Most consumers feel like they don’t get a fair shake when shopping for auto insurance.

The details: According to a new Arity survey of 1,000 drivers, 70% of consumers think they are unfairly judged or stereotyped when shopping for auto insurance, with 89% believing they were treated differently based on “misconceptions.”

Additionally, 54% feel they are paying more due to non-driving factors like low credit scores.

Meanwhile, 32% of respondents indicated that they felt judged as financially unreliable.

And 28% feel they are treated differently based on age, gender, or other personal traits.

What they’re saying: “Dealerships are often the first place drivers encounter the complexity of insurance,” an Arity spokesperson told CDG News via email. “Drivers want insurance that reflects how they actually drive, not just demographic assumptions.”

Why it matters: The perception of bias in auto insurance doesn’t just hurt trust in insurers—it can sour the entire car-buying experience. If customers feel judged or stereotyped at the point of sale, dealers risk losing loyalty, repeat business, and referrals.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Between the lines: Accuracy, transparency, and control are key to addressing consumers’ concerns when they’re shopping for insurance—enabling dealers to turn this pain point into a value proposition by taking on an educator role in the process, especially for first-time car buyers.

“For younger buyers, offering access to insurers that personalize pricing based on real-world driving can make insurance feel fair and approachable,” the Arity spokesperson explained. “When dealerships lead with clarity and choice, they position themselves as partners in helping drivers navigate smarter, safer, and more equitable mobility options.”

Bottom line: By partnering with carriers that use real driving data instead of stereotypes, dealerships can turn a major pain point into a trust-building moment, according to Arity.

A quick word from our partner

Want insider knowledge on the most up-to-date trends in auto retail?

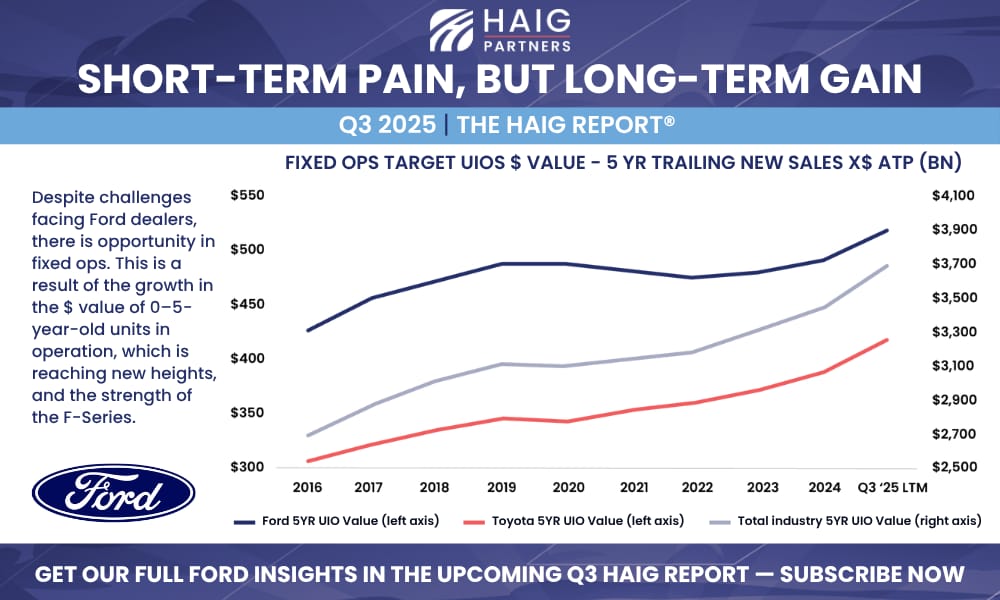

Here’s a sneak peek of what’s coming in the Q3 2025 Haig Report®—auto retail’s longest-published and most trusted quarterly report tracking trends and their impact on dealership values. Since 2014, the Haig Report® has delivered expert analysis on dealership performance, market activity, and franchise valuations, offering a clear view of opportunities and challenges in automotive retail.

Learn more in the full Q3 2025 Haig Report® by subscribing to receive it as soon as it’s released.