Honda has been battered by U.S. tariffs in 2025, with the Nexperia chip shortage now compounding the company’s operational and revenue strains.

By the numbers: The Tokyo-based automaker revealed Friday that its net profit plummeted 37% for the first half of its fiscal year, with sales for the six months down 1.5%.

Honda recorded a 311.8 billion yen ($2bn) profit for April–September, down from 494.6 billion yen ($3.2bn) a year prior.

The company’s sales over the six months totaled 10.6 trillion yen ($69bn), down from nearly 10.8 trillion yen ($70.5bn).

Honda’s global vehicle deliveries during the first fiscal half totaled 1.68 million, down from 1.78 million—though sales in North America were up.

Despite a strong U.S. manufacturing footprint, tariffs impacted Honda’s operating profit by 164 billion yen ($1.1bn).

Why it matters: Honda dealers could see more sporadic inventory gaps, slower model-mix replenishment, and more pressure on grosses due to the automaker’s challenges. So planning, pipeline management, and turn-rate discipline matter more than ever the next 8–10 weeks.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Digging deeper: Blocked shipments of chips from the Nexperia plant in China have intensified Honda’s operational issues, with the company being one of the first to make major production adjustments to mitigate the damage.

Vehicle production at Honda’s plant in Celaya, Mexico, has been halted since October 28, with production adjustments at North American plants starting October 27.

Approximately 110,000 Honda and Acura units produced in North America will be impacted by the chip shortage, per a memo to dealers from Honda National Sales, obtained by CDG News.

Amid its challenges, Honda has lowered its profit projection for the fiscal year through March 2026 to 300 billion yen ($2bn)—which would be a decline of 64% from 835.8 billion yen ($5.4bn) the year before—and down from a previous forecast of 420 billion yen ($2.7bn).

“We understand that having production reductions as we head into the final two months of the year is not ideal. However, while it is not definitive; we are working hard to restore production late November,” reads the memo.

Bottom line: Honda is now getting hit on both macro fronts at once (Washington’s 2025 tariffs and a new acute supply disruption in chips) turning what had been manageable margin pressure into a live production-volume problem.

A quick word from our partner

Want insider knowledge on the most up-to-date trends in auto retail?

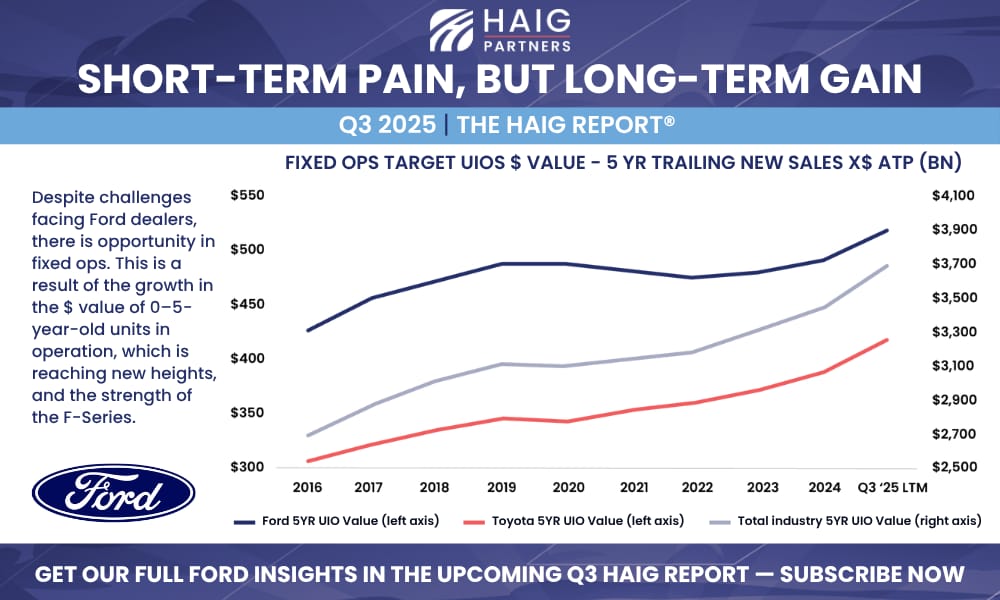

Here’s a sneak peek of what’s coming in the Q3 2025 Haig Report®—auto retail’s longest-published and most trusted quarterly report tracking trends and their impact on dealership values. Since 2014, the Haig Report® has delivered expert analysis on dealership performance, market activity, and franchise valuations, offering a clear view of opportunities and challenges in automotive retail.

Learn more in the full Q3 2025 Haig Report® by subscribing to receive it as soon as it’s released.