EV sales are down following the expiration of the federal tax incentive, but they’re “not out,” according to the latest J.D. Power E-Vision Intelligence Report.

The details: Despite the drastic drop in electric-vehicle purchases in October, EV consideration is up as a significant number of EV owners prepare to re-enter the market, with 243,000 franchise EV leases coming to an end in 2026.

According to the study, 94% of current EV owners say they “definitely will” (79%) or “probably will” (15%) consider an EV for their next purchase or lease.

More than half (59.7%) of new-vehicle shoppers say they are “very likely” (24.2%) or “somewhat likely” (35.5%) to consider buying an EV in the next 12 months.

The percentage of new-vehicle shoppers who say they are “very likely” to consider buying or leasing an EV in the next 12 months is up from 21.6% in September.

What they’re saying: “Although sales have declined following the discontinuation of the federal EV tax credit, continued interest from vehicle shoppers combined with high EV loyalty rates from existing owners, will support the EV transition as the market gains its footing from the changes,” Brent Gruber, J.D. Power’s executive director of electric vehicle practice, told CDG News.

Brent Gruber

Why it matters: High consumer interest in EVs could provide much-needed stability to the segment in the coming year—as automakers and dealers look to offset the impact of the expired $7,500 federal tax incentive.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Between the lines: One of the key drivers of EV loyalty—which is anchored in leases— is satisfaction, with lower running costs (57%) topping the list as the No. 1 reason current EV owners select an electric vehicle.

Among current EV owners, 60% say their vehicles are much less expensive to own than gasoline-powered vehicles.

26% say they are slightly less expensive to own and operate, with just 7% saying they are more expensive.

What they’re saying: “Once consumers opt to purchase an EV, it generates very high loyalty rates for repurchasing an EV going forward,” said Gruber. “Using existing EV owners as a base to build upon, the challenge then becomes convincing other consumers that EVs are a worthwhile option to consider.”

Bottom line: The disposed EVs from new-vehicle shoppers will make strong value plays in the used market. However, those returning lessees may face higher pricing than they did previously—requiring dealers to reiterate the lower running cost of EV ownership versus gas-powered vehicles, explained Gruber.

A quick word from our partner

Want insider knowledge on the most up-to-date trends in auto retail?

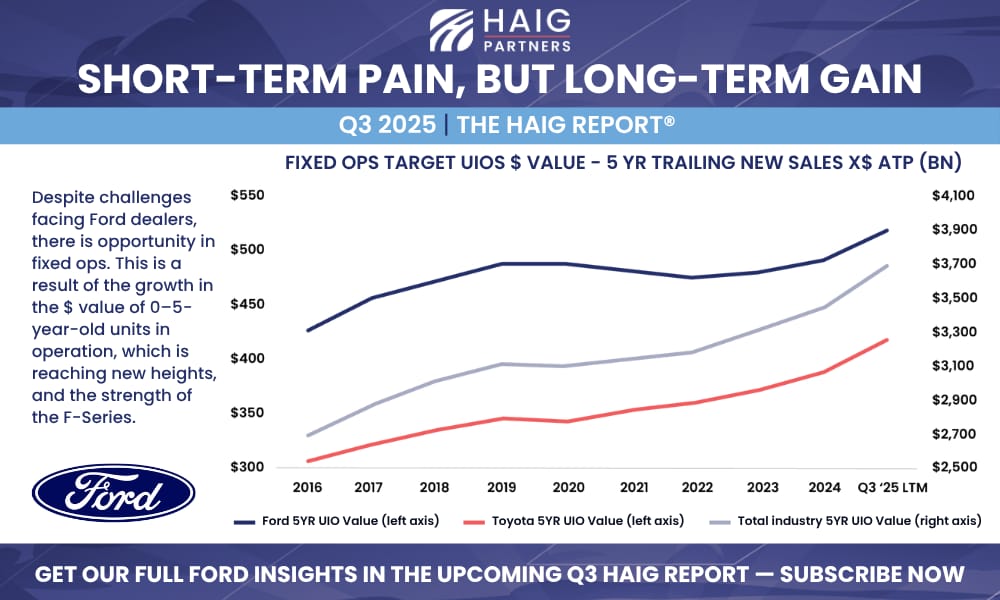

Here’s a sneak peek of what’s coming in the Q3 2025 Haig Report®—auto retail’s longest-published and most trusted quarterly report tracking trends and their impact on dealership values. Since 2014, the Haig Report® has delivered expert analysis on dealership performance, market activity, and franchise valuations, offering a clear view of opportunities and challenges in automotive retail.

Learn more in the full Q3 2025 Haig Report® by subscribing to receive it as soon as it’s released.