Compacts, hybrids, and value-driven used cars drove consumer demand in 2025, underscoring the inventory headwinds dealers could face heading into next year, according to CarGurus.

The details: The online marketplace’s 2025 Recap and 2026 Outlook attributes this year’s market shift—which has been mounting for years—to four major factors as consumers gravitated to value more than ever when shopping for a vehicle.

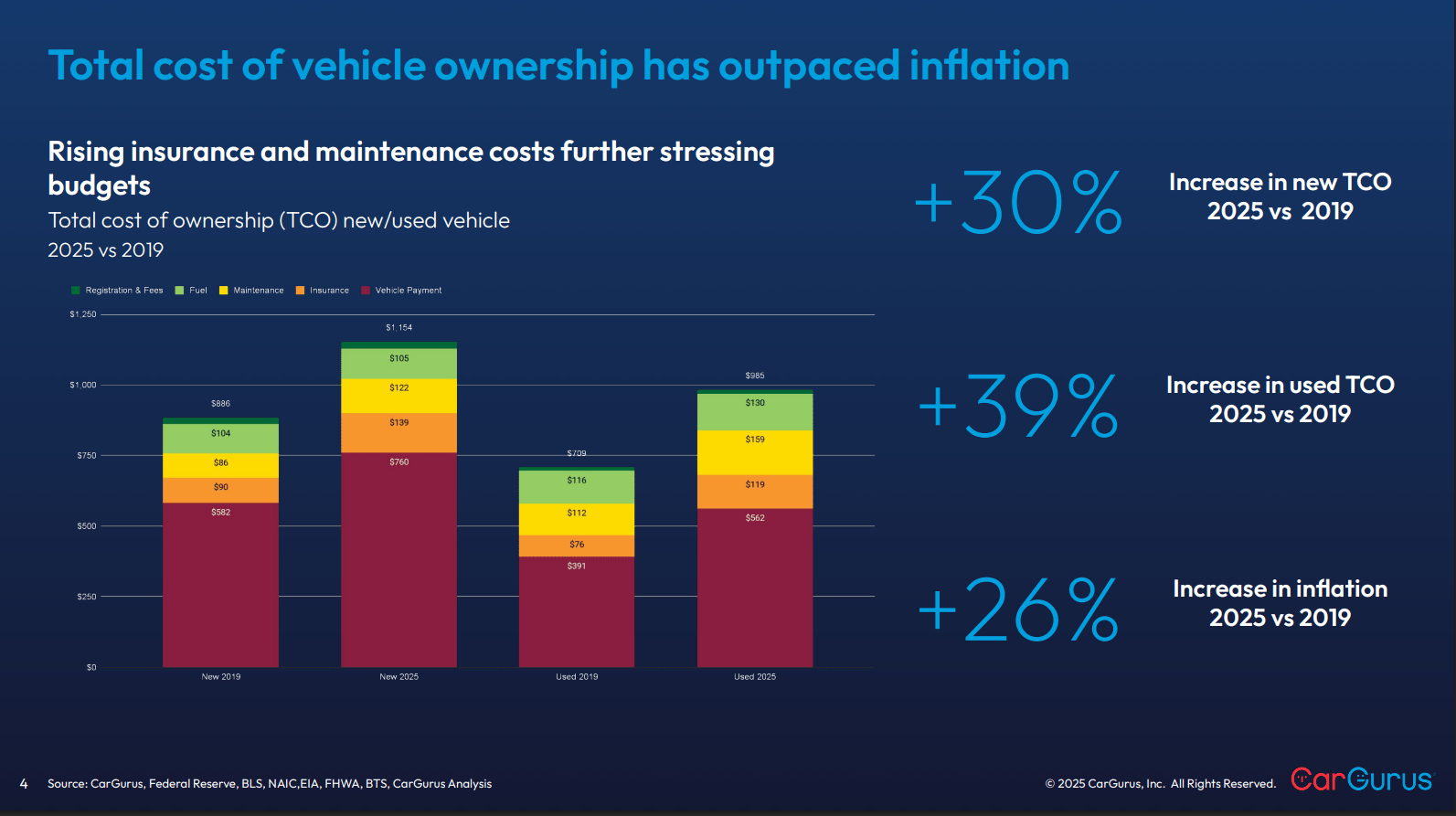

Since 2019, total cost of ownership (TCO) has climbed faster than overall inflation (26%),with new-vehicle TCO up about 29% and used-vehicle TCO up about 36%.

More budget-conscious buyers opted for used vehicles—which carried most of the load in 2025. Used retail sales increased around 8% year over year so far.

Tariffs changed the timing of car purchases more than the actual purchases, with strong sales through mid-year, but a cooling market in October and November.

With the end of the federal EV tax credit, buyers craving more fuel-efficient models turned to hybrids, with Toyota topping the list for shoppers in new and used markets.

Via CarGurus

What they’re saying: “If 2024 was defined by declining affordability, 2025 was the year consumers actively pursued it, shaping both shopping behavior and automotive supply trends,” said Kevin Roberts, director of economic and market intelligence at CarGurus, per a press release statement. “Concerns over tariff costs and the expiration of the EV tax credit accelerated this trend as shoppers pushed to lock in pricing ahead of anticipated increases.”

Why it matters: For dealers, 2025 confirmed that affordability and fuel efficiency now drive the bulk of demand, putting a premium on the right mix of compacts, hybrids, and value-priced used inventory. Stores that align stocking, pricing, and merchandising with payment-focused shoppers will be better positioned to keep volume and grosses steady as higher TCO continues to squeeze household budgets.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Between the lines: One of the most notable shifts that impacted the market in 2025 for car buyers shopping for value and dealers—highlighted in CarGurus’ report—was the age mix of used cars available.

Vehicles 3–5 years old lost share, squeezed from both sides by very young (1–2-year-old) inventory and much older vehicles.

Cars 6–10 years old now make up a significantly higher share of used listings than they did in 2019.

Inventory of vehicles three years old and newer is still about 9% below pre-COVID levels.

Bottom line: Dealers looking to win the value shopper in 2026 will need to lean into older, well-reconditioned used inventory, spotlight hybrids as the sweet spot between fuel savings and price, and stay nimble on tariffs and tax policy that can pull demand forward or push it out of reach—often with little warning.

A quick word from our partner

Identity Fraud is hurting auto dealers.

Experian Automotive found that nearly 90% of dealers are concerned about rising fraud, with 75% reporting a measurable impact on their operations. In the past year, 85% have suspected or confirmed fraud cases, primarily due to income fabrication and forged documents.

The fix? Experian Automotive's Fraud Protect.

Fraud Protect quickly and easily validates customer identities and documents with zero disruption to your sales flow or the consumer journey.