Subprime auto loan borrowers are struggling to make their monthly payments, as financial challenges for credit-challenged Americans continue to mount.

The details: Delinquencies for subprime borrowers (late payments that have gone beyond 60 days) rose 0.15% in October, while those for prime buyers (borrowers with strong credit history) held steady, according to the latest auto asset-back securities data from Fitch Ratings.

Subprime delinquencies climbed to 6.65% in October, up from 6.50% in September and 6.23% a year earlier.

The delinquency rate for prime borrowers was 0.37%, the same as in September and a year ago.

Via Fitch Ratings

Why it matters: If rising subprime delinquencies persist, lenders could tighten standards or raise borrowing costs, making it harder and more expensive for vulnerable consumers to buy or keep their cars.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Between the lines: Concerns over the subprime auto loan market (which have garnered national attention with the bankruptcy of subprime lender Tricolor) have been increasing amid deepening financial strain for lower-income consumers in the U.S., as highlighted in a Pew Research Center survey released in May.

Only 20% of lower-income adults feel they are in “excellent” or “good shape” financially, compared with 47% of middle-income and 74% of upper-income adults.

44% of lower-income adults say they’ve borrowed money from friends or family in the past year, versus 21% of middle-income and 11% of upper-income adults.

36% of lower-income adults report having trouble paying rent or a mortgage, compared with 17% of middle-income and 5% of upper-income adults.

Cox Automotive’s EVP and Chief Strategy Officer Jonathan Smoke, however, has cautioned against overstating the broader industry impact of loan delinquencies.

“We see no signs of a domino effect poised to rock the auto market or the economy,” he said in late October (via Kelley Blue Book).

Jonathan Smoke

Bottom line: A growing share of subprime customers may struggle to get financed or stay current on payments—potentially slowing sales and increasing repossessions and backend headaches. Expect more deal friction, heavier reliance on prime and near-prime buyers, and more pressure to work closely with lenders on structure, down payments, and terms.

A quick word from our partner

Want insider knowledge on the most up-to-date trends in auto retail?

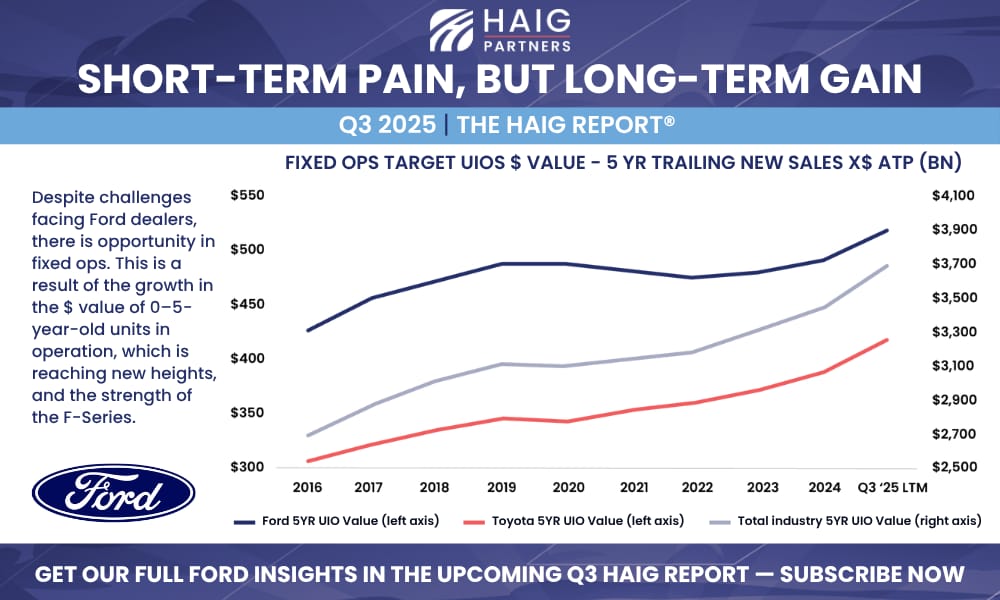

Here’s a sneak peek of what’s coming in the Q3 2025 Haig Report®—auto retail’s longest-published and most trusted quarterly report tracking trends and their impact on dealership values. Since 2014, the Haig Report® has delivered expert analysis on dealership performance, market activity, and franchise valuations, offering a clear view of opportunities and challenges in automotive retail.

Learn more in the full Q3 2025 Haig Report® by subscribing to receive it as soon as it’s released.