Subaru is the latest automaker to shift its EV strategy—announcing it is retooling its multi-billion-dollar electrification plan to align with slowing demand in the sector.

The details: Subaru President Atsushi Osaki shared the change in plans at an earnings briefing on Monday, indicating that the automaker intends to divert more resources to other powertrains that better reflect current market demand, reports Nikkei Asia.

Subaru had previously planned to invest 1.5 trillion yen ($9.74 billion) into electric vehicles by 2030.

The Japanese automaker, which has already invested 300 billion yen ($1.9 billion) into the strategy, is now calling it a “growth investment.”

Moving away from an EV-only approach, the company will now channel more funds into hybrid and gas-powered models.

What they’re saying: "Given the increasing demand for hybrids and the reappraisal of internal combustion engines, it is appropriate to delay the timing of full-scale EV mass production investment," said President Atsushi Osaki, (Nikkei Asia). “We will expand our product lineup to meet diverse needs," he added.

Atsushi Osaki

Why it matters: For retailers, Subaru’s shift means greater near-term inventory stability and a lineup that better matches shopper behavior. As EV momentum cools and hybrid demand accelerates, dealers stand to benefit from product mixes that move faster and require less infrastructure investment.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Between the lines: Subaru already has four EVs in the pipeline, though another four now appear to be in limbo as automakers recalibrate strategies amid cooling demand and the expiration of the $7,500 federal tax incentives.

Subaru remains on track to launch four sport utility EVs in partnership with Toyota by the end of 2026.

The automaker is, however, considering delaying four other EVs that had been slated for in-house production.

Bottom line: Subaru isn’t walking away from electrification, it’s slowing the pace to protect profitability and align with market realities. With EV demand softening and incentives winding down, hybrids and efficient gas models will carry more of the load in the near term.

A quick word from our partner

Want insider knowledge on the most up-to-date trends in auto retail?

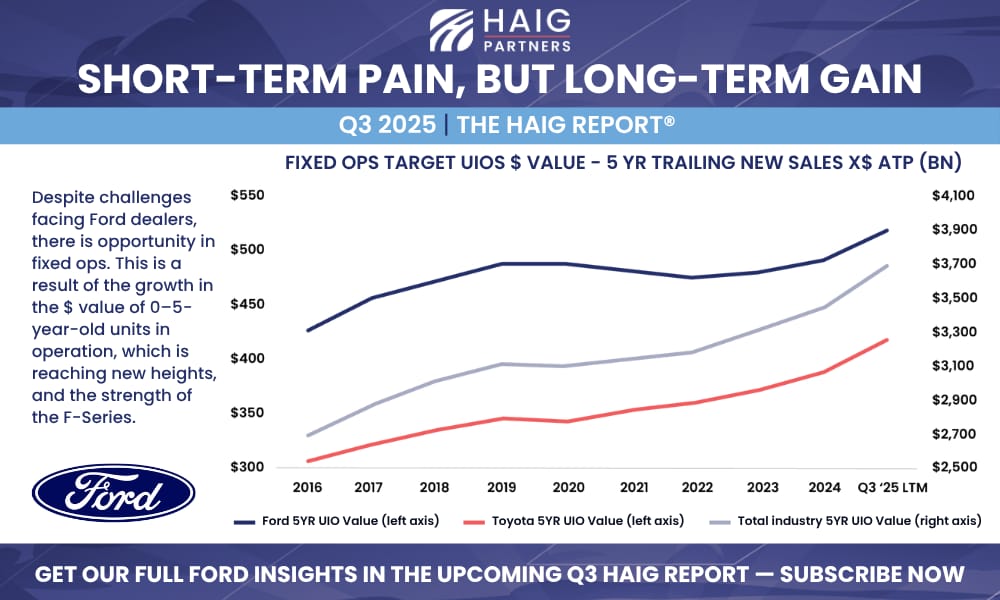

Here’s a sneak peek of what’s coming in the Q3 2025 Haig Report®—auto retail’s longest-published and most trusted quarterly report tracking trends and their impact on dealership values. Since 2014, the Haig Report® has delivered expert analysis on dealership performance, market activity, and franchise valuations, offering a clear view of opportunities and challenges in automotive retail.

Learn more in the full Q3 2025 Haig Report® by subscribing to receive it as soon as it’s released.