Presented by:

Hey everyone,

The recalls keep on rolling...

So we just updated the CDG Recall Tracker, now with revenue opportunity signals on select recalls to help fixed ops teams spot service lane potential faster.

— CDG

First time reading the CDG Newsletter?

Welcome to the Market Pulse—your no-fluff cheatsheet to auto retail, built to help dealers price right, stock smart, and stay ahead.

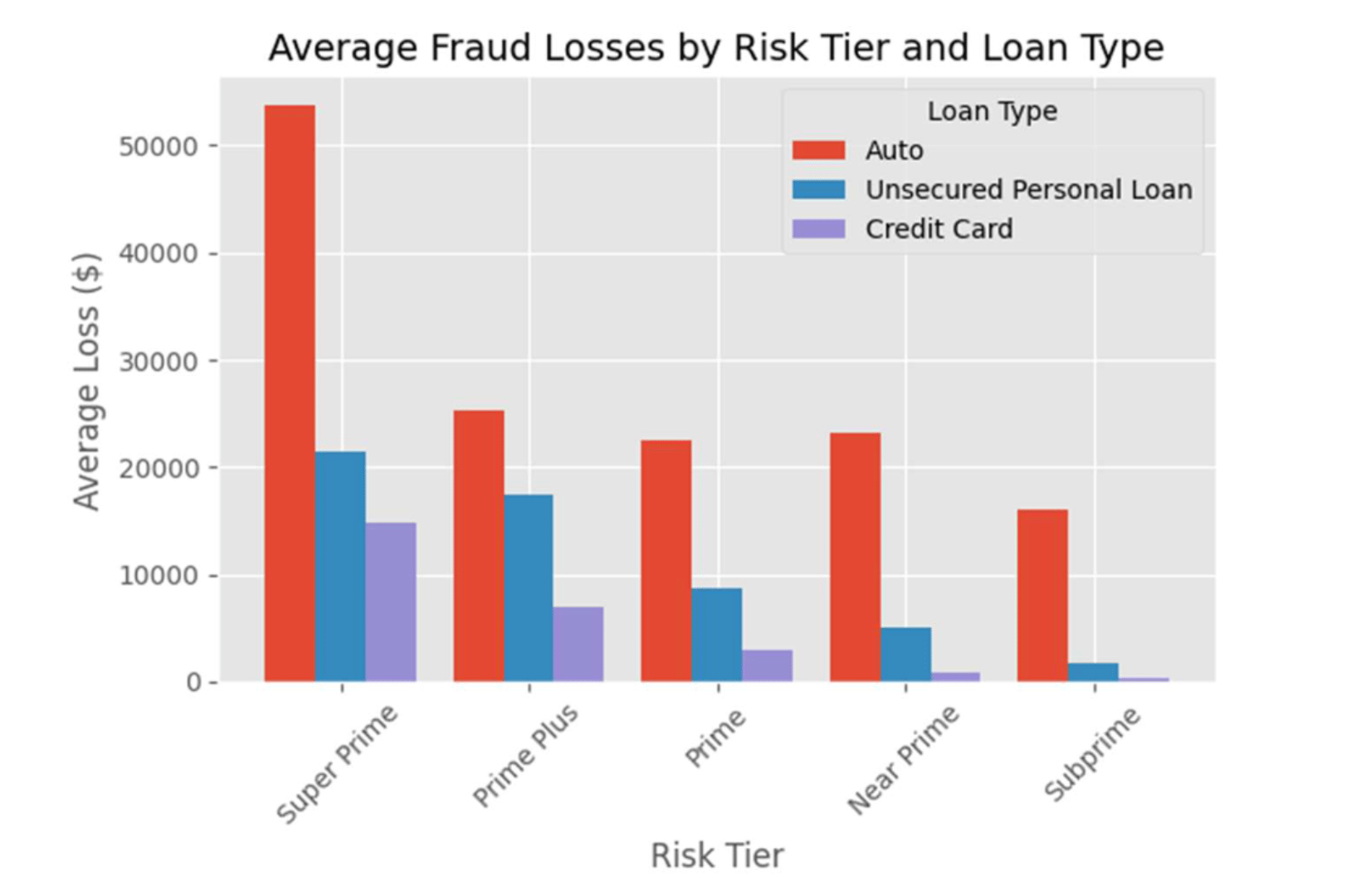

Fraud losses are creeping up the credit ladder: Synthetic IDs and credit washing are showing up in prime and even super-prime portfolios, forcing lenders to rethink how they price and approve risk.

Tighter credit is slowing inventory flow: Stricter approvals and longer funding times could leave cars sitting in recon longer and cause margins to thin.

And dealers are tightening operations to keep up: Dealers are trimming lender lists, training front-end staff on fraud, and getting “back to basics” to navigate stricter lending.

(Source: TransUnion / Cox Automotive / Bloomberg)

Subprime auto lending risks are spreading into prime and super-prime tiers

Fraud once limited to deep subprime is now showing up in prime and even super-prime portfolios, per TransUnion.

Reports even suggest losses amount to about $20K per fraudulent loan, with some super-prime losses topping $50K.

That’s partly because higher credit tiers carry larger balances, which amplify each loss. But even so, charge-off rates in super-prime are now near 3.4%, roughly the same as near-prime.

CDG analysis via Joe Cecala / TransUnion / Cox Automotive

The two main culprits: Data suggests the trend is being fueled by synthetic IDs and credit washing, which are tactics where borrowers use fake or manipulated identities, or dispute legitimate delinquencies, to wipe negatives from credit reports to temporarily inflate their FICO scores.

As expected, lenders are responding by slowing down funding and double-checking every file. That means longer approvals, tighter proof requirements, and more hesitation, even for historically low-risk deals.

NOTE TO DEALERS:

Before adding new lenders or blaming tight credit, audit who’s actually funding your deals.

As Chris Schellenberger, former GSM and now president of PURR, told CDG:

“Dealers are trimming fat, cutting from 10 or more lenders down to five or six that actually fund. They’re also grouping by credit tier and holding short weekly huddles to review declines and adjust structure quickly.”

Start there — trim the list, huddle weekly, and track approvals.

Increased fraud controls and stricter approvals are reshaping inventory and margins.

With stricter approvals and increased fraud checks, dealers are starting to feel a slower, more cautious market.

A few headlines driving that:

Tricolor’s bankruptcy (mostly tied to warehouse lending) has many in auto finance rethinking how risk is being priced across subprime and near-prime ABS portfolios.

At the same time, First Brands Group’s bankruptcy could make parts like filters and fluids harder to source, which stretches reconditioning times and pushes holding costs higher.

CDG analysis via Joe Cecala

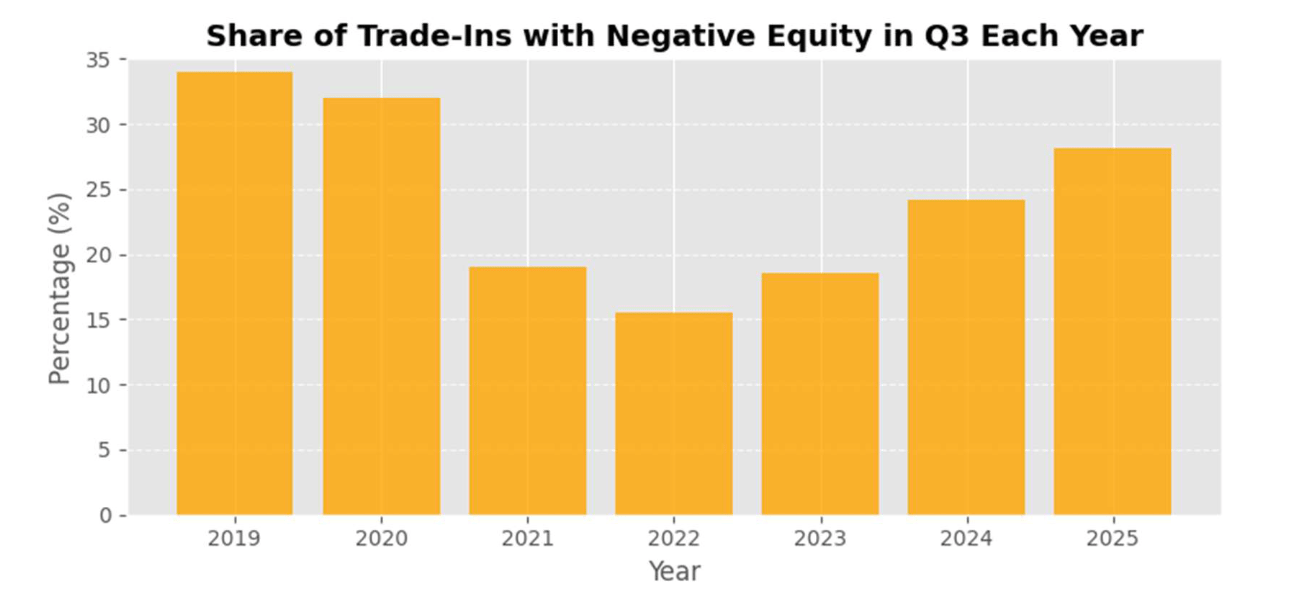

And repossessions are up 20% YoY, with loan balances about $5K higher than 2019, meaning more negative equity (chart above) and more distressed trade-ins hitting the market.

WHY IT MATTERS:

When lenders tighten up and funding slows, every extra day in recon or delay in approval eats into margin.

That’s why more dealers are moving “back to the basics,” Schellenberger said.

The basics in question:

Pricing cars to hit key payment bands ($399–$499)

Keeping recon functional, not fancy

And turning inventory inside 30–60 days

“Most dealers are leaning into under-$20K units that book clean and move fast,” he said.

A quick word from our partner

We’ve powered the BDC—now we’re bringing that same AI innovation to Service.

Meet Jerry 2.0, your fully adaptable AI Employee who learns instantly, mirrors your brand, and improves with every interaction.

Paired with Podium Service AI, Jerry manages calls, texts, and bookings directly in Xtime—turning missed calls into conversations and first visits into loyal customers.

From BDC to Service, Podium’s AI works like your best employee—only faster, smarter, and always on.

I called around to see how top operators are navigating slower approvals, tighter credit, and a rise in fraud cases.

Here are their Dos and Don’ts from the ground:

Do: Train the entire store on fraud, not just the F&I department.

I had a great conversation with Frank McKenna, co-founder and chief fraud strategist at Point Predictive, and he said something so interesting…

“Fraudsters look like a salesperson’s dream. They just see it as an opportunity to sell a car, because these people have great credit, aren’t haggling, and are coming back multiple times. They’re like the perfect customer.”

Frank Mckenna

What he means: In visiting dealerships, McKenna said most sales staff say they haven’t dealt with fraudsters in their stores. After talking with him, though, they realize they actually have. They just didn’t recognize it.

“Sometimes it’s young people, and this is their first job selling cars,” he explained. “They don’t really know what fraud looks like. Once we show them examples, they’ll say, ‘Oh yeah, I had that happen to me.’”

His point: Education and training make all the difference.

Do: Focus on deal discipline, not just credit score.

In talking with Schellenberger, he said lenders aren’t necessarily rejecting more deals. But they are asking for cleaner ones.

“Prime deals fund fine, but with thinner reserves. Near-prime is getting hit hardest; lenders want cleaner proof and lower advances. Subprime is still open if there’s real down payment and a newer, bookable unit.”

Chris Schellenberger

Don’t: Assume your fraud tools are up to date.

Old red-flag checklists aren’t built for today’s synthetic IDs and credit washers.

In McKenna’s words: “Ninety percent plus of the fraud that we’re seeing when we work with dealers, it’s because they’re using outdated red flags. They’re using stuff that worked 10 years ago, but they’re not doing new things like driver‘s-license scanning.”

“You have to have some technology to scan those licenses to find the fakes, because they’re popping up everywhere, and if you don’t have that, it’s impossible to detect them,” he said.

We know dealers don’t control the credit box. Lenders do.

But that’s exactly the point.

Because when approvals tighten and fraud checks stack up, what you control is how transparent, efficient, and connected operations are on your side of the line.

Put it this way: Lenders are auditing risk, dealers should be auditing process.

If you could strengthen one link in your operation this month, where would you start?

Three opportunities hitting the CDG Job Board right now:

Sames Auto Group: Service Manager (Laredo, Texas)

Capital Automotive Group: Service Technician (Shallotte, North Carolina)

Kitsap Auto Outlet: Sales Professional (Port Orchard, Washington)

Looking to hire? Add your roles today—it’s 100% free.