Hey everyone. Our *consumer-only* survey on how shoppers are reacting to tariff news is still live—but it closes tonight at 11:59 p.m. ET.

Are tariffs making you rethink your next car purchase?

[Tell us—2 minutes, no fluff.]

We’ll share the results once they’re in.

— CDG

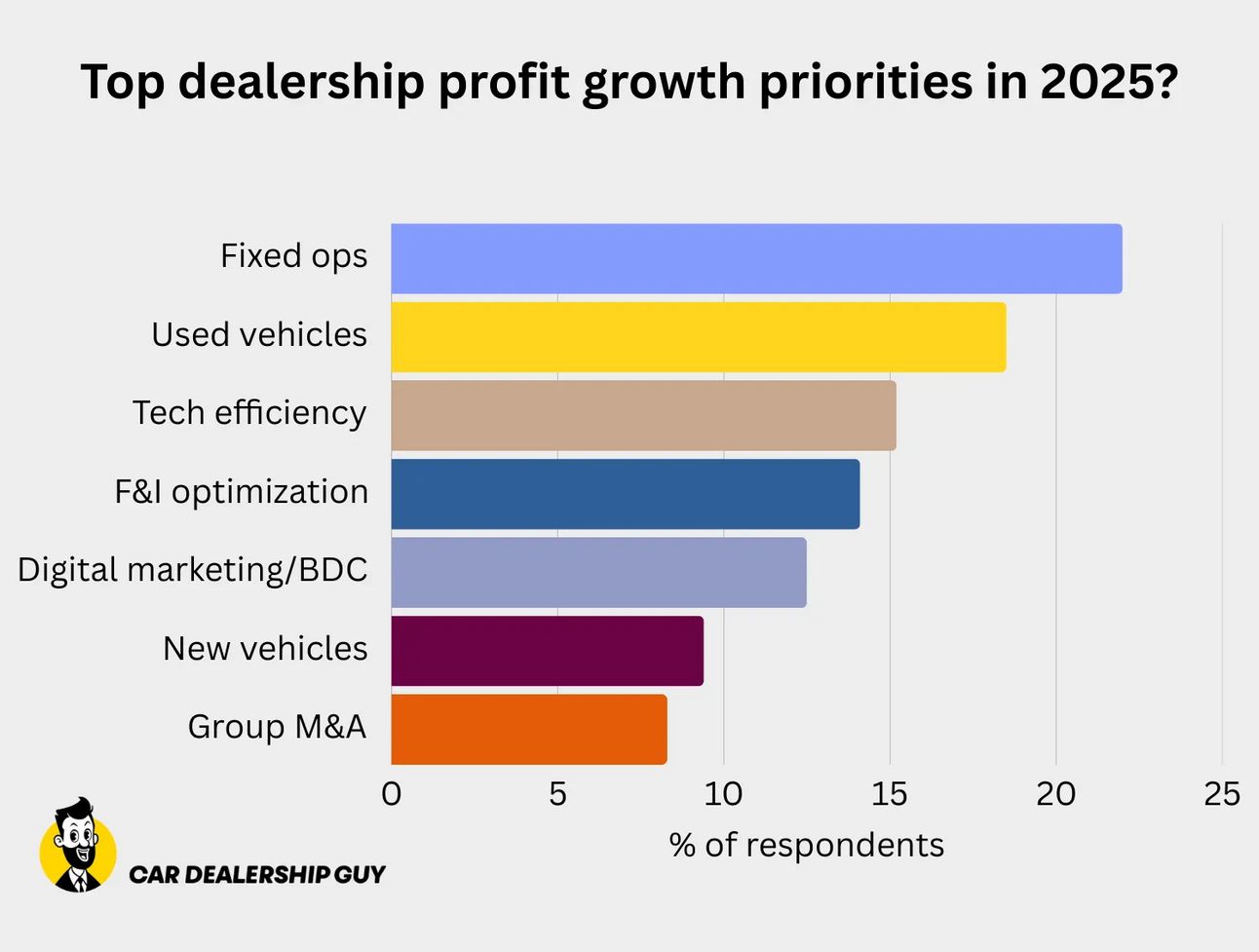

Intriguing breakdown from our CDG Dealer Outlook Survey (Q2):

More dealers are betting on service, parts, and collision work to drive profit growth than anything else.

Meanwhile, used cars ranked second—but dealership M&A?

Dead last.

Big picture: Right now, many dealers are refocusing on what they can control by optimizing the stores they already own.

(Data source: Car Dealership Guy)

1. Tariffs jitters push buyers into showrooms, but the surge might be short-lived

New car sales are on track to rise 10.5% in April—marking seven straight months of growth.

What’s driving it?

In part, shoppers rushing to buy before potential tariff price hikes.

But the sugar rush is fading. Incentives are down, prices are up, and J.D. Power says demand cooled in late April.

Big picture: Dealer profits are steady for now—but the real challenge comes when tariffs start hitting unevenly across brands and segments.

Are you struggling sifting through inventory that’s just not right for your lot?

OPENLANE brings dealers like you exclusive inventory, simple transactions and better outcomes — all with lower fees.

OPENLANE can fill out your lot with thousands of quality, late-model vehicles your customers are looking for.

OPENLANE features:

Exclusive access to over 70% of all off-lease vehicles in the U.S.

Luxury or high-mileage, source trades from dealers nationwide

AI-enhanced condition reports with photos, OBD scans, engine recordings, and more

The industry’s leading buyer protection with our Buyback Guarantee

New to OPENLANE?

Sign up now and receive a $2,500 buy and sell fee credit.

2. Hyundai shifts Tucson production to dodge tariffs, keep sales rolling

Hyundai’s making moves ahead of U.S. tariffs—like shifting Tucson production from Mexico to Alabama to protect one of its best-sellers.

Call it proof that Hyundai’s “sell like hell” strategy isn’t just a slogan.

Canada-bound units?

Those are shifting to Mexico instead.

Why it matters: The Tucson’s a core driver, with Q1 deliveries up 21% and hybrids fueling record profits. And Hyundai isn’t waiting for tariffs to hit—it’s reworking its playbook to stay ahead.

Don’t overspend on dealership vendors.

Get exclusive discounts and insider deals from top automotive vendors. No catch—just free savings for all CDG followers.

3. Stellantis hits milestone on faster solid-state batteries for future EVs

Stellantis isn’t backing off EVs—it’s doubling down with solid-state batteries that charge to 90% in 18 minutes and handle -22°F to 113°F.

Why it matters:

Solid-state batteries may solve future EV headaches—but Stellantis is still battling today’s demand problem.

Charger Daytona EV sales barely hit 1,947 units in Q1, and Jeep’s already slashing up to $12,500 off the Wagoneer S.

Zooming out: Tech breakthroughs give Stellantis a stronger EV story—but turning that into sales will demand new strategies on the showroom floor and beyond.

Buick vulnerable to Trump tariffs: ‘It could just disappear altogether’

Toyota Industries shares set to surge on potential buyout by Toyota Motor

German auto parts maker files for bankruptcy

How the Slate truck might be the wrecking ball the industry needs

Tesla hikes prices on its EVs in Canada amid tariffs, expect demand collapse

Did you enjoy this edition of the Daily Dealer newsletter?

Thanks for reading everyone.

— CDG

Want to advertise with CDG? Click here.

Want to be considered as a guest on the CDG podcast? Right this way.

Want to pitch a story for the newsletter? Share it here.