EVs might be cheaper to “refuel” than gas-powered cars at the pump, but they’re now significantly more expensive to insure.

The details: While the average cost of car insurance has stayed relatively stable over the past year, premiums for electric vehicles have surged 16% in the past 12 months and now average 49% higher than those for internal combustion engine (ICE) cars, according to a report from Insurify.

EV drivers paid an average of $4,058 for insurance for 12 months.

Insuring a gas-powered vehicle for a year costs an average of $2,732.

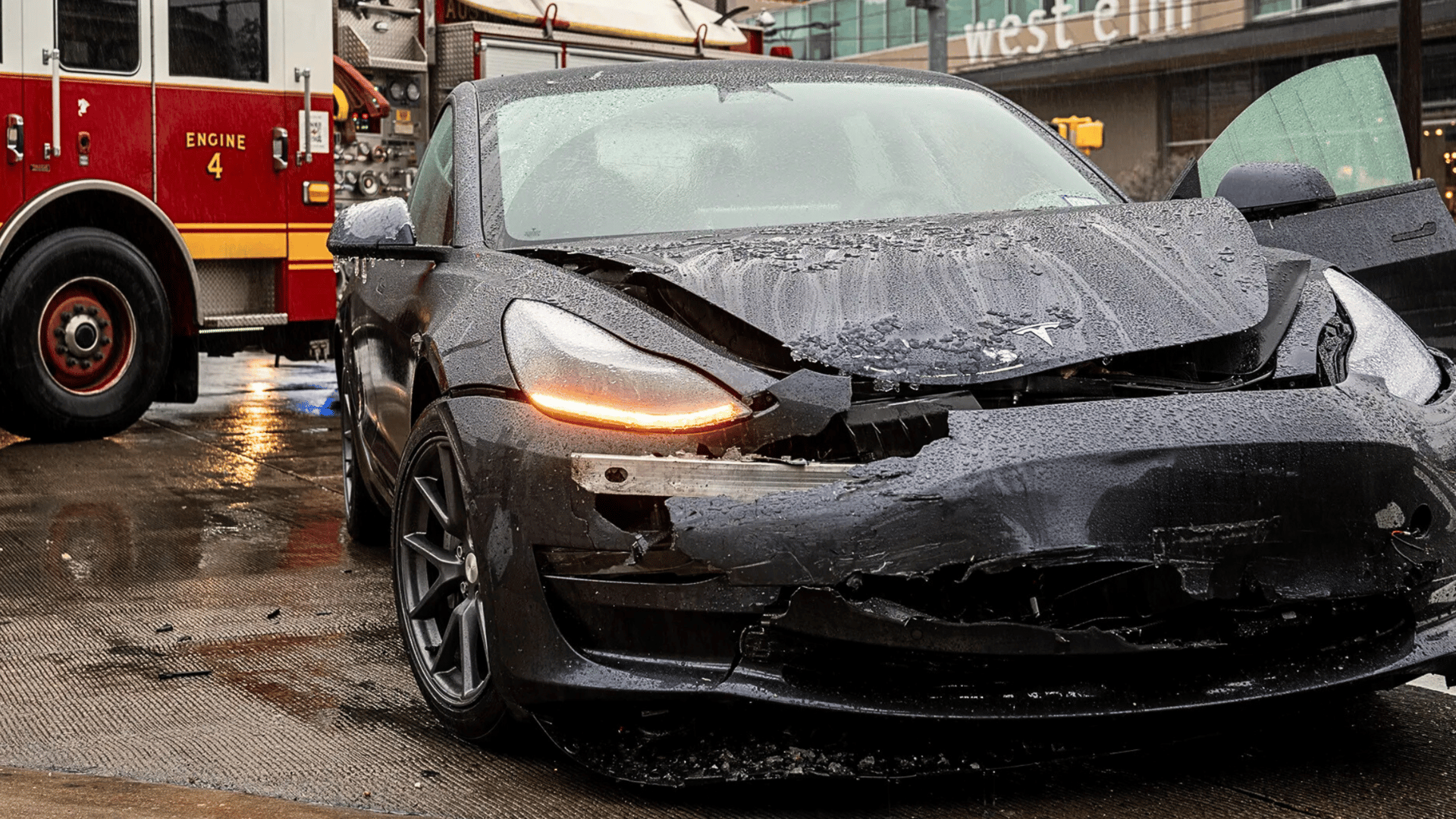

The reason: The wide gap is tied to the higher cost of repairing and replacing EVs, since premiums reflect both the risk and expense of paying out claims, noted Insurify.

EVs cost 22% more to repair than gas-powered cars, according to Mitchell collision data.

New EVs average $57,734 vs. $48,799 for gas vehicles, according to Kelley Blue Book. Meaning, insurers could pay 18% more on average to replace totaled EVs.

What they’re saying: “Elevated risk, a higher-priced car that’s more expensive to repair, and fewer places to fix it can raise insurance costs,” said Daniel Lucas, carrier relations manager at Insurify.

Why it matters: Rising insurance costs could compound headwinds for the EV sector as sales slow and the $7,500 federal tax incentive phases out, putting additional pressure on dealers trying to sell EVs in the coming months.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

No-BS insights, built for car dealers. Free, fast, and trusted by 55,000+ car dealers.

Between the lines: Insurance costs vary widely depending on brand, geography, and other in-market factors such as adoption rates, EV infrastructure, and state-level financial incentives.

The Tesla Model X and Model 3 top the charts for the most expensive EVs to insure, with the Model X averaging $4,765 annually—up 36% from last year.

Arkansas is the most expensive state to insure an EV versus an ICE car, with premiums 99% higher. In contrast, drivers in California and New Jersey pay 15% to 31% more.

On the lower end, the Chevrolet Bolt EUV, Ford F-150 Lightning, and Volkswagen ID.4 are among the least expensive EVs to insure, averaging $2,657, $2,778, and $2,960 annually, respectively.

What they’re saying: “I think in the long run, state policies promoting the purchase of EVs are what will ultimately decide the fate of these cars,” Carl Rodriguez, founder and head of marketing at NX Auto Transport, told Insurify. “Higher adoption rates dictate the availability and price of repairs, charging rates, and even insurance costs. That’s the bulk of EV expenses right there.”

Bottom line: With EVs carrying both higher purchase prices and steeper insurance costs, broader adoption and supportive state incentive policies will be essential to bringing costs down and sustaining long-term affordability. Hopefully, it'll also inspire more automakers to bring sub-$35,000 EVs to the market.

A quick word from our partner

Are you struggling sifting through inventory that’s just not right for your lot?

OPENLANE brings dealers like you exclusive inventory, simple transactions and better outcomes — all with lower fees.

OPENLANE can fill out your lot with thousands of quality, late-model vehicles your customers are looking for.

OPENLANE features:

Exclusive access to over 70% of all off-lease vehicles in the US

Luxury or high-mileage, source trades from dealers nationwide

AI-enhanced condition reports with photos, OBD scans, engine recordings, and more

The industry’s leading buyer protection with our Buyback Guarantee

New to OPENLANE? Sign up now and receive a $2,500 buy and sell fee credit.