As new-car prices continue to trend higher against last year, car buyers are increasingly turning to the used-car market. And while prices are rising there also, it's at a much slower pace.

The problem: The sustained demand for used cars is pressuring dealers to keep their inventory pipelines flowing fast.

And while wholesale auctions can be a great tool for closing inventory gaps quickly, used-car directors like Nick Huff at Fred Martin Motor Company, would rather pay their own employees to source used cars locally, instead of paying auction fees and transport costs.

Driving the news: "We're very aggressive from what we call a street purchase acquisition front," Huff told Daily Dealer Live. "We have dedicated processes in place to purchase those quickly, write checks immediately, and then pay our staff, our sales staff, to do those transactions.”

How it works: Sales people can earn a commission of up to $500 per vehicle sourced from the streets.

The commission structure is tiered by price point, with the highest payouts going toward the inventory “sweet spot” (i.e., cars in the $10,000 to $20,000 range).

"I'd much rather pay one of our salespeople to administer that transaction and let me get a good read on the car, opposed to go buy a car somewhere else," Huff said.

"Ultimately, we're just trying to drive down those auction rental car acquisition numbers, and paying our salespeople a good amount of money to acquire them is a big part of how we're doing that," he explained.

Zooming out: Spiffing staff in this way can be a lot less expensive than the additional costs often associated with securing a used vehicle.

"I look at it kind of like an auction buy fee," Huff said. "But I don't have to transfer the car, it's going to show up on my lot free, and I have the opportunity to road drive and do an OVD scan on that car before I buy it."

The result: Fred Martin’s Superstore moves about 230 retail used cars monthly while also operating as a volume Stellantis $STLA ( ▲ 2.93% ) dealer pushing 150-155 new units.

“Our average tenure of used-car managers is probably 12, 13 years," Huff said. "They know what to do. They know how to appraise the cars. It really just comes down to having those people around for a long time."

From there: Reconditioning speed sits at 4.93 days to “retail ready.” The store uses Rapid Recon to track movement and compensates their recon manager heavily on speed and efficiency.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Why it matters: Street purchase incentives solve multiple problems simultaneously. They reduce auction dependency, eliminate transport costs, provide pre-purchase inspection capability, and most importantly, keep the supply of retail used cars flowing.

Looking ahead: Competition in Fred Martin's local subprime market has intensified. Pre-COVID, only a few competitors operated in that space. But the pandemic pushed new-car dealers into used cars, and some are now entering subprime.

"COVID happened, it made a lot of our new-car competitors get into the used-car game, which now some of them are dipping their toe in the subprime market," Huff said. "There's more competition in our local market than there ever has been."

A quick word from our partner

Want insider knowledge on the most up-to-date trends in auto retail?

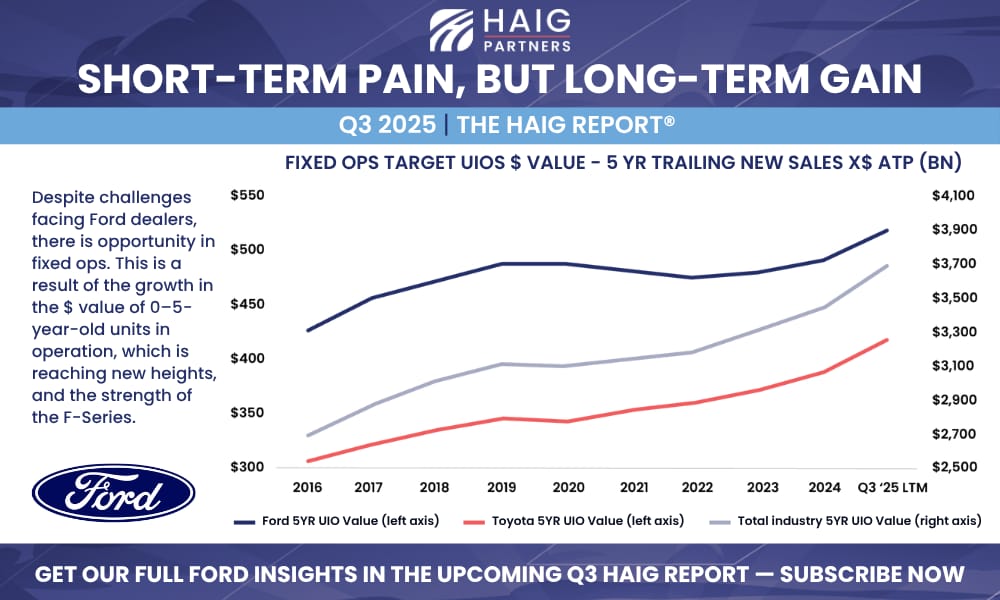

Here’s a sneak peek of what’s coming in the Q3 2025 Haig Report®—auto retail’s longest-published and most trusted quarterly report tracking trends and their impact on dealership values. Since 2014, the Haig Report® has delivered expert analysis on dealership performance, market activity, and franchise valuations, offering a clear view of opportunities and challenges in automotive retail.

Learn more in the full Q3 2025 Haig Report® by subscribing to receive it as soon as it’s released.