The used-car market’s traditional role as a pressure-release valve for affordability is being tested—leaving buyers and dealers alike in a delicate dance, searching for value amid rising costs.

By the numbers: Edmunds credits higher average used-car transaction prices (ATPs) for the slower selling pace, particularly as some late-model used inventory approaches price parity with certain new car models.

The ATP for 3-year-old vehicles climbed to $31,067 in Q3 2025, up 5% year over year from $29,578 in Q3 2024.

Lot time for used cars rose from 37 days in Q3 2024 to 41 days in Q3 2025—the slowest third-quarter pace since 2017, when 3-year-old vehicles sold for nearly $10,000 less.

What they're saying: "The used-car market continues to challenge both shoppers and dealers as prices climb and vehicles spend longer on lots," said Ivan Drury, director of insights at Edmunds. "For dealers, the elimination of the highly visible federal credit for new EVs could push more shoppers toward the used market in search of affordability."

Ivan Drury

Why it matters: The more desirable end of the used car market is repricing, but underlying consumer demand should stay supported as new car ATPs reach record highs, the aging American fleet forces replacement cycles, and credit constraints limit access to new car incentives.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Between the lines: Used EVs largely bucked these trends in Q3 ahead of the federal tax credit expiration on September 30. Fast turns were also driven by extreme scarcity—3-year-old EVs represented just 1.6% of total inventory due to limited 2021-2022 production.

Still, they represented eight of the 20 fastest-selling 3-year-old vehicles in Q3, selling in an average of 34 days—seven days faster than the overall average.

Nearly two-thirds of 3-year-old EVs (63.1%) fall in the $20,000–$30,000 range, compared with 42.5% of other vehicles, providing used car shoppers with wider options.

Nearly two-thirds (66.3%) of used EVs have under 40,000 miles, compared with 56.8% of other 3-year-old vehicles.

Bottom line: With near-new prices in the most sought-after segments, the underlying need for replacement vehicles remains firm. The conversation at the dealership-level is turning from simple supply and demand to the nuanced calculus of who can afford to buy, and what they’re willing to settle for.

A quick word from our partner

Want insider knowledge on the most up-to-date trends in auto retail?

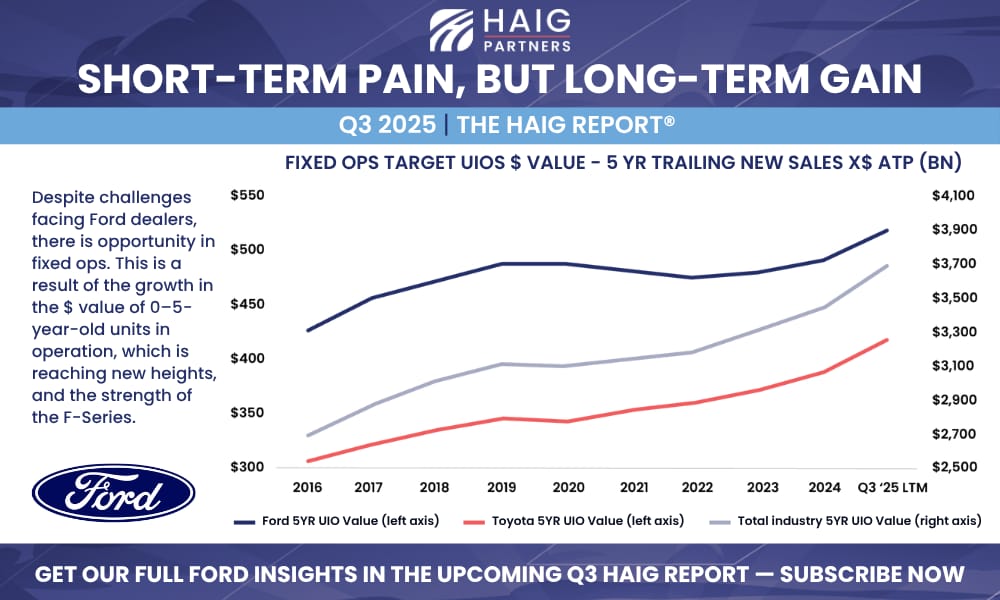

Here’s a sneak peek of what’s coming in the Q3 2025 Haig Report®—auto retail’s longest-published and most trusted quarterly report tracking trends and their impact on dealership values. Since 2014, the Haig Report® has delivered expert analysis on dealership performance, market activity, and franchise valuations, offering a clear view of opportunities and challenges in automotive retail.

Learn more in the full Q3 2025 Haig Report® by subscribing to receive it as soon as it’s released.