Presented by:

Hey everyone,

In case you missed it over the weekend.

Part 4 of our Pre-NADA AI Spotlight just dropped with Shaun Sorensen, CEO & Co-Founder of Kenect.

Shaun breaks down inbound vs. outbound AI, the real risks dealers fear, and how data-driven personalization is already driving nine-figure service revenue results.

— CDG

Welcome to the Market Pulse—your cheatsheet to auto retail, built to help dealers price right, stock smart, and stay ahead.

Front-end gross is collapsing into year-end lows: Front-end gross fell to $279 in December, down 52.4% YoY.

F&I income is offsetting margin pressure: F&I profit per vehicle retailed (PVR) reached $1,975 in December, up 8.5% YoY and above $1,950 for a third straight month.

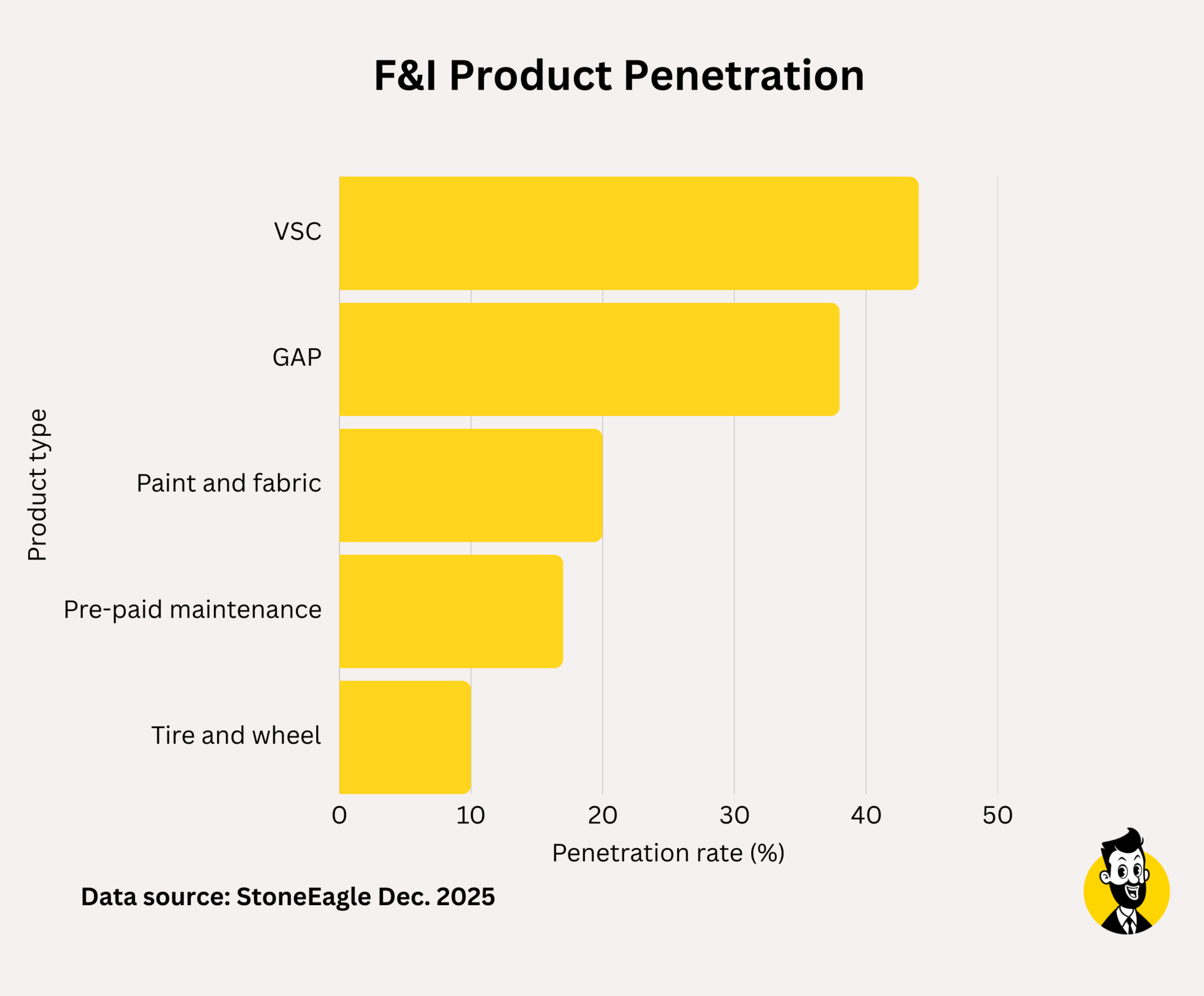

Service contracts and GAP are carrying F&I results: These two products account for most F&I income, especially when discussions start before finance.

(Source: StoneEagle December 2025 report)

Front-end margins are tightening as F&I continues carrying total deal profit.

In December, front-end gross per retail vehicle fell to $279, one of the lowest points of 2025, even as dealers sold more cars. Total gross per retail vehicle also slipped 6.4% YoY to $2,253.

What did improve, though, was income tied to F&I.

Profit per vehicle retailed held near $2,000 for a third straight month, and total F&I income per dealer continued to rise.

And here’s what’s driving that split:

Used-vehicle pricing has normalized post-pandemic, wholesale values are softer, depreciation has sped back up, and inventory levels are healthier, all of which push more price competition back into deals.

Despite that mix in place, F&I income is holding up. But only when executed well.

NOTE TO DEALERS:

I recently heard Justin Lasky say on Daily Dealer Live,

“Great finance managers will be involved with their sales floor.”

Couldn’t agree more. Because silos get expensive. And the stores holding up best are the ones where sales and F&I move together.

Starting conversations earlier, sharing context, and treating the deal as one continuous experience, not two separate handoffs.

F&I results are being driven by service contracts and GAP, not a broader product mix.

According to StoneEagle, the dealerships holding F&I PVR near recent highs are doing it by ensuring service contracts and GAP offerings show up in most deals, across most vehicle types.

In fact, service contracts and GAP sit well above everything else in penetration, while the rest of the product menu trails by a meaningful margin.

CDG analysis via Joe Cecala

That’s not to say those other products don’t help. But they just aren’t doing enough on their own to keep F&I results steady when vehicle margins are thin.

Plus, when fewer buyers choose a service contract or GAP, F&I income drops quickly, especially on higher-mileage used cars, even if other add-ons still sell.

WHY IT MATTERS:

If service contract and GAP adoption stay consistent deal to deal, total deal profit is easier to protect.

However, when adoption slips, front-end margin pressure shows up faster.

That’s why reviewing how often buyers are choosing service contracts and GAP, by vehicle type and mileage, is becoming more useful than tracking total F&I PVR alone.

A quick word from our partner

Shopping AI at NADA? Choose Carefully.

AI can drive growth or create risk, depending on how it’s deployed.

Toma helps dealers deploy voice AI the right way, with built-in safeguards that protect revenue, retention, and your reputation.

Our AI agents:

Answer calls

Handle real service workflows

And know when to bring a human in.

If you’re evaluating AI at NADA, see what thoughtful deployment actually looks like.

StoneEagle’s data shows which products are carrying F&I right now. But real-world execution still varies by store, market, and buyer.

So we asked operators what’s actually working on the ground.

Here are the Dos and Don’ts they’re using to tighten F&I execution in 2026:

Do: Start the protection conversation earlier than delivery day.

At Lexus of North Hills, sales introduces service contracts and GAP when customers review numbers, not after they reach finance.

“The biggest problem is, ‘I had three weeks to kind of think about this, but I didn’t think about anything for my vehicle,’” Business Manager Justin Lasky told Daily Dealer Live hosts Sam D’Arc and Uli de Martino.

Justin Lasky

By introducing protection sooner, Lasky said customers are arriving more prepared, which is allowing F&I to focus on fit over pressure.

Do: Reduce friction before trying to raise PVR.

At Preston Automotive Group, the biggest gains came from simplifying the process, not adding steps, according to General Manager JB Burnett.

Using iPads and AutoFi, JB said customers can complete as much of the deal as they want at home, then continue seamlessly in-store.

“Everything’s done on iPads. You can do as much or as little from home.”

JB Burnett

As he sees it: By the time they arrive, sales and finance are aligned, and the conversation moves faster with less friction.

Don’t: Overcomplicate the F&I menu and expect consistent outcomes.

At Mercedes-Benz of Laguna Niguel and Foothill Ranch, operator DJ Jevtinijevic said moving to a one-column menu helped reframe the conversation, especially on used vehicles.

“It shifted the conversation away from simply selling a traditional service contract and toward a more holistic protection discussion that also includes cosmetic coverage and road hazard.”

DJ Jevtinijevic

His take: Having a clearer presentation led to more consistent outcomes, especially in their high-lease (70%), luxury markets, where buyers value efficiency, clarity, and time savings.

Let’s put a timeline on this for a second.

Sales surges (tax season, incentive pushes, spring demand) usually start showing up around late February into March. That gives shops a matter of weeks to answer a few questions:

Which F&I products are actually selling in your market?

Where are buyers dropping off?

And what’s getting in the way when they should be saying yes?

Auditing those now = added profit brought in consistently and with purpose.

Missed yesterday’s episode of Daily Dealer Live?

Presented by:

Dealer Succession Panel w/ Fred Beans

Featured guests:

Fred Beans, owner of Fred Beans Family of Dealerships

Beth Beans Gilbert, VP of Fred Beans Family of Dealerships

Hugh Roberts, partner with the Rawls Group

The latest updates to the CDG Buy/Sell Tracker.

Sandy Sansing Automotive purchases BMW of Tuscaloosa from Carlock Automotive