General Motors $GM ( ▼ 2.58% ) is pushing its auto parts makers to pull their supply chains out of China with new urgency, aiming to avert geopolitical disruptions to its operations.

The details: The new directive, first reported by Reuters, reflects growing concern among automakers that their supply chains are overly dependent on China for raw materials and components, a risk magnified by the rising tech content in vehicles.

GM began approaching suppliers in 2024, accelerating the initiative this past spring amid escalating trade tensions between China and the U.S.

The automaker is urging supply partners to find alternatives to China, with the long-term goal of shifting its supply chains out of the country entirely.

GM has reportedly set a 2027 deadline for some suppliers to meet the directive, according to Reuters.

And the company is also seeking to move sourcing away from Russia and Venezuela—though China remains by far its largest source of raw materials and parts.

What they’re saying: “We've been working now for a few years to have supply chain resiliency,” Barra said during GM’s quarterly conference call in October, adding that the automaker tries to source parts in the same country where it builds cars whenever possible.

Why it matters: GM is fast-tracking efforts to de-risk its supply chain from China—a shift that could reshape where and how North American vehicles are built. The move will force suppliers to retool, relocate, and absorb higher near-term costs, introducing new execution risks even as it strengthens long-term stability.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Between the lines: GM’s heightened urgency follows China’s recent ban on Nexperia chip exports, which left several automakers scrambling to adjust—underscoring the fragility of global supply networks. Still, cutting auto supply chain ties with China won’t be easy.

China has become the dominant hub for automotive supplies, spanning lighting, electronics, and tool-and-die makers that produce custom components.

Finding viable alternatives will be lengthy and costly, given how deeply China’s parts and materials ecosystem is embedded in global production.

What they’re saying: “In some cases this has been 20 or 30 years in the making, and we’re trying to undo it in a few years,” said Collin Shaw, head of MEMA, the Vehicle Suppliers Association, per Reuters. “It’s not going to happen that fast.”

Collin Shaw

Bottom line: GM’s push to shift sourcing out of China could create short-term inventory and parts volatility, affecting allocations, launch timing, and service bay throughput. But over time, greater North American and allied sourcing should stabilize supply and give dealers a stronger, “locally built and resilient” story to tell.

A quick word from our partner

Want insider knowledge on the most up-to-date trends in auto retail?

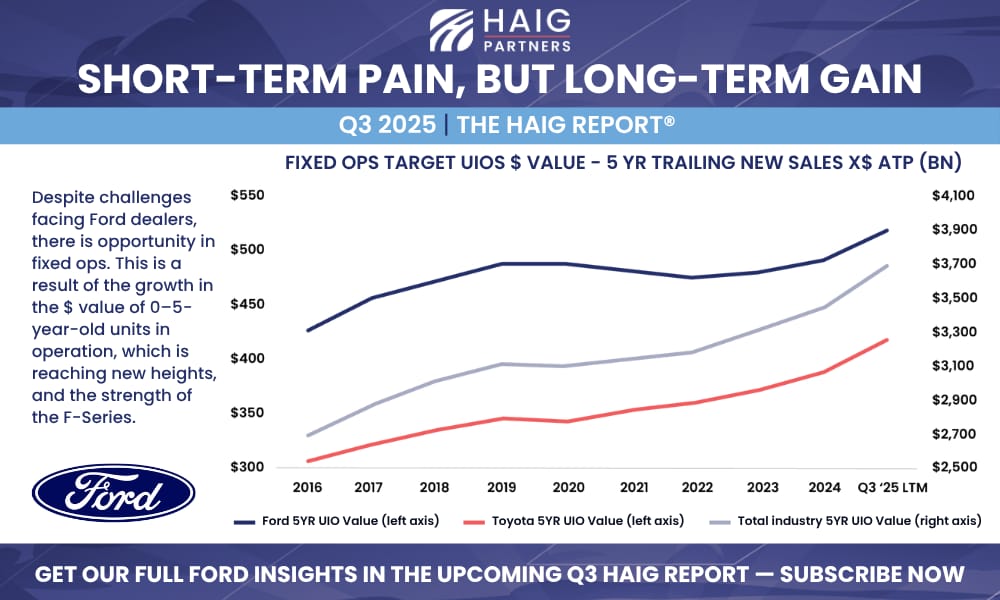

Here’s a sneak peek of what’s coming in the Q3 2025 Haig Report®—auto retail’s longest-published and most trusted quarterly report tracking trends and their impact on dealership values. Since 2014, the Haig Report® has delivered expert analysis on dealership performance, market activity, and franchise valuations, offering a clear view of opportunities and challenges in automotive retail.

Learn more in the full Q3 2025 Haig Report® by subscribing to receive it as soon as it’s released.