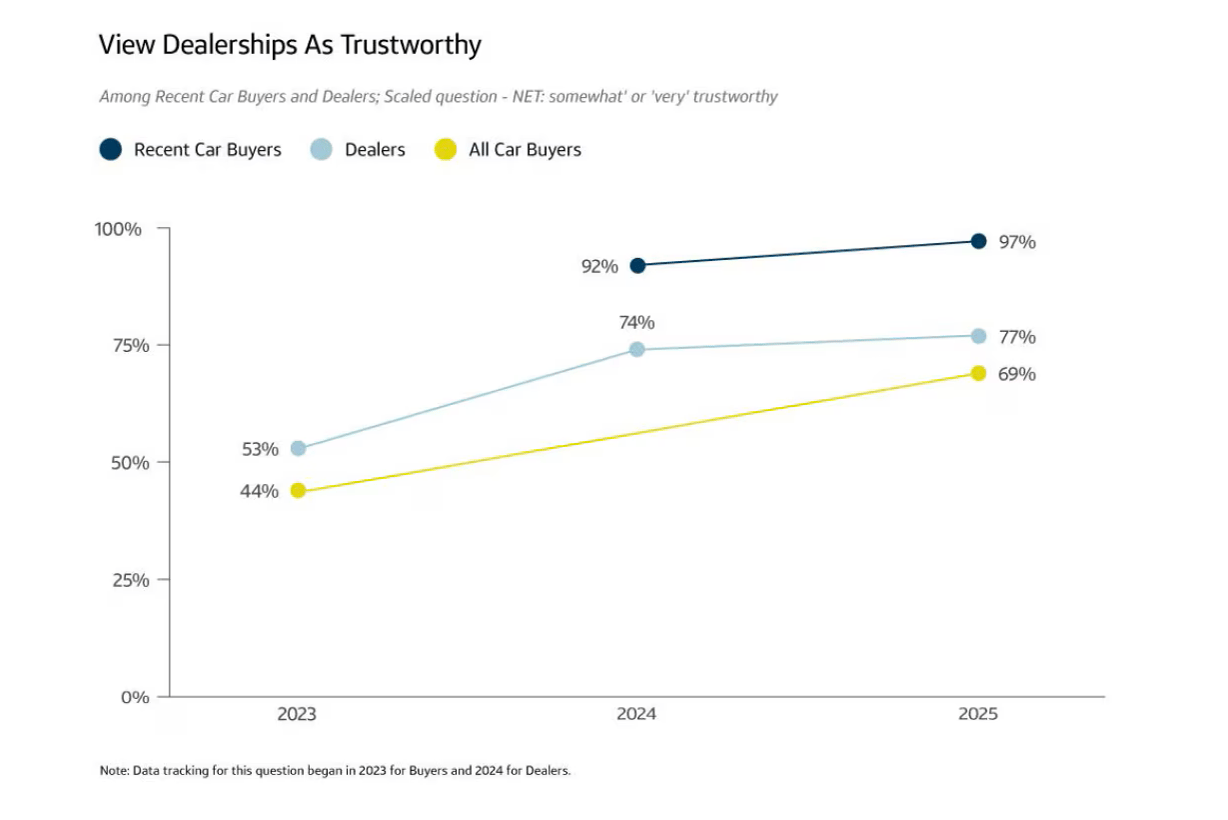

Consumer confidence in dealerships is high, with the number of car buyers who view auto retailers as trustworthy surging 25 percentage points over the past two years.

The details: The findings—as detailed in the 2025 Capital One Car Buying Outlook—reveal that two-thirds, or 69%, of car buyers now view dealers as trustworthy, up from 44% two years ago, with several factors helping drive a higher level of trust.

Buyers using digital tools are even more likely to trust dealers at 71%, an increase of three percentage points compared to the trust level overall.

Almost half (45%) of recent car buyers said manufacturers contributed to their trust in dealerships, compared to 20% who said so in 2024.

The Capital One report—drawn from a survey of 2,042 U.S. car buyers (recent and future), ages 18-plus—also highlights the impact of higher consumer confidence, revealing that buyers who trust dealers are almost twice as likely to return to that store for their next purchase (46% vs. 24%).

Why it matters: With 7 in 10 buyers now seeing dealers as trustworthy—and those who trust auto sellers almost twice as likely to return—dealerships aren’t just selling a vehicle with trustworthy practices, they’re building a repeat customer base.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Between the lines: The experiences of in-person shoppers compared to those who shop online, as detailed in the Capital One report, also spotlight the value of in-store visits in establishing trust among consumers.

Car buyers who shop in person were more likely (40%) than online shoppers (18%) to find the car-buying experience transparent.

Those in-person shoppers also experienced more excitement (67% vs. 56%) and delight (52% vs. 44%) than online shoppers.

Buyers who shopped entirely, mostly, or some in person felt a greater sense of control (43%) than those who shopped entirely, mostly, or some online (23%).

What they’re saying: “When trusted, personal relationships meet an increasingly digital world, buyers feel more confident and in control," said Sanjiv Yajnik, president of Capital One Auto. "Finding the right balance between online research and in-person connection creates a better experience than either one alone. When trust is present, everyone benefits–buyers, dealers and the industry as a whole."

Digging deeper: Building trust among Gen Z buyers has proven to be a bit more challenging for dealers due to several factors.

When engaged in the car-buying process, Gen Z buyers rely on external sources not related to the dealership more than other generations, especially in determining which dealerships to engage, at 53%.

They are also more likely than other car buyers to feel overwhelmed (34%), stressed (29%), intimidated (25%), frustrated (21%), or confused (24%) throughout the car-buying experience.

Bottom line: As consumer trust in dealers surges and in-person visits remain the best way to build it, there’s a huge sales opportunity for dealerships that blend online convenience with strong in-store relationships—especially to better support more skeptical and easily overwhelmed Gen Z buyers.

A quick word from our partner

Identity Fraud is hurting auto dealers.

Experian Automotive found that nearly 90% of dealers are concerned about rising fraud, with 75% reporting a measurable impact on their operations. In the past year, 85% have suspected or confirmed fraud cases, primarily due to income fabrication and forged documents.

The fix? Experian Automotive's Fraud Protect.

Fraud Protect quickly and easily validates customer identities and documents with zero disruption to your sales flow or the consumer journey.