November U.S. car sales were down for most automakers reporting results—with electric vehicles taking another hit across the board as deeper headwinds from the end of the federal EV tax credit settling in.

First things first: Toyota and Kia were the only two automakers of the seven reporting monthly sales that saw an overall increase in November.

Toyota’s overall sales increased 2.7% year-over-year, with 212,722 deliveries in 2025 compared to 207,222 in 2024.

Deliveries for the Toyota division rose to 180,990 in November 2025 from 173,356, an increase of 4.4%—though Lexus sales declined 6.2% compared to the same period last year.

Kia’s deliveries rose 3% year-over-year to 72,002 units sold, compared to 70,107 deliveries for the same period last year.

Feeling the pain: Sales for Honda, Mazda, Subaru, and Volvo decreased across the board in November, while Ford and Hyundai’s brand divisions (not including Kia) also saw declines.

Deliveries for Honda and its Acura division dropped 16.8% (to 91,582) and 1.4% (to 11,242), respectively, down from 110,020 and 11,399 in 2024.

Mazda sales dipped 1.5% to 32,909 deliveries in November, down from 33,422 the same period last year.

Subaru deliveries in the U.S. slid 9.7% to 52,081 units for the month compared to 57,690 units last November.

Total Ford sales were down 0.7%, with Ford division sales remaining relatively flat at 156,097 deliveries in 2025 versus 156,139 in 2024—while Lincoln’s deliveries slid 12.3% for the month.

Deliveries for Hyundai dropped 2%, going from 76,008 to 74,289 units sold—while Genesis sales ticked up 0.2% in November.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Digging deeper: With the end of the federal EV tax credit now two months in the rearview, electric vehicle deliveries took a major hit in November across the board.

Sales for Hyundai’s two core EVs, the Ioniq 5 and Ioniq 6, dropped more than 50%.

Ford’s EV sales slumped 60.8% compared to the same period last year.

Kia saw a decline of 57% or more for two key EVs in its lineup, the EV6 and EV9.

Sales of the Honda Prologue EV and the Acura ZDX each dropped by over 80%.

What we’re watching: Interest rates and monthly payments, overall consumer confidence and job security, shifts in government and OEM incentives, and the availability and tightness of credit—the key forces shaping affordability and willingness to buy, and the ones most likely to help turn sales around.

A quick word from our partner

Stop the Fixed Ops Revenue Leak.

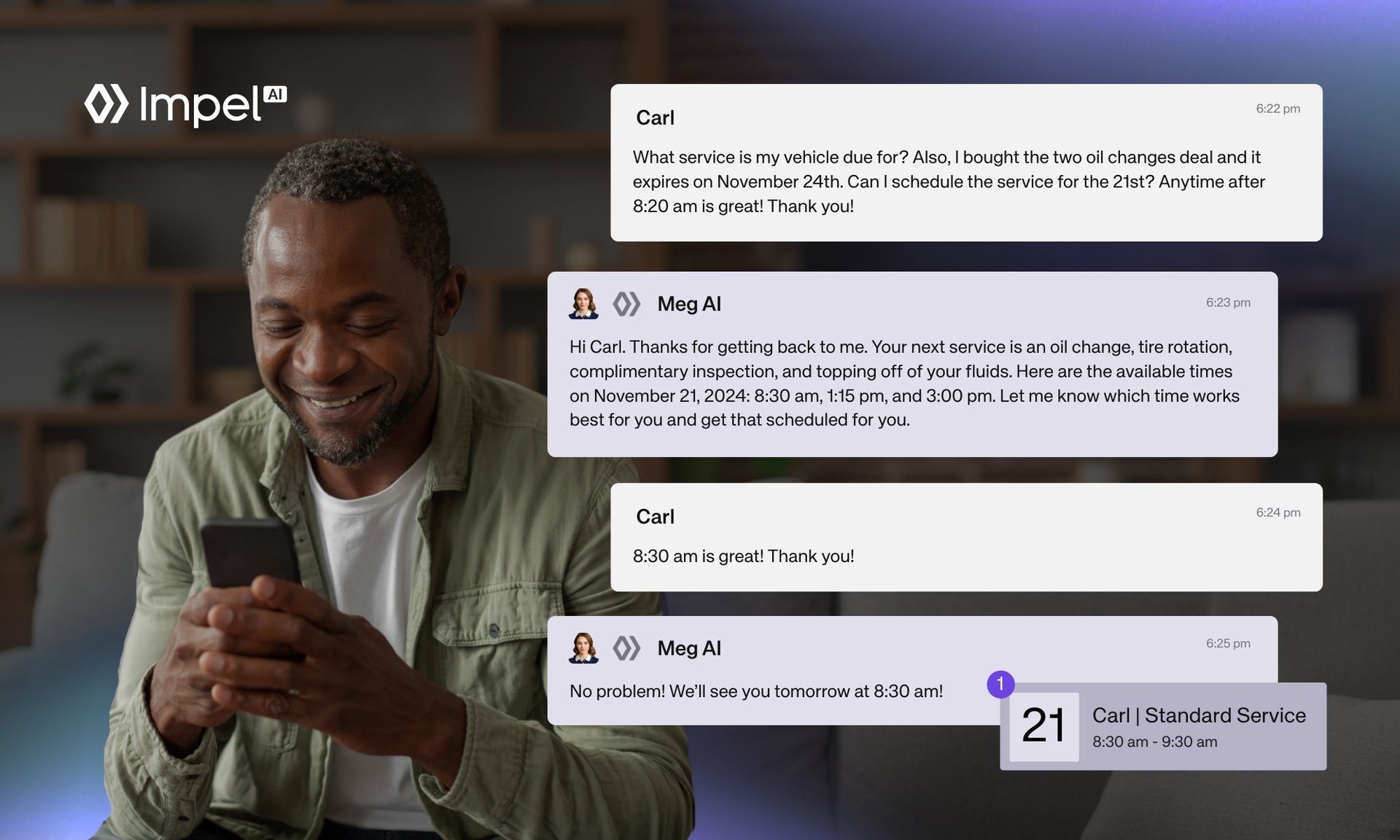

Missed calls and manual follow-up kill retention. Impel’s Service AI with Voice AI fixes this by automating personalized outreach based on driving behavior, capturing every missed call, and booking appointments instantly via text and email.

Keep advisors focused on the lane while customers get faster answers and your bays stay full. One platform. Zero missed opportunities.