Prefer to listen to this newsletter? Click here for the audio version.

Hey everyone. We’ve got tons of great jobs hitting the CDG Job Board right now:

BizzyCar: Account Executive Outside Sales (Remote, Orlando, FL)

Toma: Account Executive (Regional - West Coast and East Coast).

Dealer Pay: Creative Design Specialist (Remote).

So, if you’re looking to hire or are on the job hunt, visit the CDG Job Board — it’s 100% free.

— CDG

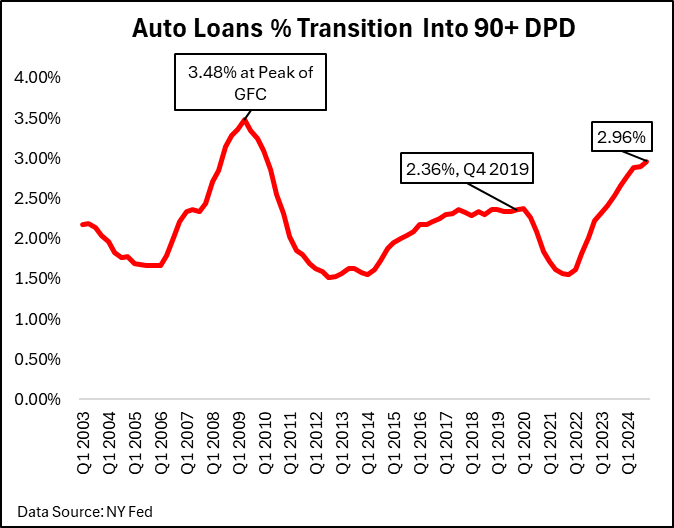

Deep auto loan delinquencies just hit a near 15-year high:

While still not at the record high seen during the peak of the Great Financial Crisis—

Auto loans transitioning into 90+ days past due are up 60 basis points from 2019.

The punchline?

Consumers are buckling under the weight of economic pressures (and probably high pandemic-era monthly payments in some cases).

(Data source: NY Fed / graph source: Capital markets analyst Joe Cecala)

1. Winter storm delays expected to fuel new car sales spike in February

New vehicle retail sales are on track for an 8.1% jump over last February—when adjusted for selling days—but even without that tweak, sales are still up 3.8%, according to J.D. Power and GlobalData.

One primary reason? A major winter storm at the end of January pushed some purchases into February, but that’s not the whole story.

Automakers are fueling demand with deeper discounts, with average incentives now up nearly 23% to over $3,200 per vehicle.

The trade-off? While volume is climbing, dealer profitability is tightening as margins shrink.

Bottom line: March could see another lift from tax refunds and fresh incentives, but the bigger question is whether automakers can keep buyers engaged without sacrificing too much profit … (Go deeper: 4 min. read)

2. Rivian’s R2 aims for the mass market—but can the automaker deliver?

Rivian is making a play for the mass-market EV space with its upcoming R2 SUV, set to launch in early 2026.

The goal? Cut costs and boost scale.

The R2’s bill of materials will be 50% lower than the R1 models, and labor costs will drop by more than half—allowing Rivian to price it at $45,000, far below the $75,900 R1S.

If Rivian can deliver, it could pressure legacy automakers to lower prices—but if it stumbles, it’ll fuel doubts about whether EV startups can compete on profitability… (Go deeper: 2 min. read)

Ship Smarter. Pay Less. No Middlemen.

Tired of brokers driving up costs and slowing you down? Auto Hauler Exchange puts YOU in control.

Ship cars faster and cheaper with 5,000+ vetted carriers

Get cars delivered in just 5 days on average

Transparent pricing, no hidden fees, and real-time tracking

Move cars smarter. Move cars faster.

3. Next-gen Ford F-150 production delayed until 2028

While it might seem like a simple scheduling delay—analysts say it’s part of a broader shift as Detroit automakers rethink their future EV strategies.

After years of aggressive electrification plans—many automakers are slowing down or even canceling future models, with Stellantis pausing the next-gen Jeep Compass and axing the all-electric Chrysler Airflow.

Adding to the uncertainty—the Trump administration could roll back EV mandates and eliminate federal tax credits, making automakers even more cautious.

But for Ford—keeping the current F-150 on lots longer could mean fewer fresh incentives and a tougher sales cycle, all while dealers navigate shifting inventory, floorplan costs, and shrinking margins … (Go deeper: 3 min. read)

China’s EV price war leaves behind a trail of zombie cars.

Tesla courted over Nissan investment by Japan group, report says.

Honda ditches GM, goes solo on next-gen hydrogen fuel cell amid shifting alliances.

How Black auto workers drove the industry and UAW to new heights.

Stellantis develops in-house automated driving technology.

Did you enjoy this edition of the Daily Dealer newsletter?

Thanks for reading everyone.

— CDG