Presented by:

Hey everyone,

You asked for it. And we’re delivering.

Super pumped to bring you the first edition of the CDG Fixed Ops Pulse—an inside look at what’s really happening in the dealership service drive and how top operators are adapting in real time.

What you’ll find:

3 key trends to watch

Real operational tactics straight from dealers

And strategies to stay current and competitive

Best part? It’s 100% free.

— CDG

First time reading the CDG Newsletter?

Dealership service drives are starting to show cracks.

After years of nonstop growth, repair orders (ROs) fell 4.6% in September and service revenue dropped 3.7% month-over-month, suggesting that consumer demand might be leveling off.

This week, we spoke with analysts, dealers, and fixed ops leaders to explore what’s fueling the slowdown, and the three signals dealership service operators are watching closely…

The slowdown in RO growth is caused by more than seasonality.

As of October 18, completed service appointments were down 6% year-over-year.

That’s primarily due to high repair and maintenance costs, which are forcing many customers to delay service or seek out independent shops (more on that later.)

But uneven service department flow puts added (and unwelcome) pressure on the dealership’s bottom line as front-end sales margins shrink.

The fix: Dealers that market to owners of older vehicles proactively and —can smooth out any dips. Just ask Paul LeBlanc, Service Director at Longo Toyota, who uses AI-driven BDC tools to send out 34,000 text messages to service customers (old and new) every quarter.

Competition from independent repair shops is further shrinking dealer territory.

Since 2018, independent repair shops have jumped 12%, to about 300,000 locations.

And the reason is simple—many customers believe independents are cheaper, though Cox data shows average RO costs of $261 for dealers vs. $275 for independents.

Cox Auto’s Skyler Chadwick said this “misconception” is pulling customers away from franchised dealers around the five-year ownership mark—making retention that much more difficult.

The fix: At Mike Terry Automotive Group, technicians independently document the issues they find with visual evidence—which naturally increases approval rates from customers and builds trust.

Customer confusion about repairs is reducing approval rates and retention.

Surprisingly (or maybe not), poor communication—not technician skill—drives most service defection.

“Consumers get oversold or confused,” Chadwick explained. “They just want someone to explain what’s really going on.”

The catch is, technicians and other service department employees are often the busiest in the dealership. And when they don’t have time to properly communicate with customers (or each other), revenue opportunities fall through the gaps.

The fix: At Gold Coast Cadillac, each customer receives a physical thank you letter at point of sale that employees read aloud, outlining benefits like loaner programs, VIP loyalty cards, service perks, and even a QR code linking directly to the store's online appointment scheduler.

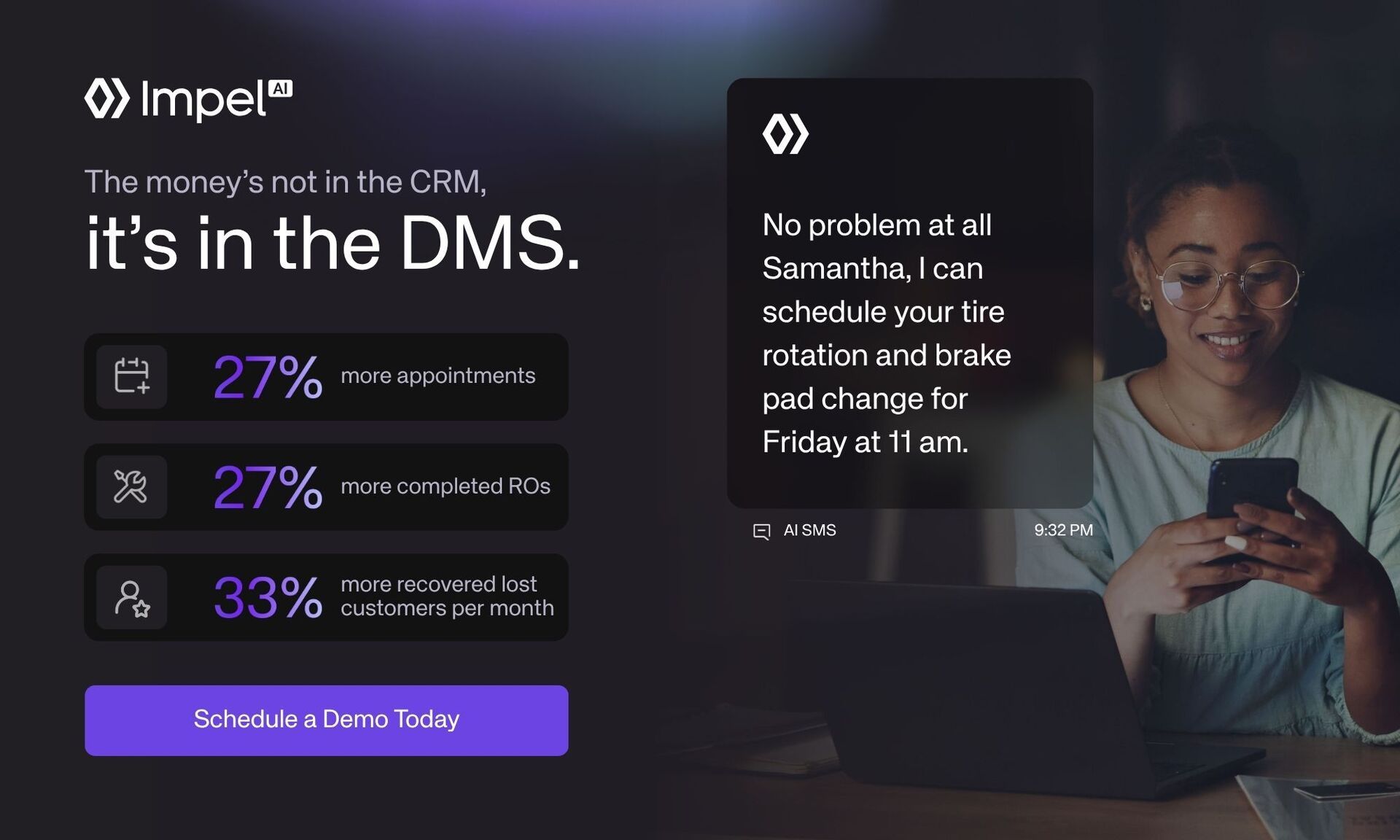

A quick word from our partner

Hitting service absorption above 80% is within reach.

Dealers using Impel Service AI see 27% more appointments, 27% more completed ROs, and 33% more recovered lost customers each month—while simplifying tech, cutting costs, and freeing staff for higher-value work.

Service AI delivers VIN-specific personalization, mines your DMS for proactive outreach, automates reminders and scheduling, and books instantly via SMS or email.

The result: full bays, higher retention, and smarter operations.

See how: https://go.impel.ai/CDG

CDG News spoke with Charlie Spradlin, sales director at Art Moehn Chevrolet Honda, about why his team seeks used Teslas $TSLA ( ▲ 0.03% ) (despite no tax credits), and how he turns them quickly/profitably.

“EVs as a whole are easy to recondition,” Spradlin said. “There’s just not a lot of maintenance unless there’s a battery or electrical issue.”

Charlie Spradlin

Spradlin’s playbook:

Initial inspection: Every Tesla trade-in gets a quick system scan and range test. “We check the performance at 100% and 80% charge,” Spradlin said. “If the numbers don’t line up, we know the battery’s degrading and adjust the car’s value accordingly.”

OEM collaboration: When a repair is needed, his store works directly with Tesla. “They’re great to deal with,” he said. “If something needs to be fixed, we send it up and they take care of it—no big deal.”

Smart pricing and turnover: Affordable Teslas, especially Model 3s and Model Ys under $30K, move fast.

The result? Spradlin says no Tesla has stayed on his lot longer than 30 days.

One of the biggest advantages of completing more repair orders is the increase in opportunities to acquire used inventory.

The move: Have service advisors flag trade-in prospects in the DMS or CRM before the visit so sales managers are prepared. When the customer arrives, service advisors can explain the car’s equity position, and introduce a sales rep who has prepared numbers and options.

This should be a quick, no-pressure system fueled by constant service and sales communication. Boom.

Three opportunities hitting the CDG Job Board right now:

Habberstad Auto Group: Chief Financial Officer (New York)

Leikin Motor Companies: Volvo Sales Manager (Ohio)

Sunrise Toyota: Service Advisor (New York)

Looking to hire? Add your roles today—it’s 100% free.