The used car market is operating at a permanently elevated price floor, and that reality is reshaping how dealers buy, stock, and sell inventory in 2026.

Driving the news: Average used retail prices at franchise dealers hit $30,202 in 2025 for vehicles aged 0-8 years, Jonathan Banks, vice president of product development for valuation services at J.D. Power, told attendees at last week's J.D. Power Auto Summit ahead of the 2026 NADA Show.

"Forget about whatever inflation assumptions you had from 2019 and before. We are in a new reality," Banks explained.

The reason: New vehicle sales collapsed during 2020-2022, bottoming at 13.7 million units in 2022 compared to the pre-COVID range of 17 million annually.

Those missing new vehicles are the desirable used cars dealers are struggling to stock now.

And even though lease maturities will increase this year, inventory still remains constrained.

"Low new-vehicle sales are basically defining the pool of used vehicles that we're facing today," Banks said. "We're still going to see that supply gap flowing through the market."

As a result: Retail used car prices are sticking at elevated levels, reshaping what consumers (especially lower to middle-income ones) can buy. And dealers are now stocking a fundamentally more expensive mix because that's what's available to buy.

The reality: Buyers are now looking at inventory that's 30-40% more expensive monthly, and the sub-$20,000 options they remember have mostly disappeared.

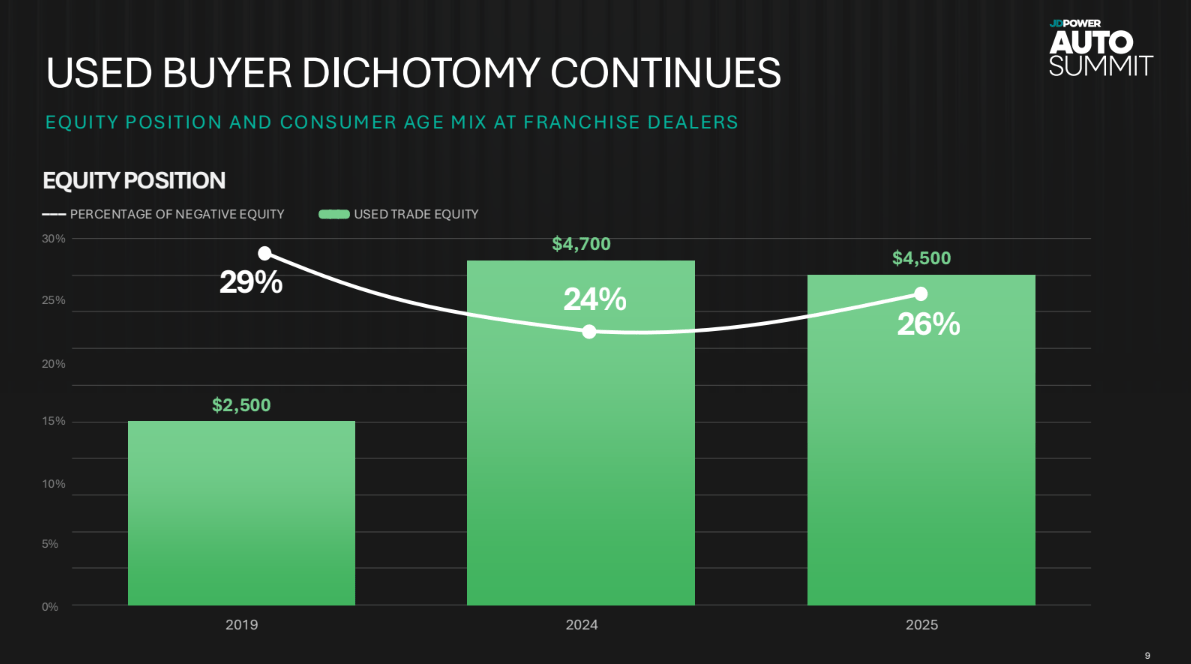

And although average trade equity across all buyers sits around $4,500, only about 75% are in positive equity positions. The remaining 25% that are underwater will really struggle to afford the inventory that's available.

Why it matters: Turn rates are often dependent on affordability, and understanding which inventory moves fast matters when holding costs are high. Compact cars averaged 35 days to turn in 2025. Midsize cars turned in 38 days. And large pickups sat for 53 days.

Buyers are gravitating toward affordable segments because that's what their budgets can handle.

Meaning, dealers need to stock inventory that aligns with the payment bands their local buyers can actually afford, and they need to move it before acquisition costs shift underneath them.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Between the lines: While retail prices have climbed steadily from $23,668 in 2019 to $30,202 in 2025, wholesale prices (what dealers pay for auction inventory) have been more volatile.

"When you start to think about what dealers need to do when you're managing your inventory, you're looking at a market where, two weeks later, no matter what, I guarantee you, you're going to have a different wholesale price compared to what you acquired the vehicle for," Banks noted.

The silver lining: Certified pre-owned inventory can help solve the payment problem, the turn problem, and the loyalty problem simultaneously.

CPO monthly payments average $592, now lower than non-CPO used at $609 and dramatically lower than new cars at $719.

The payment proximity to non-CPO units, gives buyers the affordability they need while the OEM warranty provides confidence they won't face expensive repairs.

CPO vehicles turn in 48 days on average versus 62 days for non-CPO inventory.

That's comparing vehicles that qualify for CPO programs, so it's an apples-to-apples velocity advantage.

"One lever that I would argue is underutilized, and I don't know why because there are so many advantages, is certified pre-owned," Banks said.

What's next: J.D. Power forecasts used retail prices will decline 4% in 2026, driven primarily by stronger competition and persistent affordability pressure keeping buyers cautious.

A quick word from our partner

ChatGPT can write emails, plan trips, even tell jokes…

But it can’t tell you which VINs are at risk of sitting too long, how your dealer performs against your competition, or how to improve your VDPs.

That’s where LotGPT comes in. It's the only chatbot built exclusively for car dealers. It knows your market, dealership and inventory.

Fueled by Lotlinx’s decades of VIN and Shopper data, plus your live inventory, Google Analytics and CRM, it delivers relevant answers and guidance to help you sell cars faster and more profitably.

LotGPT is free for dealers, but invite-only.