Marketing and advertising are among the most costly recurring expenses for car dealerships.

For context: Dealers spent 8% more on advertising during the first half of 2025 year-over-year for a total of $4.8 billion, according to the National Automobile Dealers Association (NADA).

That's the most money auto dealers have ever collectively spent on advertising during the first half of the year, beating the previous record from 2017.

Via NADA

However, Jeff Ramsey, CMO of Ourisman Automotive Group is taking the opposite approach by focusing on lead quality over volume, coordinating marketing spend with incoming inventory, and heavily prioritizing used cars.

Driving the news: "We're fine tuning all of our spend at each individual dealership," Ramsey told Daily Dealer Live hosts Sam D'Arc and Uli de' Martino. "We're down $108 for the year on cost per sale versus 2024."

That's a savings of $2.8 million in advertising year-to-date compared to 2024.

The kicker: The group's conversion rate was the highest it's ever been in October, leading to a record sales result.

How it works: The operational changes started with inventory decisions.

On new cars, Ramsey coordinates with operations on the incoming pipeline and adjusts ad spend around sales events and new offers.

For used cars, the marketing team communicates with the acquisition team about the used cars coming in, and markets backward into that inventory.

The group's used car volume jumped nearly 50% year-over-year.

"Focus on used cars and you'll always be profitable," Ramsey said.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

As far as leads are concerned, "CarGurus has been the most reactionary in a positive way when you do the right things, you see that lead count and those call counts increase," Ramsey explained.

The group's own websites rank second, followed by Cars.com and AutoTrader.

Video communication through DriveCentric pushes conversion higher.

The group tracks daily video send rates as a percentage of total opportunities and coaches reps through footage review.

The key to sales conversion is getting customers real answers, Ramsey explained. From his standpoint, blasting out a generic nationwide or tier 2 OEM message is “not where our focus is.”

Looking ahead: More customer-facing AI communication platforms are Ramsey’s primary concern.

"For the informed car dealer, it's going to be what sets them apart,” he said. “For the uninformed car dealer that gets taken advantage of, it's going to be the biggest waste of spend that they have."

A quick word from our partner

Want insider knowledge on the most up-to-date trends in auto retail?

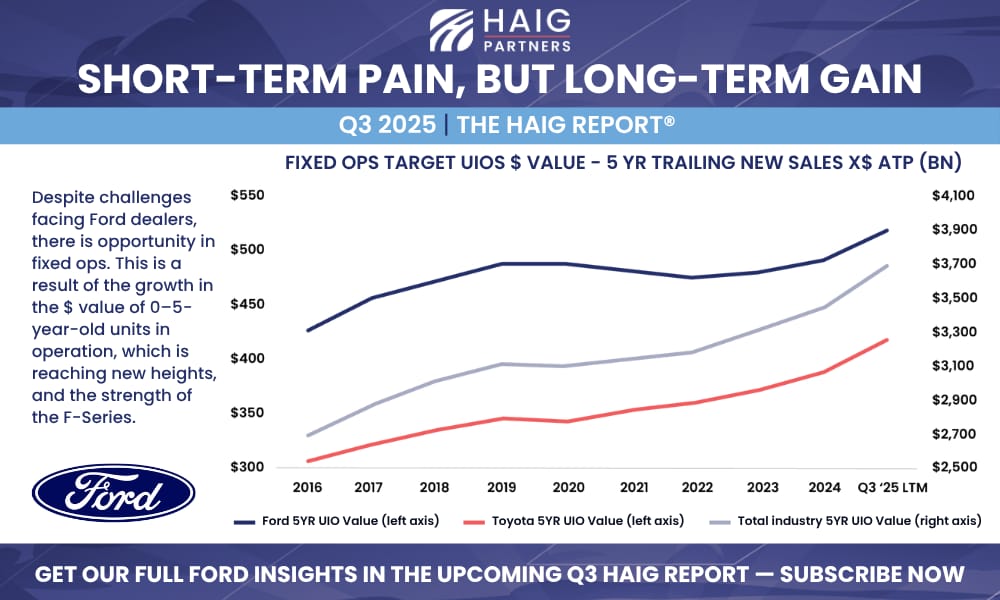

Here’s a sneak peek of what’s coming in the Q3 2025 Haig Report®—auto retail’s longest-published and most trusted quarterly report tracking trends and their impact on dealership values. Since 2014, the Haig Report® has delivered expert analysis on dealership performance, market activity, and franchise valuations, offering a clear view of opportunities and challenges in automotive retail.

Learn more in the full Q3 2025 Haig Report® by subscribing to receive it as soon as it’s released.