When Findlay Chrysler Dodge Jeep Ram owner Kable Derrow noticed that “5.0” condition reports for wholesale auction vehicles weren’t matching reality, he spoke up.

The Ohio dealer, whose store sells more than 200 used cars a month, was tired of “favorable sellers” and bad reports that left him chasing refunds.

Derrow told Daily Dealer Live hosts Sam D’Arc and Uli de' Martino his team started rechecking cars and finding consistent misses.

The problem: “We’re running into a lot of discrepancy,” he said. “I’ve got cars I’m buying that are 5.0s, and we’re checking them—they’re not 5.0s. We check them back in at the auction, and they’re 3.5s.”

“You’ve got a million dollars in cars that are non-sellable,” Derrow said. “Then you’re chasing your money back. It’s frustrating. It gets old.”

“You file a claim, wait two weeks, and maybe you get an adjustment,” he added. “Sometimes, it’s just pounding sand.’”

The fix: He took sourcing into his own hands. Derrow stopped relying solely on auctions and started building other sourcing pipelines to support used car operations.

“We’re finding different channels to buy the cars,” he said. “Direct from the sellers, skipping the auction process completely and just building relationships with individual sellers. We found out that’s the best way to combat it.”

About 75% of his inventory now comes from Canada—not because it’s ideal, but because domestic supply is thin. Derrow’s dealership is located about 180 miles from the border.

“If I had to buy all-American cars, we’d barely have any cars in stock,” Derrow said. “They’ve got it figured out for the most part.”

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Why it works: “I think the high-volume sellers have been allowed to write their own ticket,” Derrow said. “There’s clearly some favoritism and some control by the sellers. I’m okay with that—just tell me that. But if you get caught with it, take care of it.

Now his team verifies cars upfront and keeps inventory moving. That means he’s regaining control and confidence.

“We’re trying to keep the turn going, trying to, you know, just create smoother processes to keep moving fast,” he added.

The impact: Derrow’s bread-and-butter is two- to three-year-old trucks and SUVs, often $60–$80K units.

“You buy a $100,000 Escalade and get it back and it’s been hit by a train—that’s a difficult one,” he explained.

Bottom line: With inventory tight and prices rising, trust and accuracy matter most.

“I can’t imagine I’m the only guy that thinks one thing and gets another,” Derrow said.

His advice for auctions is simple: “Accuracy is the thing.”

Until that changes, Derrow’s strategy is clear: buy direct from consumers, and never trust condition reports blindly.

A quick word from our partner

Want insider knowledge on the most up-to-date trends in auto retail?

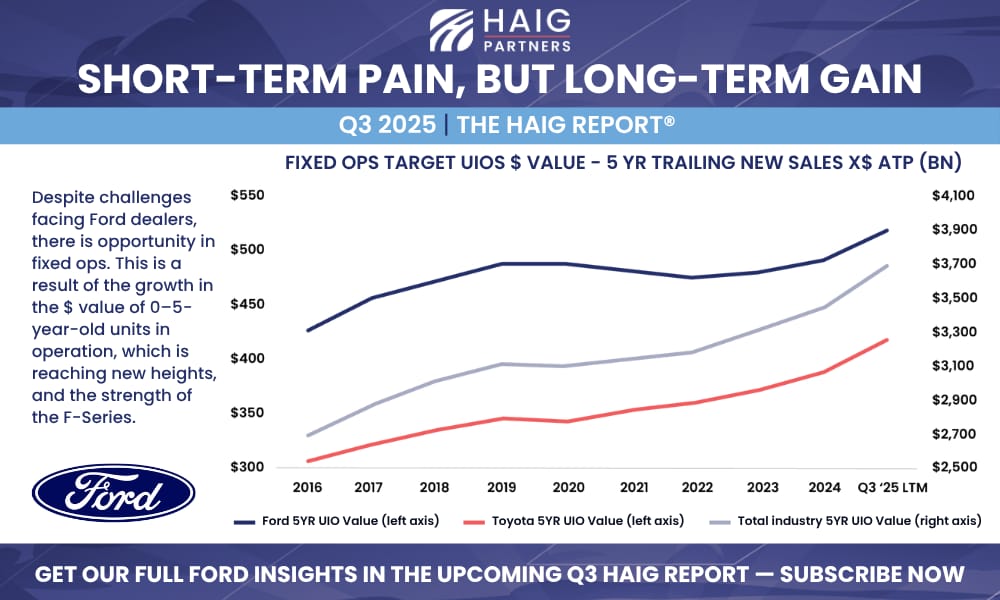

Here’s a sneak peek of what’s coming in the Q3 2025 Haig Report®—auto retail’s longest-published and most trusted quarterly report tracking trends and their impact on dealership values. Since 2014, the Haig Report® has delivered expert analysis on dealership performance, market activity, and franchise valuations, offering a clear view of opportunities and challenges in automotive retail.

Learn more in the full Q3 2025 Haig Report® by subscribing to receive it as soon as it’s released.