declining slightly again.

And even without the federal tax credits, Robb thinks used EVs are still “a pretty affordable product for a consumer if it's the right product for them.”

That means, dealers who don't typically stock EVs should pay attention. Off-lease EVs will flood back over the next two years, creating an inventory source.

"This is where you can source used vehicles over the next coming years," Robb said. "We know there's been a lot more consumer adoption for them than there has been for a while."

Bottom line: The window to position for spring demand is already open and the dealers who prepare the best will take advantage of those fatter refunds.

A quick word from our partner

Stop the Fixed Ops Revenue Leak.

Missed calls and manual follow-up kill retention. Impel’s Service AI with Voice AI fixes this by automating personalized outreach based on driving behavior, capturing every missed call, and booking appointments instantly via text and email.

Keep advisors focused on the lane while customers get faster answers and your bays stay full. One platform. Zero missed opportunities.