Hey everyone. The CDG Podcast is surging, with 52K+ unique listeners in the last 60 days. And that doesn’t even count X or YouTube.

Fastest growth since our early run.

Why? Daily Dealer Live is cutting through the noise with raw, unfiltered auto retail coverage—and it’s hitting. Appreciate everyone tuning in.

P.s. Another big segment drops today at 1 p.m. EST. Watch it live anywhere.

— CDG

Welcome to the Daily Dealer a concise rundown of the most important automotive industry headlines that matter to car dealers, automakers, and industry insiders.

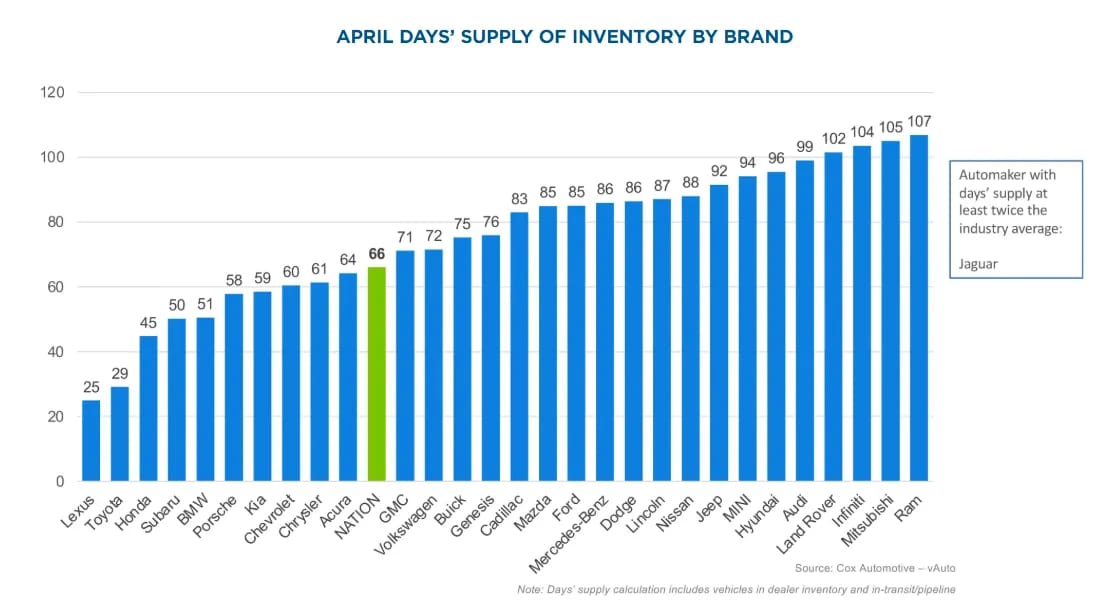

Stronger than usual demand is shrinking new car inventory:

In April, only five brands had an average market days’ supply over 100 days—

Land Rover: 102

Infiniti: 104

Mitsubishi: 105

Ram: 107

Jaguar: 132+

But for others, supply is at its lowest level so far this year.

And as automakers make reactive manufacturing decisions in light of tariffs, don't expect inventory to restock evenly.

(Tesla has no franchised dealerships and is excluded from this report)

1. Midwest mega-dealer Aaron Zeigler explains latest Ferrari acquisition

Zeigler Auto just bought a Ferrari store—and it’s their biggest single-rooftop deal ever.

The group picked up Ferrari Lake Forest, a high-volume exotic dealer moving 265 Ferraris a year, plus Koenigseggs and Paganis. And with multi-year waitlists and sky-high margins, it’s a big swing into ultra-luxury.

Big picture: With Ferrari in the fold, Zeigler’s laying the groundwork for more ultra-lux growth, starting with pre-owned and service scale-ups.

Missed Calls = Missed Revenue

Dealerships miss 15–30% of inbound calls—costing 5 to 6 figures in lost revenue every month. That’s where Mia comes in.

Mia is your 24/7/365 AI super employee. She answers every call, books appointments, checks inventory, and keeps your team in the loop—no awkward pauses and no lost leads.

CDG listeners get their first month FREE—just mention CDG when you request your demo.

2. Car buyers face slimmer pickings as new vehicle inventory shrinks

Tariff fears juiced demand in March and April, but May’s shaping up differently.

New-car inventory reached 2.49 million units at the start of May, down 7.4% MoM and 10.5% YoY, while listing prices climbed and incentives pulled back.

“Manufacturers seem to be holding back production with a wait-and-see attitude to see how the tariffs shake out,” Cox Auto’s Erin Keating explained.

Zooming out: May’s shrinking inventory shows how quickly consumer leverage can vanish when manufacturers go reactive.

Miss Friday’s episode of Daily Dealer Live?

Ford brake failures, Apple launches CarPlay Ultra, and more.

Ryan Maher, CEO of BizzyCar

Aaron Zeigler, President of Zeigler Automotive Group

Justin Villa, General Manager at Clay Cooley Ford

3. GM faces lawsuit over controversial fix to V8 engine recall

GM is facing a lawsuit over its L87 V8 engine recall—owners say the fix tanks fuel economy.

Instead of replacing engines, GM’s using thicker oil, which plaintiffs argue means more trips to the pump.

The recall covers 600K+ trucks and SUVs from 2021–2024. And so far, GM’s linked the defect to 12 crashes and 12 injuries.

Bottom line: No customer should have to choose between their vehicle’s reliability and the efficiency that was advertised.

Auto retailing giant Braman Motors plans to build mixed-use campus with skyscrapers.

Miami auto group Braman Motors is planning to add two 60-story residential towers and an 11-story automotive facility to its longtime home in the Wynwood neighborhood.

Boyd Automotive and NASCAR’s Kyle Busch team up for Chevy acquisition.

NASCAR star Kyle Busch is taking a detour into car sales, joining Boyd Automotive Group as part-owner of their newly acquired Chevy dealership in Kitty Hawk on North Carolina's Outer Banks.

Did you enjoy this edition of the Daily Dealer newsletter?

Thanks for reading everyone.

— CDG

Want to advertise with CDG? Click here.

Want to be considered as a guest on the CDG podcast? Right this way.

Want to pitch a story for the newsletter? Share it here.