Dealer confidence declined in the fourth quarter, underscoring concerns about current and future market conditions as the industry shifts into 2026.

The details: The Q4 Cox Automotive Dealer Sentiment Index (CADSI) reveals that market sentiment has dropped significantly, with independent stores much less optimistic about the business than franchise dealerships.

The current market index dropped to 38 from 43 in Q3, with future outlook declining to 42 (from 46), both well below the positive threshold of 50.

Franchised dealers reported a current market index of 47, compared to 35 for independent stores—though both groups saw declines.

Why it matters: Demand and profitability are under pressure as the industry closes out the year—signaling that dealers face tougher grosses, slower turns, and more price-sensitive buyers.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Between the lines: From customer traffic to vehicle inventory, the drop in dealer sentiment can be attributed to a variety of factors, as highlighted in the Cox report.

Overall traffic dropped to 31, with in-person traffic at 29 and digital at 40, with franchised dealers seeing both in-person and digital traffic reach all-time lows.

New-vehicle sales sentiment slid to 49 and used-vehicle sales to 42, both below 50, with independent dealers reporting a used-vehicle sales sentiment at 39.

The economy index dropped to 39 from 43 in Q3, with both franchised (44) and independent dealers (37) seeing economic sentiment decline.

And probably to no one's surprise, future EV sales sentiment dropped to 24 from 33 in Q3, in the new post-EV tax credit environment.

On a brighter note, new-vehicle inventory rose slightly to 59, with franchised dealers viewing their new-vehicle inventory as growing—though overall used inventory remains tight at 43.

What they’re saying: “Dealers are signaling caution as 2025 ends,” said Mark Strand, deputy chief economist at Cox Automotive in a statement. “Persistent economic uncertainty and fading consumer confidence are weighing on sentiment. Compared to the rest of the year, the current market feels like it’s running out of gas.”

Bottom line: Looking ahead into 2026, material interest-rate relief and a rebound in consumer confidence will be pivotal to renewing market momentum, explained Strand—indicating that dealers that tighten their operations now will be positioned to seize the opportunity the moment rates and consumer confidence turn around.

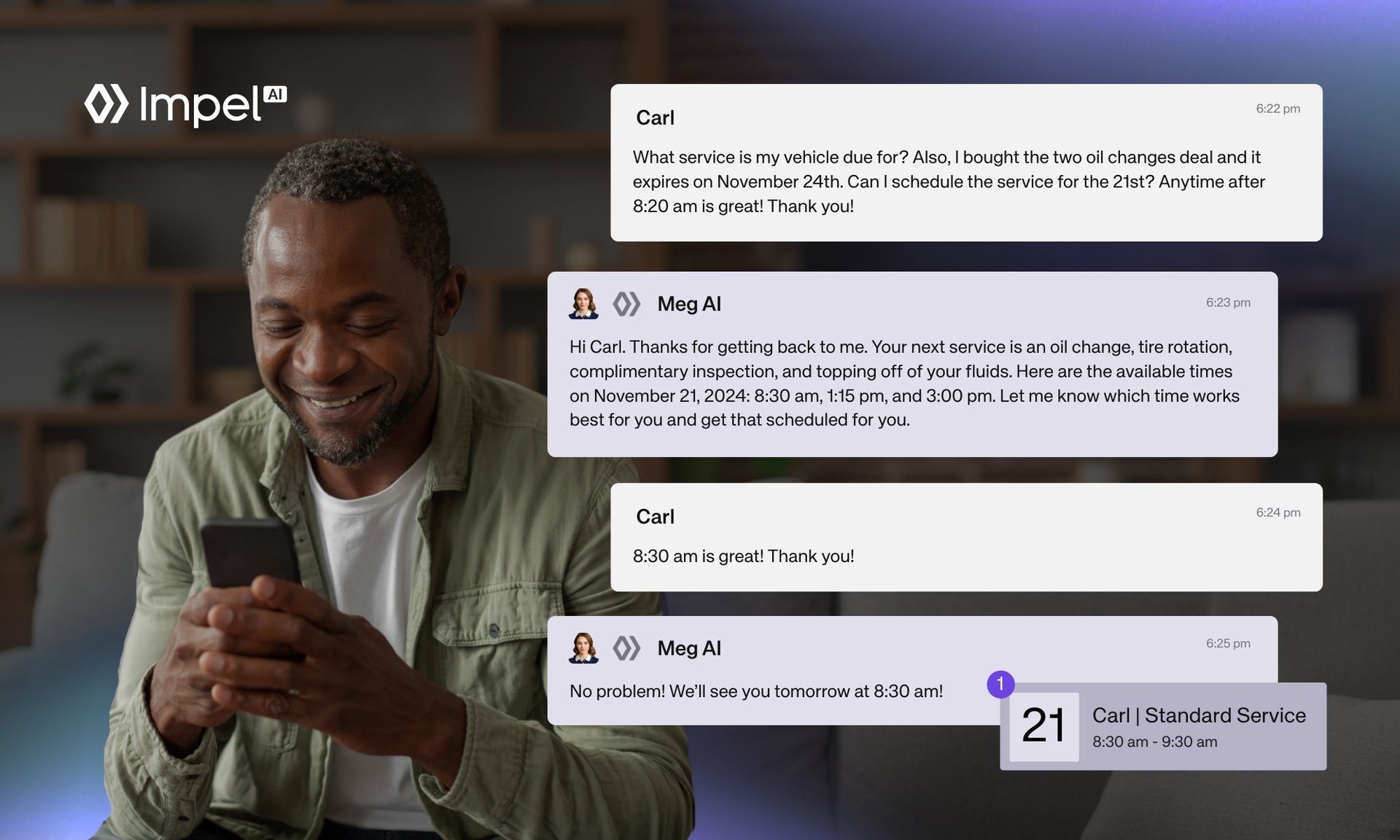

A quick word from our partner

Stop the Fixed Ops Revenue Leak.

Missed calls and manual follow-up kill retention. Impel’s Service AI with Voice AI fixes this by automating personalized outreach based on driving behavior, capturing every missed call, and booking appointments instantly via text and email.

Keep advisors focused on the lane while customers get faster answers and your bays stay full. One platform. Zero missed opportunities.