Rivian $RIVN ( ▼ 1.79% ) and Volkswagen $VLKAY ( ▼ 0.99% ) are aiming to expand the scope of their offerings in the industry, especially when it comes to electrification.

The details: VW and startup Rivian now plan to sell the underlying electrical architecture they have been co-developing for new Rivian, Audi, and Porsche vehicles to other car companies, reports Inside EVs.

The underlying tech consists of advanced computing and software platforms to be shared across both VW and Rivian.

It’s part of the $5.8 billion investment Rivian received from VW, giving Rivian the ability to leverage the German automaker’s massive scale to secure cheaper electronics.

Under the partnership, VW landed the development of a new electric vehicle platform, known as the “zonal architectures,” for all its brands.

Worth noting: The two companies now plan to leverage these key components—through Rivian and Volkswagen Group Technologies—to offer the platform tech to other automakers, with indications it could extend to combustion vehicles in the future.

What they’re saying: "We're solving a problem not only for Rivian and VW, but we're solving a problem for the larger automotive industry," Wassym Bensaid, Rivian's chief software officer and a co-head of the joint venture, told reporters on Wednesday. "And that could become basically an opportunity for a standard technology stack that others can use as well."

Wassym Bensaid

Why it matters: Rivian and VW are aiming to become the software backbone for other automakers—giving both companies a new, high-margin revenue stream as the industry braces for additional market headwinds.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Between the lines: VW’s plan to sell its joint Rivian platform technology to other car companies comes as the German automaker looks to soften the blow of its heavy EV push amid slowing U.S. demand and the expiration of federal EV tax incentives.

Porsche (part of VW) announced in August that it was shifting its EV strategy, abandoning plans to build EV batteries in-house and steering its focus toward research and development.

Audi (which also falls under VW) began sounding the alarm in March about losing ground, in part due to its accelerated push into EVs—revealing that it was reviewing its earlier plan to stop introducing new gas models in 2026.

What they’re saying: "The Volkswagen Group as a whole went really, really heavy towards EVs globally. And they stopped innovating anything really on the ICE side,” said Alan Haig, president of Haig Partners, in a recent CDG Podcast episode. “And I feel bad for Audi dealers…they have these expensive facilities that Audi required them to build, but they're not getting near enough volume to justify the investment.”

Alan Haig

Bottom line: VW’s joint-venture with Rivian is a sign the factory is pivoting from “all-in on EVs” to “sell the underlying tech to everyone,” a shift that could eventually stabilize product plans. In the near term, Audi and Porsche dealers are still managing thin EV demand and costly facility requirements, but longer term this standardized platform could mean faster product updates, lower costs, and a clearer roadmap for both EV and combustion inventory.

A quick word from our partner

Want insider knowledge on the most up-to-date trends in auto retail?

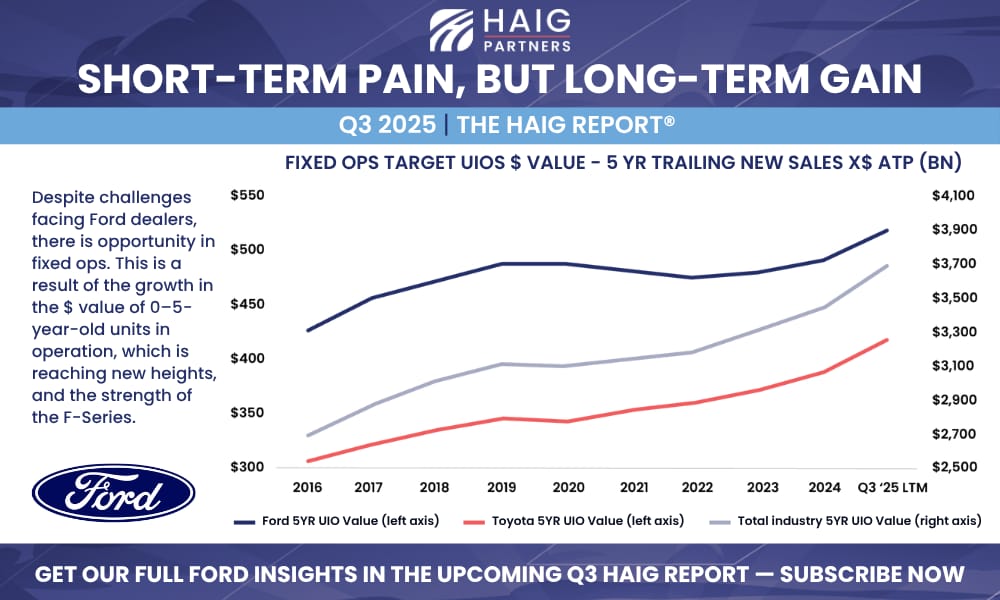

Here’s a sneak peek of what’s coming in the Q3 2025 Haig Report®—auto retail’s longest-published and most trusted quarterly report tracking trends and their impact on dealership values. Since 2014, the Haig Report® has delivered expert analysis on dealership performance, market activity, and franchise valuations, offering a clear view of opportunities and challenges in automotive retail.

Learn more in the full Q3 2025 Haig Report® by subscribing to receive it as soon as it’s released.