Hey, everyone. Carvana has acquired a traditional dealership, Jerry Seiner Chrysler Dodge Jeep Ram 🤯

This is HUGE news, and I have some thoughts…

So, stay tuned—next week, I’m breaking down what this really means for the auto industry.

— CDG

First time reading the Car Dealership Guy Newsletter? Subscribe here.

Welcome to The Weekly, your go-to roundup of the top five auto industry headlines of the week. Let’s dive in.

1. Trump moves to hit EU with 25% tariffs ‘on cars and all other things’

President Trump isn’t backing down on tariffs—now floating a 25% levy on European autos and goods.

Speaking to reporters last Wednesday—he claimed that tariffs are a natural consequence of the EU taking advantage of the U.S. However, President Trump offered no details on when or how these tariffs would take effect.

Trump also said that 25% tariffs on Mexico and Canada will start April 2, but the White House later clarified that they’ll actually start next week. Tariffs on Chinese imports are already in effect but remain limited in scope.

For automakers? The stakes are massive. Honda says the tariffs could cost them over $20 billion—possibly forcing a shift in production. And Ford CEO Jim Farley warns they’d “blow a hole” in the U.S. auto industry.

The bottom line: With tariffs stacking up and details changing by the day, industry stakeholders are waiting with baited breath.

But that’s not the only piece of automotive-related news to come out of Washington this week...

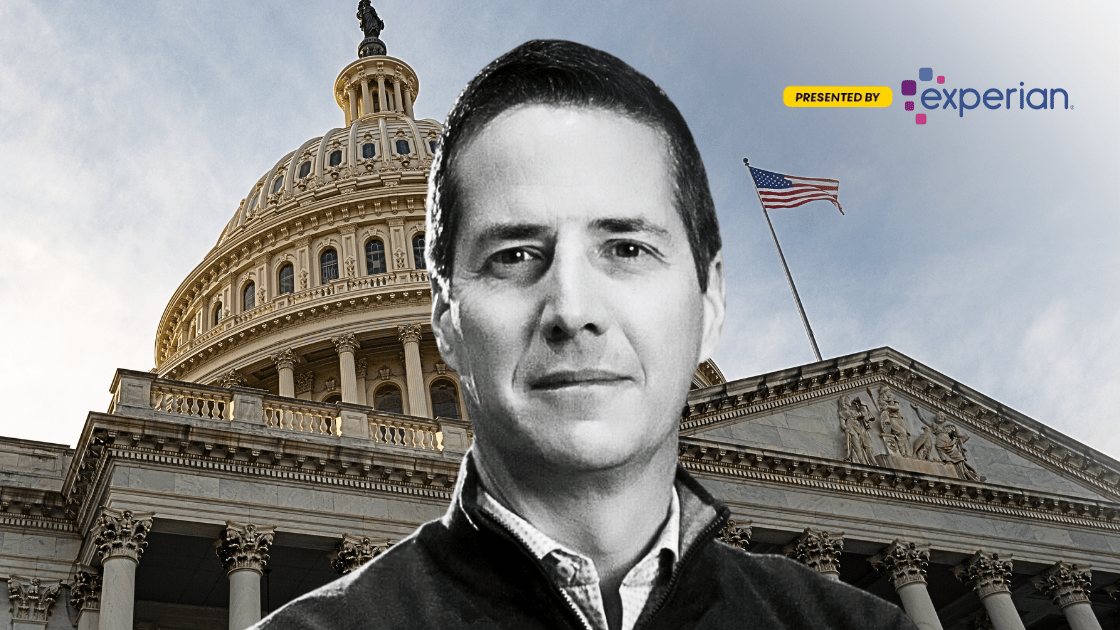

2. Senator Bernie Moreno claims new legislation will lower car prices

Recently elected U.S. Senator (and former car dealer), Republican Bernie Moreno from Ohio—is wasting no time shaking up regulatory policy for the auto industry.

Diving the news: He says his first major bill—the Transportation Freedom Act—is all about lowering car prices by reducing regulatory hurdles for automakers.

His proposal—first viewed by The Washington Examiner— would:

Give automakers a 200% tax deduction on wages paid to U.S. auto workers—while blocking companies from using the savings on stock buybacks.

Kill California’s emissions waiver, which requires all new cars sold in the state to be emissions-free by 2035.

Overhaul federal fuel economy rules, replacing CAFE standards with a new system Moreno says will provide stability for automakers.

Backing his bill—are industry heavyweights, including Toyota and the American Trucking Association, who call it a long-overdue fix to decades of inconsistent regulations.

Speaking of California’s emissions waiver—New York is one of 12 states that have adopted some aspects of the initiative—but one dealer says—it’s not feasible…

OPENLANE brings you exclusive inventory, simple transactions and better outcomes — all with lower fees.

Dealers never have to worry about finding the perfect vehicles for their lot, thanks to thousands of fresh vehicles each day - from the largest inventory of off-lease vehicles, to rental, dealer trades and more.

OPENLANE brings transparency to digital wholesaling with best-in-class inspections, exterior damage detection powered by AI and simplified OBD2 code scan summaries. Plus, on OPENLANE, you always know who you’re buying from. Follow a seller and get notified when they list a new vehicle.

That’s wholesale on easy mode!

New to OPENLANE? Sign up now and new sellers receive a $2,500 sale fee credit.

3. New York dealer says state’s EV sales rule is not practical

The Empire state requires that 35% of all new 2026 model-year vehicles sold be zero-emission, a major step toward its goal of banning new gas-powered cars by 2035.

The problem? Mohawk Chevrolet’s Andy Guelcher says demand isn’t there. Battery-electric vehicles make up just under 10% of the state’s new car sales, according to registration data from the Alliance for Automotive Innovation.

At Mohawk Chevrolet, EV sales are stuck at 7-8%. And the ones that are selling? Andy says they’re not organic—with many of the buyers having a huge amount of negative equity, average credit, at best—and needing the $7,500 federal rebate just to make the numbers work.

But trade groups point to a bigger issue—charging infrastructure is nowhere near ready. They warn that without more fast chargers—range anxiety will keep customers away.

Big picture? New York’s aggressive EV mandate is running up against market reality. Dealers don’t see a path to 35% by 2026, and political tension could further complicate things.

But there is some good news…

Stay informed in just 5 minutes a day.

CDG Bites brings you sharp insights, delivered every weekday in audio.

Equifax is forecasting a rise of 12-20% in auto loan originations during tax refund season…

4. Auto lending competition heats up as car buyers spend tax refunds

The slight wrinkle? refunds are arriving later. As of February 14th—the IRS has issued 13.6 million refunds, down from 20.8 million at this time last year. And the average refund is tracking 33% lower, currently at $2,169.

However—experts say those numbers should rebound soon, as refunds tied to the Earned Income Tax Credit and Child Tax Credit roll out later this month.

Meanwhile—financing is getting tougher. Auto loan rates are climbing, with new car loans averaging 9.53% and used car loans hitting 14.12%, per Cox Automotive. And the average buyer is borrowing over $28,000, with payments now $620 a month.

Still—lenders aren’t sitting back. Nick Huff—Director of Fred Martin Auto Group—told CDG News that Chase, Capital One, and Ally are loosening restrictions to capture more subprime buyers—making financing more accessible than it was a year ago.

At the end of the day—lenders are now racing to capture buyers while they have cash in hand, but with rising auto loan rates and broader uncertainty, affordability remains a question mark.

And backing up that sentiment—are some findings from S&P Global Mobility’s latest analysis of auto asset-backed securities…

5. Auto lenders increasingly turn to payment extensions

As of December 2024—subprime auto loan delinquencies (more than 60 days late)—hit 6.56%—the highest level ever recorded.

It’s a sharp jump from 6.01% in November and above 2023 levels. Prime borrowers saw a slight uptick, but delinquencies there remain low at 0.62%.

To keep struggling borrowers afloat—lenders are extending loan payments at levels not seen since 2020—but that comes with risks.

Subprime borrowers are taking extensions at nearly five times the rate of prime borrowers.

And some subprime lenders are seeing even bigger spikes like DriveTime, Carvana, and Westlake.

The broader concern? These extensions can add thousands in extra interest and create a wave of debt that’s unlikely to be paid—what analysts sometimes call “extend and pretend.”

But even though lenders know the risks—some seem willing to take them. Ally and CarMax admitted in recent earnings calls that they’re loosening extension policies, making it easier for borrowers to delay payments.

Have a tip for our editorial team? Send us your scoop at [email protected].

Three opportunities hitting the CDG Job Board right now:

HoneyCar: Corporate Reconditioning Director (Virginia).

Dealer Pay: Creative Design Specialist (Remote).

Subaru of Jacksonville: Service Manager (Florida)

Looking to hire? Add your roles today—it’s 100% free.

The 2026 Ramcharger: Stellantis hedges bets on 'Goldilocks' pickup.

Most auto dealers are failing to harness AI's potential—survey.

Ex-Stellantis CEO Carlos Tavares is walking away with a sizable payday.

Mercedes-Benz design chief predicts AI will take over car design.

Ford recalls 240,000 SUVs over seatbelt issue as quality struggles continue.

That’s a wrap for now – make sure you’re following along on X, LinkedIn and IG for more real-time updates.

Did you enjoy this edition of The Weekly newsletter?

Thanks for reading. Hit reply and let me know if you found this Weekly valuable or have any feedback. I’ll see you next weekend.

— CDG

Want to advertise with CDG? Click here.

Want to be considered as a guest on the CDG podcast? Right this way.

Want to pitch a story for the newsletter? Share it here.