Presented by:

Hey everyone,

Last week, we launched our new Groups Directory inside CDG Circles.

Here’s the concept: Imagine being in a room with hundreds of dealers... each one an expert in one specific thing.

And when you need that expertise, they’re right there for you.

That’s the problem we’re solving with this.

— CDG

Welcome to the Market Pulse, your cheatsheet to auto retail, built to help dealers price right, stock smart, and stay ahead.

Trade negotiations are delaying OEM planning decisions: Launch timing, incentive support, and supply commitments are staying flexible instead of locked.

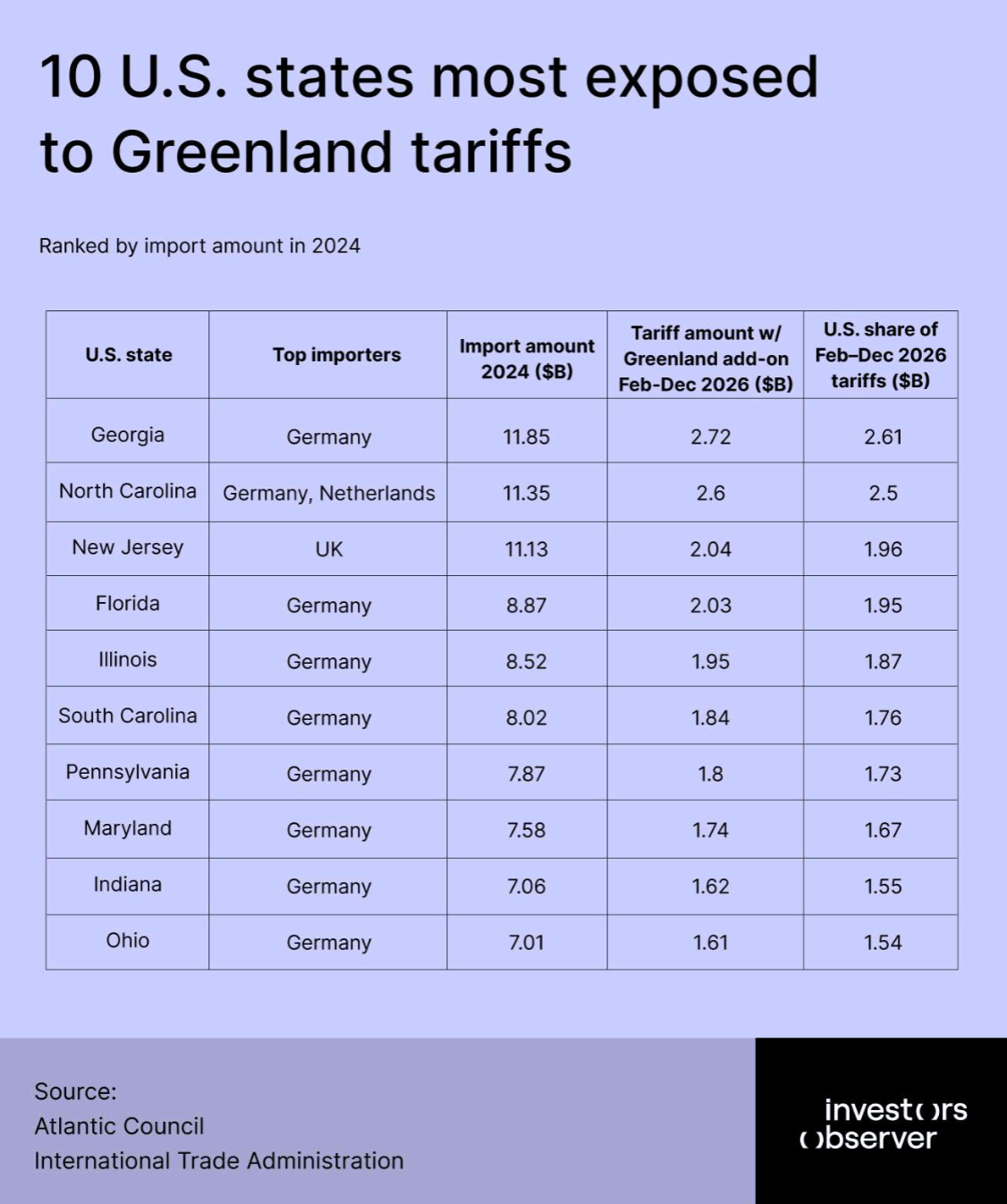

Import-heavy states are carrying outsized tariff exposure: CDG analysis shows 33 states avoided ~$11.36B in added costs, led by GA, NC, and NJ.

And the USMCA review is approaching as the bigger supply-chain risk: Cross-border parts flow and final assembly exposure are likely to disrupt inventory and service operations in mid-2026.

(Source: CDG Interviews / InvestorObserver)

Rollercoaster trade negotiations are disrupting how OEMs plan the years ahead.

Over the past week, tariff policy tied to U.S.–Europe negotiations left the auto industry facing a new set of what-ifs.

ICYMI: Tariff threats were raised against the E.U. (by the U.S.), negotiations were then paused on a previously agreed-upon U.S.-E.U. trade deal (by the E.U.), and then the proposals (initially threatened by President Trump) were pulled back…all within days.

The concern here is that even though nothing ultimately went into effect, each move forced OEMs to revisit assumptions around pricing, sourcing, and timing.

In fact, CDG analysis of InvestorObserver data shows that had the tariffs gone live, 33 states would have absorbed roughly $11.36B in added costs, with the highest exposure concentrated in Georgia, North Carolina, New Jersey, Florida, Illinois, and South Carolina.

In addition to that, the impact these sudden negotiations have on product timing is endless.

As Frank McCleary, partner at Arthur D. Little, put it, OEMs historically operate on six- to seven-year product cycles. But when trade policy shifts week to week, that planning framework breaks down, leaving dealers operating with longer-term signals that are harder to trust.

NOTE TO DEALERS:

Recently, one operator told us his team knew Stellantis would exit its PHEV lineup before the official announcement.

And that was because the ordering windows stopped opening on schedule. Incentives were doing more of the heavy lifting. And factory support became less consistent.

The same applies here. Meaning, now’s the time to have one or two operators in-store tracking ordering availability, incentive reliance, and allocation changes weekly, especially on brands and models most exposed to potential tariff shifts.

USMCA negotiations are also adding a second layer of planning risk.

Unlike the Europe situation, USMCA sits directly under how vehicles and parts move across North America.

And as John Murphy, with Haig Partners, explained:

“The reality is we have the next big chapter being the USMCA rework or review in July of this year, and the industry is incredibly exposed through final vehicle assembly and then potentially even more importantly, the parts supply chain in between the US, Canada, and Mexico.”

He added that brands like BMW, Mercedes-Benz, and parts of the Volkswagen Group are clearly exposed due to import-heavy lineups.

But that some brands dealers often view as “safer” are also tightly tied to USMCA outcomes.

Lexus, for example, relies on meaningful production and parts flow through Canada and Mexico, which means changes to cross-border rules or costs would ripple through its supply chain faster than many dealers expect.

WHY IT MATTERS:

If trade policy shifts mid-year, OEMs won’t be able to easily reroute production or rebalance supply without added cost or delays.

That’s why, even with the U.S.–E.U. tariff threat pulled back, dealers should still expect uneven effects across 2026, especially for brands with deeper North American supply chains.

A quick word from our partner

Get NADA deals without going to the show.

You don’t have to be at NADA to get the best ideas coming out of it.

In a 10-minute demo, see how dealers are improving AI search visibility, responding faster to leads, and driving more sales and service revenue—without adding staff or budget.

You’ll get:

A free AI Search Visibility Report

Event swag shipped to you

And a chance to win tickets to the Big Game.

And if you’re coming to NADA, we’ll get you into our party at Allegiant Stadium.

With OEMs stuck in planning limbo and supply signals shifting week to week, we asked what’s still working on the ground.

Here are the Dos and Don’ts Murphy and McCleary say matter most right now:

Do: Plan for extremes. Not a single forecast.

When policy can (and probably will) change overnight, traditional planning assumptions stop holding. Which is why McCleary says the biggest mistake operators are making right now is betting on one outcome.

“What we’ve been discussing with clients is scenario planning out the various extremes and what actions need to be taken when those scenarios were to actually happen,” he told me.

Frank McCleary

As he sees it: Planning for the best, worst, and everything in between gives OEMs and dealers more flexibility than anchoring to one version of the future, especially when long-term confidence is hard to come by.

Do: Run the used and fixed ops businesses harder than ever.

Murphy believes the response to uncertainty is largely tied to daily in-store execution.

“For dealers, that really is focusing on used and fixed ops, and driving those businesses as hard as possible. It's not a new philosophy or a new idea, but the impetus and the importance to focus on them more than ever before is there.”

John Murphy

What he means: Even in choppier markets, customers still need affordable transportation and reliable service. And dealers who execute better in used inventory and fixed ops are better positioned to absorb volatility, even if they can’t avoid it entirely.

Don’t: Assume 2026 will be more stable than 2025.

While last week’s tariff headlines were pulled back, Murphy expects more turbulence ahead, especially as USMCA negotiations move closer.

“We’re going to have potentially a bit more heartburn as we go through the spring in summer months or whenever Trump decides to open the [USMCA] chapter on those negotiations,” he said.

In other words: Dealers planning as if volatility is behind them risk reacting too late when the next policy shift inevitably pops up.

When we talked to dealers late last year, a lot of the optimism around 2026 sounded the same. Not that it would be a breakout year.

Just that it might be calmer. Easier to plan. Fewer surprises.

And while things are already shaping up to be quite the opposite, I can’t help but think of this line that Murphy shared during our call:

“One of the great things about the dealership business is it's incredibly profitable with reasonably good returns. The reality is, it could have much higher profits and higher returns than it does right now if everybody optimized their businesses. Optimizing the business is more crucial than ever.”

I couldn’t agree more. So my question is this:

What did your store double down on last year that still worked when the policy or product plan changed?

Missed yesterday’s episode of Daily Dealer Live?

Presented by:

Pres on Insurance, Perrotta on Scout Threat

Featured guests:

Chris Pres, VP, Automotive Distribution of Polly

Laura Perrotta, President of NJ CAR

The latest updates to the CDG Buy/Sell Tracker powered by The Presidio Group.