Presented by:

Hey everyone,

Just a reminder, the latest CDG Dealer Outlook Survey (Q4 2025), exclusively for dealer principals, managing partners, and group executives, is closing soon.

It only takes two minutes to complete, and we’ll be sharing a full analysis of the results in the coming weeks.

*Your individual answers are fully confidential and will not be shared with anyone.

— CDG

Welcome to the Market Pulse—your no-fluff cheatsheet to auto retail, built to help dealers price right, stock smart, and stay ahead.

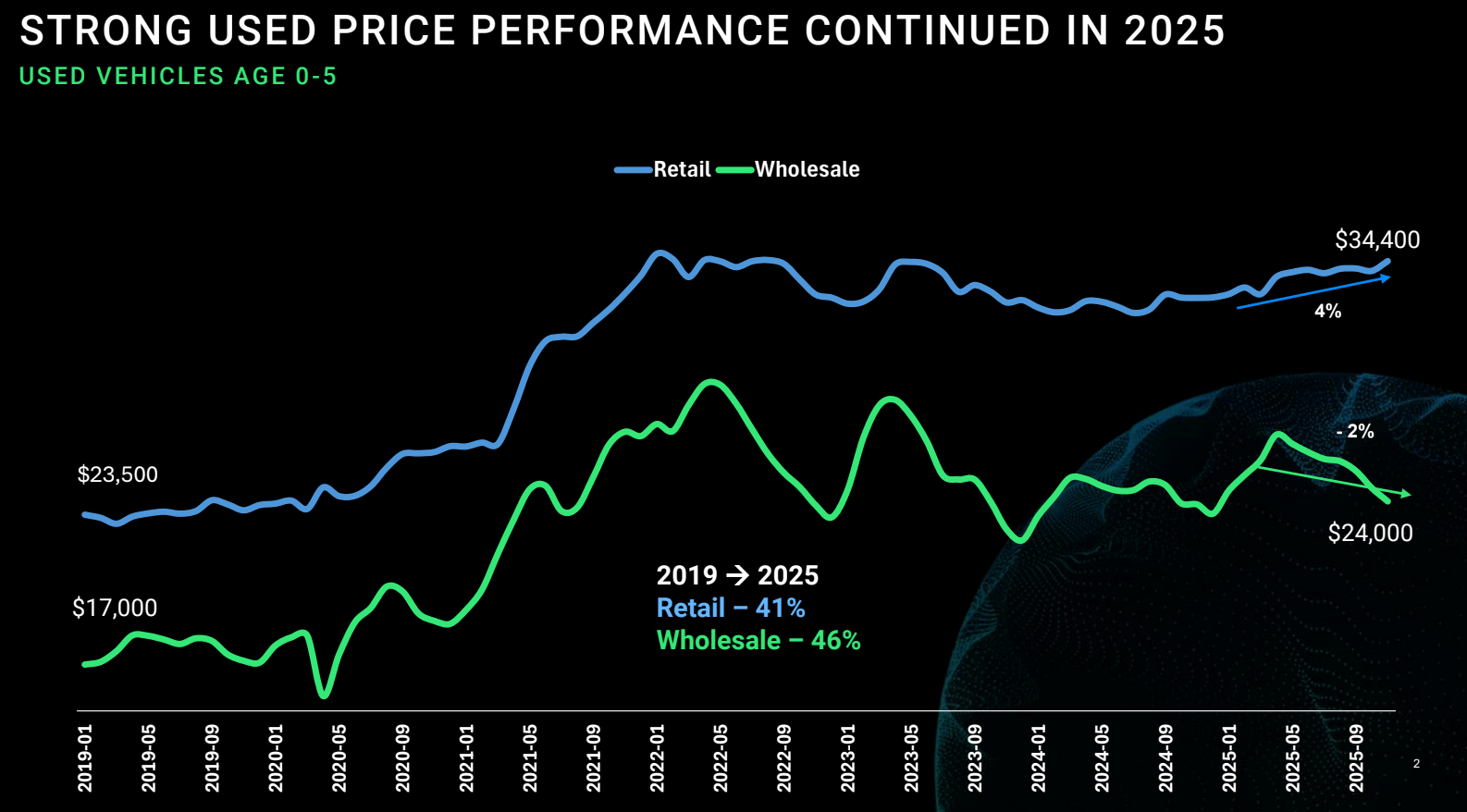

Used-car values are dropping faster than normal: Prices are down roughly 10% vs the late-summer peak, a move that typically takes six to nine months.

Meanwhile, demand is holding far stronger than expected: Retail used prices remain 40%+ above 2019 and slightly above 2024, showing surprising stability despite tariffs, incentive resets, EV turbulence, and payment pressure.

And the biggest pressure point is consistency: When online valuations, in-store pricing, and service-drive numbers don’t line up, deals fall apart, and inventory decisions miss the mark.

(Source: J.D. Power / Cox Automotive / CDG Interviews)

Used prices are normalizing while demand is staying unexpectedly strong.

At Used Car Week last week, J.D. Power’s Tyson Jominy and Jonathan Banks walked through how used prices are trending, and their message was pretty clear:

The used market is ending the year far better than anyone expected.

Here’s what they said is happening:

Used values are down about 10% from the late-summer peak, and that entire swing happened in roughly two and a half months.

The anxiety comes from how quickly book values are adjusting, because moves of this size usually stretch over six to nine months.

This one, however, compressed into a single quarter (as seen below).

Sourced via J.D. Power

The good news: Even with that drop, Jominy and Banks shared that retail used prices remain more than 40% above 2019 and slightly higher than last year, a remarkably strong finish considering the year’s tariffs, incentive resets, EV turbulence, and ongoing payment pressure.

NOTE TO DEALERS:

When the market is moving faster than your appraisal cycle, you can lose margin without realizing it.

On top of that, in a conversation I had with Micah Tindor and Elizabeth Stegall (Cox Automotive), they highlighted that the appraisal experience often falls apart the moment the customer switches channels, whether it’s from an online valuation to an in-store visit or from the service drive back into sales.

A solution to consider:

Pick up the appraisal exactly where the shopper started it by pulling their online valuation or service-drive estimate directly into the same workflow (IMS → appraisal → service), so you’re continuing one unified record instead of rebuilding it from scratch.

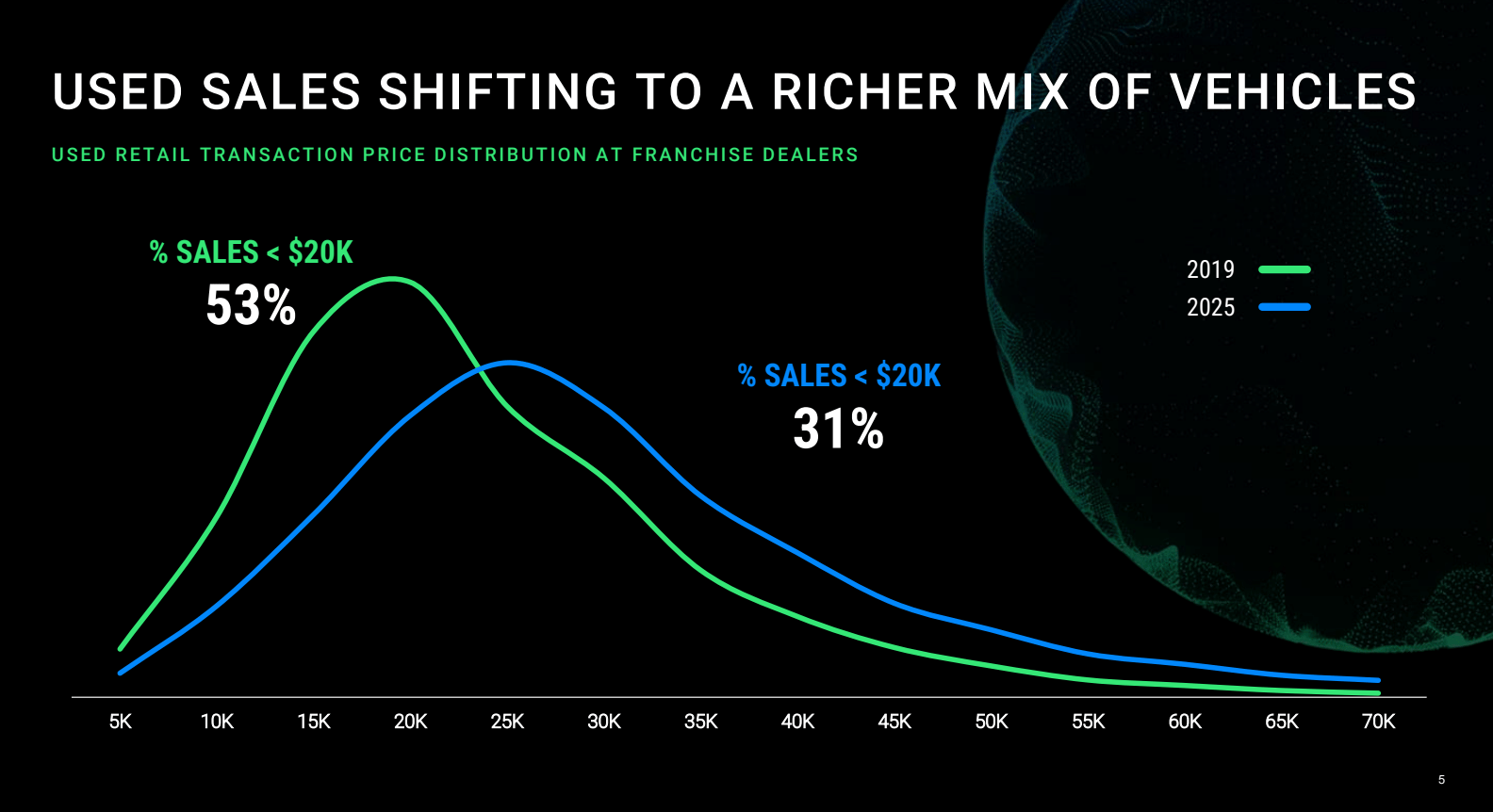

The affordability crunch is reshaping mix, margins, and where shoppers are landing.

We covered how used prices are adjusting quickly. The next layer is how those prices are changing what consumers can actually afford, and what that means for inventory and gross.

And despite the headwinds, J.D. Power’s view is that the used market is still performing far better than the macro story suggests.

Here’s what they mean:

The average used payment has climbed from the low $400s in 2019 to the mid-$500s today, while wage growth for most households has risen only about 15%, per their presentation. In practice, that means the payment that once bought a midsize SUV now buys a compact sedan instead.

Sourced via J.D. Power

This shift has left dealers with fewer sub-$20K units, more shoppers capped by tight payment ceilings, and more equity-light customers coming out of 2022 purchases.

Still, even with those constraints, Jominy and Banks note that days-to-turn remain steady and demand is persistent, meaning that while affordability is stressed, the overall used market is actually ending the year surprisingly well.

WHY IT MATTERS:

And as Tindor (Cox Auto) explained, this affordability squeeze is exactly why shoppers are moving up and down the price stack more than ever.

His advice:

Equipping your team to pivot between new, used, and CPO will keep those deals from stalling.

Because when salespeople can confidently show workable alternatives across the stack, they protect gross, solve for affordability, and prevent shoppers from walking simply because they started in the wrong segment.

A quick word from our partner

Shoppers will leave. Don’t let them be lost.

You don’t close every shopper on the first visit—over 80% leave without buying—and many walk your lot after hours with zero follow-up.

ScanForInfo’s Precision Retargeting gives you 30 days of targeted social ads to every local shopper who scans a vehicle, keeping your dealership in front of them while they decide.

Plus, with custom QR code labels, instant text alerts, and automatic lead capture to your CRM, you’ll win deals your competitors never even saw.

During my chat with Stegall and Tindor, which also took place at Used Car Week, we got into how dealers can keep deals moving as affordability tightens, equity thins out, and shopper behavior keeps shifting.

And here are their Dos and Don’ts for 2026:

Do: Build your process around how your shoppers actually want to buy.

Dealers often overthink demographics and underthink behavior, per Stegall.

“This is the second biggest purchase they’re going to make, and in their world, that’s the end all be all. It doesn’t matter if it’s a $30,000 car or an $80,000 car. They want the same experience. They want trust and credibility. They want you to get rocks out of the road while they’re trying to figure out what they’re doing and what they’re buying.”

Elizabeth Stegall

Her point: Every buyer expects a premium experience now, and the stores that can deliver it across all price points, not just the high-end, are the ones more likely to secure deals over their competitors.

Do: Treat transparency as a conversion tool, not a compliance box.

Stegall added that the biggest trust failures still happen when the online and in-store experiences don’t line up in pricing, availability, or willingness to negotiate remotely.

“If I were a dealer right now, and going into 2026, I would treat my business like every customer is never going to walk in the door, and I’m going to do everything I can to build that trust and value, virtually,” she said.

Don’t: Let AI overstep and break trust with the shopper.

Handing a customer from a polished AI experience to an unprepared salesperson is where tons of deals are dying right now.

In Stegall’s words: “AI is how you integrate it into your entire operating process to make it more efficient. And if you do that effectively, the consumers will have no idea it was ever a part of it.”

Right now, the easiest way to do this is to reach for what Tindor calls the lowest-hanging fruit, aka service-drive acquisition, running down mis-trades, and using IMS + appraisal + service tools together.

Micah Tindor

Demand only matters if your process can meet it, and too many stores are still running a 2026 market with a 2018 workflow.

The good news is you don’t need a grand reinvention. As Stegall and Tindor made clear, we’re talking about simple housekeeping like cleaner handoffs, consistent valuations, honoring the shopper’s starting point, and delivering a premium experience at every price point.

And since we’re heading into the season of “what are you thankful for?”, here’s a thought experiment:

Would your customers name your process on that list?

If the honest answer is “probably not,” consider this your sign for a pre-2026 reset. Because if the market is going to show up this strong, your experience should too.

Missed yesterday’s episode of Daily Dealer Live?

Presented by:

Barbosa on End of Sale, Steinberg on Data Silos, Woolsey on Dealership Security

Featured guests:

Eric Barbosa, VP of Variable Operations at Cavender Auto Group

David Steinberg, CEO/Founder of Foureyes

Robert Woolsey, Director of Corporate Security at Swickard Group

The latest updates to CDG’s Buy/Sell Tracker.