Presented by:

Hey everyone,

In case you missed it, last week, Sam D’Arc sat down with Phil Pecoraro, Operating Partner of Murdock CDJR.

They got into Phil’s first month running his new store, why he’s returning to the same dealership where he earned his first GM role 16 years ago, and how he’s carrying forward the legacy of Larry H. Miller’s final store.

— CDG

First time reading the CDG Newsletter?

Welcome to the Market Pulse—your no-fluff cheatsheet to auto retail, built to help dealers price right, stock smart, and stay ahead.

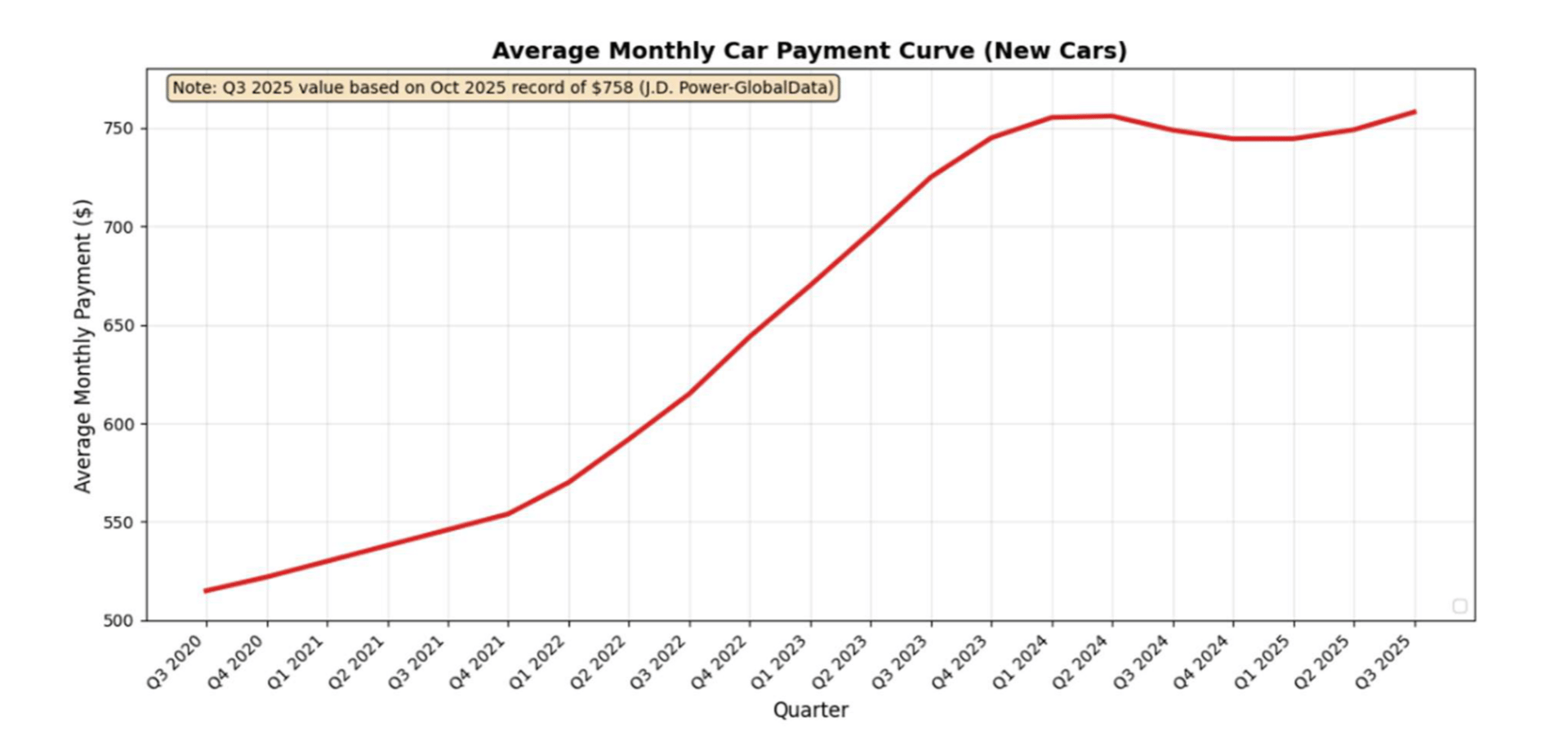

New-car prices are climbing: Average transaction prices ($46,057) increased 2.2% YoY in October, while average monthly payments reached $758, a record for the month.

New-vehicle inventory is growing: New-vehicle supply rose to 2.87 million units (+4.8% MoM) as of early October, the highest since Q1 2025.

And dealers are prioritizing ordering precision over volume: Dealers are especially focused on stocking what sells, by trims, price bands, and powertrains, instead of just filling the lot.

(Source: J.D. Power / Cox Automotive / Erin Keating)

Record new-car payments and rising transaction prices are testing which dealers really know their market.

New-car prices and payments are still inching higher, even with more inventory on the ground, per J.D. Power and Cox Automotive.

By the numbers…

In October, the new-car ATPs reached $46,057 (+2.2% YoY), while listings climbed to $49,394 (+1.6% MoM; +4.2% YoY) as 2026 models rolled in.

At the same time, the average monthly payment hit a record $758, driven by longer 84-month loans (now 11.8% of financed sales) and larger loan balances.

CDG analysis via Joe Cecala & derived via quadratic interpolation using Experian/Edmunds/Lending Tree Data

As Erin Keating with Cox Auto pointed out in a call we shared, the keyword in most of these stats is “average.”

Which is exactly why, she says, if dealers “know which pond to fish in,” they can still find success, even when the affordability woes get woe-ier.

NOTE TO DEALERS:

Knowing which pond to fish in means ordering with purpose.

In other words, don’t order every trim or tech feature when some shoppers just want “an engine and four wheels,” as Keating put it.

Instead, focus on the configurations your customers can actually afford and move quickly.

Rising new-vehicle inventory and model-year transitions are reshaping what’s moving, and what’s not.

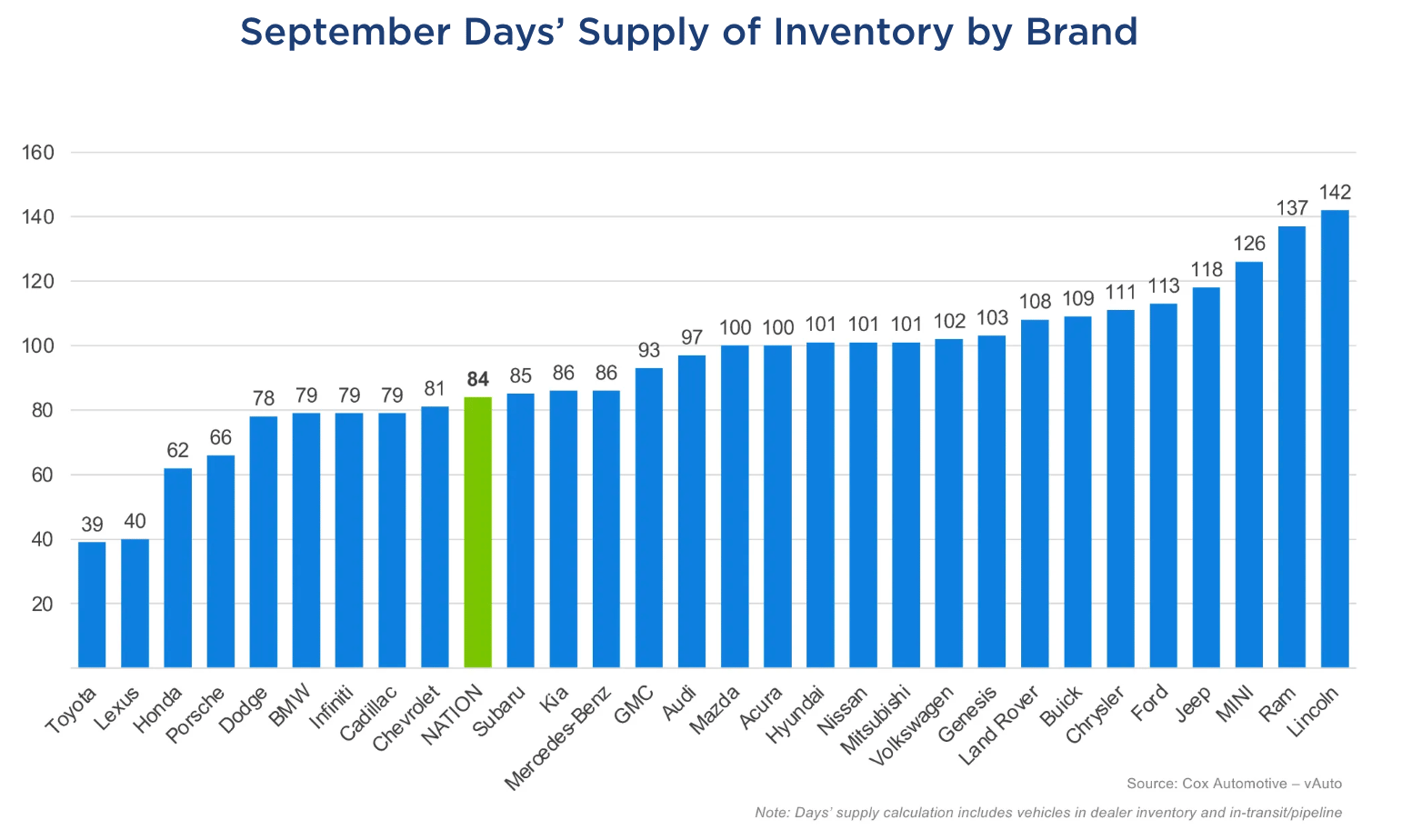

New-vehicle supply climbed to 2.87 million units as of early October, the highest since Q1 2025, just after days’ supply hit 84 in September.

On top of that, nearly half of brands now sit above 100 days, as 2026 models flood in and the market adjusts from Q3’s pull-ahead demand.

Data source: Cox Automotive

Per Keating, this isn’t oversupply; it’s the market catching its breath after months of aggressive buying and model-year transitions.

For dealers, that means zeroing in on what’s actually turning right now, and what’s not:

Hybrids are on pace to make up a record 14.2% of retail sales in October. Not a new trend, but one that’s holding steady.

Meanwhile, EV demand has cooled since the credit expired, but it hasn’t disappeared. Just needs stronger messaging (more on that in a second.)

And finally, OEMs are actively pulling back on EV production, leaning into hybrids, and right-sizing ICE output.

Keating’s advice: Now’s the time to capture remaining EV demand (if you have the inventory) by marketing as aggressively as the pre-deadline countdowns.

“There are plenty of manufacturers who are still heavily incentivizing the purchase of the EV or the lease of an EV…emphasize that there are still very good deals to be had out there,” she said.

WHY IT MATTERS:

If you don’t have EVs, it all goes back to the pond analogy.

Know your market, their capacity to spend, which trims will move well, and run with them.

A quick word from our partner

Close the loop with Repair 360—the first and only recon software that connects every function in the dealership to tighten recon and help you sell more cars.

Repair360 lets used car managers connect all the dots—every department, every task—one system for everything.

Approve, deny, and assign work in seconds. See exactly where every car is and what its recon is costing in real time minute-to-minute.

When recon moves, your lot does too.

In catching up with Keating, she shared a few more tactics on how dealers can keep momentum as affordability tightens and market shifts reshape buyer behavior.

Here are her Dos and Don’ts from the ground:

Do: Order for your actual buyers, not the “average.”

The smartest dealers are narrowing in on what sells locally, aka by trim, price point, and audience.

“Every dealer should always be focused on what actually sells in my market, what have I seen done well, and what do I keep buying to the extent that the manufacturer’s going to give me enough allocation for it.”

Erin Keating

Her point: Know your pond. Because data-backed ordering beats chasing national trends every time.

Do: Focus inventory where value and demand overlap.

As used prices stabilize, mid-range models remain the new margin play.

“Used vehicles are starting to soften just a bit, but the zero-to three-year-old vehicle is still, you know, we still have a dearth of those on the market. So, prioritizing from an inventory and stocking perspective, for dealers, it would be looking at five- to eight-year-old vehicles,” she said.

This tracks, because the five- to eight-year-old segment hits the sweet spot for affordability and availability.

Don’t: Expect full control over allocation.

OEM production realities are shaping what dealers can even order.

“I think the automakers are going to come in and probably be a little bit more directional on allocation and ordering these days, simply because they’re the ones having to make a lot of the major decisions on production,” Keating said.

What she means: Stay flexible. And work with the flow, not against it.

Inventory planning was already tough before tariffs, parts delays, and shifting demand joined the party.

Now, I have to imagine every order feels like a forecast and every forecast feels like a total gamble.

My take: The only way to beat the odds is by making investments in technology that can help pair real-time data (AI demand forecasts, CRM insights, etc) with what your gut already knows about your market.

Have a game-changing tool/strategy for inventory ordering?

Missed yesterday’s episode of Daily Dealer Live?

Presented by:

Used Cars: Power, Profit, and Playbooks

Featured guests:

Nate Myers at Mercedes-Benz of West Chester

Burt Davidson at Diehl Automotive Group

Eric Miller at Morrie's Auto Group

Charlie Spradlin at Art Moehn Auto Group

Three opportunities hitting the CDG Job Board right now:

Bodwell CJDR: Service Advisor (Brunswick, Maine)

Crown Automotive Group: Automotive Sales Consultant (Pinellas Park, Florida)

Hertrich Family of Automobile Dealerships: General Manager (New Castle, Delaware)

Looking to hire? Add your roles today—it’s 100% free.