CDK Global’s Ease of Purchase scorecard plunged in November, falling to its lowest level since the tech company began tracking customer sentiment more than three years ago.

The details: Last month’s Ease of Purchase score, released Monday, dropped to 66% overall, down from 85% in October and 86% in September, though it’s not clear what factors contributed to the massive dip.

By the numbers:

Finding the car customers wanted in stock fell to 49% from 55% last month.

More people had to order in transit (23% vs. 18%) and more picked an alternate vehicle (9% vs. 6%)—leading to a drop in the share of people who said finding the car they wanted was easy (73% vs. 87%).

Discussing and agreeing to a final price for the vehicle was considerably more difficult in November too (57% vs. 70%).

But the clearest culprit was trade-in value negotiations.

The ease of reaching an agreement on trade-in value hit a record low of 45%. That's down from 66% in October.

Used car market volatility likely played a role, but CDK didn't elaborate on the connection.

What they're saying: CDK’s David Thomas dug into survey respondents' comments looking for a reason, but: "There weren't a lot of clear answers either," Thomas wrote in the report. "There was a single comment that cited the dealer 'just wanted a sale' and another that the Finance Manager was 'a little rude' but most of the criticism seemed relatively constructive."

Dave Thomas

CDK Global

Why it matters: While the reasons behind the lower scores might be murky, the signal is sharp. The Ease of Purchase drop points to a shift from inventory being the main pain point to the buying experience itself. When customers feel the process is hard or unfair, they're less likely to buy, return, or refer friends—even if the right cars are on the lot.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Between the lines: Dealerships remain the preferred way to buy. Just 2% of consumers bought online in November, consistent with October.

There were, however, some slight changes in the time spent at the dealer.

17% spent less time at a dealership than expected in November, down from 24% the month prior.

47% of consumers spent the amount of time they expected to spend last month, nearly on par with 48% in October.

35% spent more time at a dealership than expected in November, up from 27% the month prior.

What's clear: Nearly all consumers surveyed (98%) still prefer buying from dealerships, but something about how deals get done in November made the experience significantly harder. Dealers who tighten appraisal processes, reduce time waste, and build pricing trust have an opening to fix this before it becomes a pattern.

A quick word from our partner

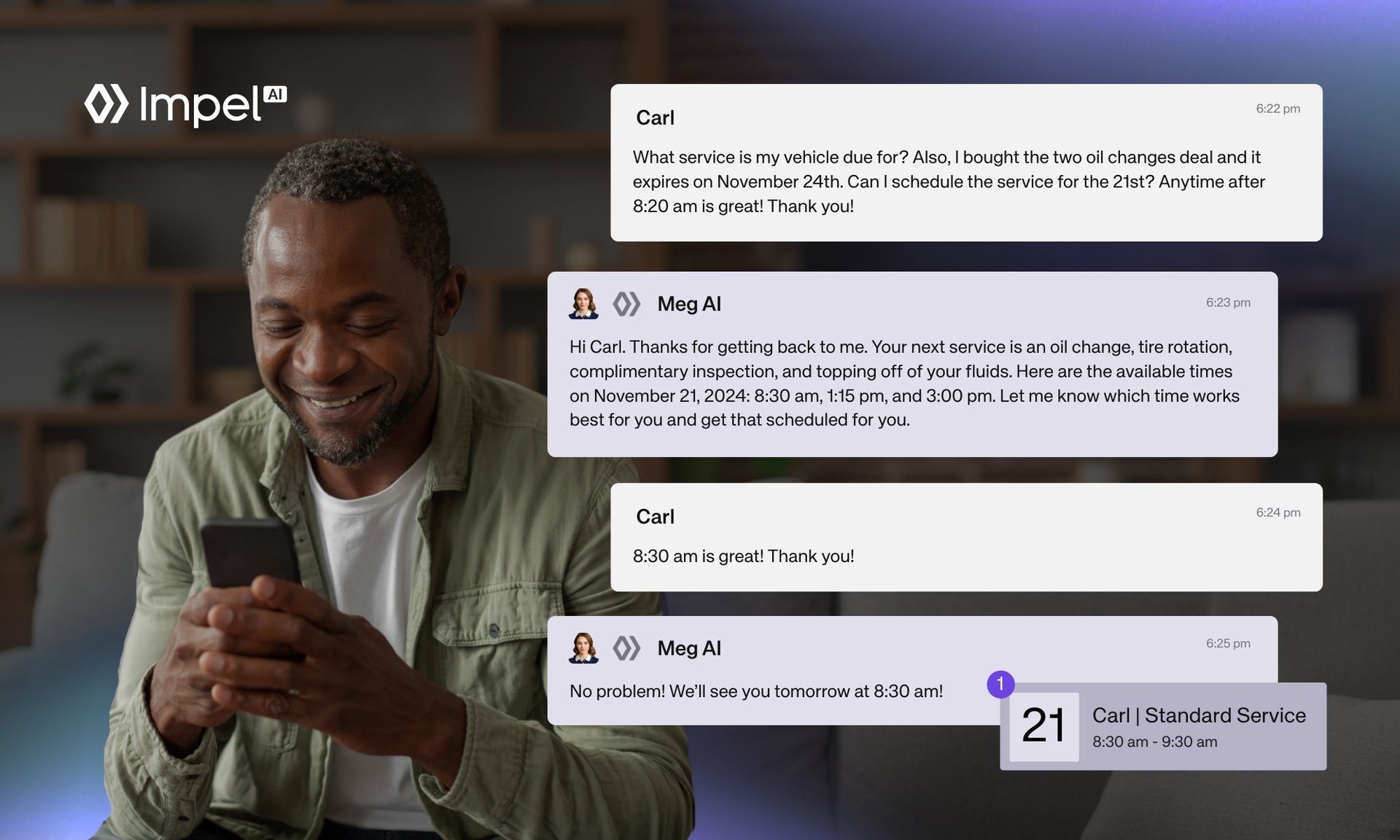

Stop the Fixed Ops Revenue Leak.

Missed calls and manual follow-up kill retention. Impel’s Service AI with Voice AI fixes this by automating personalized outreach based on driving behavior, capturing every missed call, and booking appointments instantly via text and email.

Keep advisors focused on the lane while customers get faster answers and your bays stay full. One platform. Zero missed opportunities.