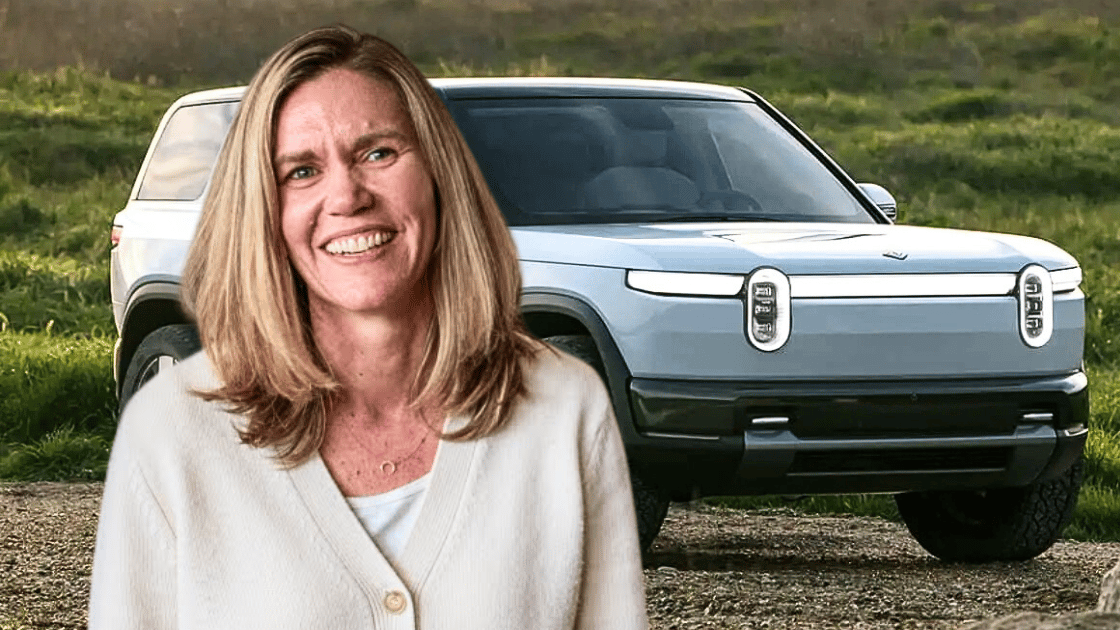

Rivian CFO Claire McDonough

Slow and steady wins the race, and Rivian's $RIVN ( ▼ 1.79% ) really leaning into that philosophy as they work toward becoming a household name in the EV space.

The question is whether their timeline and execution can match their ambitions.

The issue: Rivian wants to be a household name, but to get there, it needs more than brand buzz.

It needs to also hit a price point that unlocks real volume, without bleeding cash on every unit sold, something it hasn't achieved yet with the R1 lineup.

That's why CFO Claire McDonough used her appearance at the Deutsche Bank Global Auto Conference yesterday to double down on Rivian's next chapter: lower-cost models, a leaner lineup, and a slower, smarter path to scale.

Because to her point: Right now, the R1 lineup is doing exactly what it's supposed to do, aka proving the brand works.

She even highlighted that 86% of Rivian owners say they'd buy again, which she said is 13 points above the next closest premium EV brand.

No competitor or survey firm was named, and early adopter loyalty, while encouraging, doesn't always translate to mass market success.

But that's why Rivian’s next chapter is more about the harder challenge of profitable scaling.

As McDonough put it: Becoming a widely known household name means getting more people behind the wheel at a price point that actually works for the business, a balance they're still working to strike.

And so far, they're making progress…

McDonough, citing the brand's Q1 earnings call, reiterated that the brand shaved $22,500 off the cost of goods for each vehicle (across both retail and commercial products) compared to Q1 2024 thanks to their Gen 2 R1 update.

That included a redesigned battery structure, zonal electrical architecture, and better terms with suppliers.

What they’re saying: “There’s so many ways in which we’re driving significant reductions in the cost of the product itself, but also ensuring that it’s a feature rich product that’s going to not be half of the car that you’ll see with an R1 as well,” she said.

This is where the $45,000 R2 comes in.

McDonough said Rivian's vertically integrated approach should cut R2's material costs to "roughly half of an R1."

If they execute this successfully: The R2 becomes Rivian's clearest shot at cracking the premium EV segment under $50K, where real volume lives, though they'll be entering an increasingly crowded field.

Between the lines: Headwinds remain significant. EV demand continues to be volatile, and execution risks are high for a company still refining its manufacturing processes.

Also, tariff exposure adds another variable.

McDonough said Rivian is still seeing "a couple thousand dollars of impact per vehicle from a tariff standpoint," though pressure has eased slightly due to a short-term reprieve on reciprocal tariffs with China.

To mitigate supply chain risks, the automaker has imported enough battery cells to cover production through next year.

McDonough said Rivian is also launching the R2 with Korean-made LG cells, keeping critical components outside China's tariff crosshairs.

Cell production will also eventually shift to a new LG facility currently under construction in Arizona.

What we’re watching: R2 production begins the first half of 2026 on a single shift at Rivian's Normal, IL, plant, with a second shift possible by year-end.

Their Georgia plant, central to long-term scaling, is also expected to go vertical next year, representing a major capital investment that needs to start paying off.

Bottom line: Cost cuts help. So does brand loyalty. But none of it totally shields Rivian from the bigger question: can the brand scale profitably in a market that won’t sit still?

Outsmart the Car Market in 5 Minutes a Week

No-BS insights, built for car dealers. Free, fast, and trusted by 95,000+ auto pros.

Subscribe now — it’s free.

Toma’s AI agents answer every call—free for 1 month.

Overwhelmed advisors? Too many missed calls?

You’re not alone… but you’re leaving revenue on the table.

Toma’s AI agents answer every inbound call 24/7, schedule appointments, and give your team hours back.

No more missed opportunities, frustrated customers, or burnt out team members.

Dealers using Toma are saving 30–40 hours of staff time per week and booking 100+ extra appointments per month.

CDG subscribers get an exclusive, no-risk 1-month free trial—claim yours today!