American consumers are shifting gears when it comes to buying cars to cope with high sticker prices for new vehicles, potentially signaling more headwinds for dealers in the months to come.

The details: With the average new car price now at about $50,000, those looking to purchase a vehicle are downsizing, opting for used vehicles, taking on longer car loans, and holding out for deals—with several market trends revealing just how tight the market has become, reports The Wall Street Journal.

Dealers are stacking on extra discounts to entice buyers to purchase vehicles.

Lower-income borrowers are defaulting on car loans in record numbers.

Buyers are spending less on vehicle purchases than they did a year ago.

What they’re saying: “People are asking, ‘How can I afford this?’” said Robert Peltier, who owns dealerships in East Texas (via WSJ). “There are people who are in debt and living paycheck to paycheck.”

Robert Peltier

Peltier Enterprises, Inc

Why it matters: The squeeze on affordability is reshaping how and what consumers buy, forcing dealers to work harder to move inventory while also managing rising delinquencies and more cautious, budget-conscious shoppers. That combination threatens margins and makes it harder for dealerships to rely on new-vehicle volume alone.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Between the lines: Some dealers that are having success weathering economic headwinds by leaning heavily into buyers willing to dish out the cash for higher-profit vehicles in addition to maintenance and service costs.

The full-size pickup truck market in the U.S. was up 3.7% in Q3 of 2025 compared with Q3 of 2024, with Chevrolet and GMC pickup truck sales leading the way, followed by Ford.

Service and parts now make up 13.2% of a dealership’s total income, up from 12.4% in 2023—with dealerships that offer both bringing in more than $156 billion in 2024.

Still, the fact remains that new car sales, which are essential to dealerships, are at a critical crossroads, as more consumers find themselves trying to balance other economic challenges with their need for a vehicle.

“Something’s got to give and it’s typically the dealer that will have to put more money on the hood to move the vehicle,” Erin Keating, an executive analyst at Cox Automotive told WSJ, noting that she expects U.S. vehicle sales to continue to climb, but at a much slower pace.

Erin Keating

Cox Automotive

Bottom line: As affordability pressures mount, dealers are being pushed to lean harder on discounts, higher-margin trucks and SUVs, and the service lane to keep profits up—while consumers increasingly look for smaller payments, used options, and better deals before driving anything off the lot.

A quick word from our partner

Stop the Fixed Ops Revenue Leak.

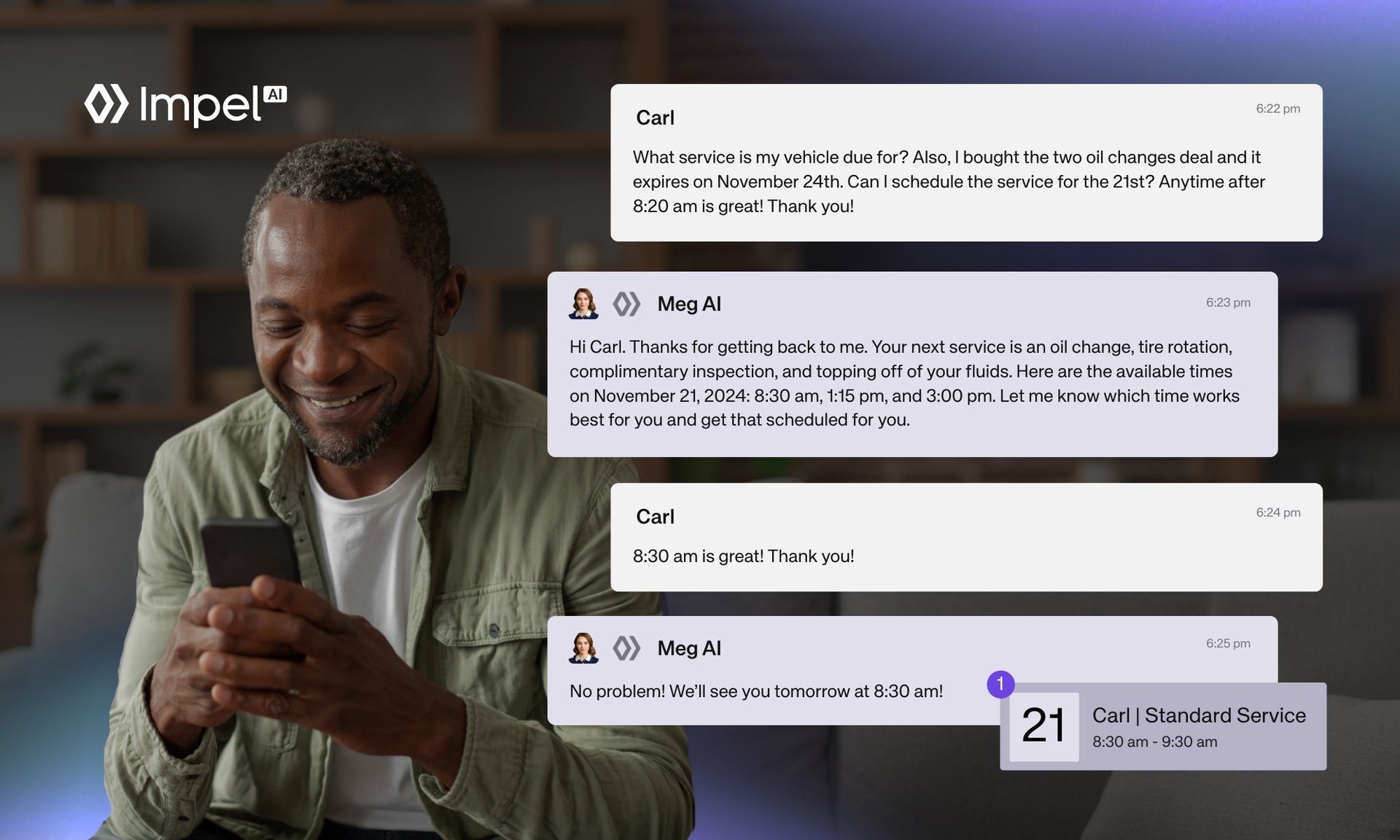

Missed calls and manual follow-up kill retention. Impel’s Service AI with Voice AI fixes this by automating personalized outreach based on driving behavior, capturing every missed call, and booking appointments instantly via text and email.

Keep advisors focused on the lane while customers get faster answers and your bays stay full. One platform. Zero missed opportunities.