Prefer to listen to this newsletter? Click here for the audio version.

Hey everyone. Lots of murmurs about Dallas-based Yendo—

Which offers credit cards backed by vehicle equity, giving customers a financing option when traditional lenders say no.

My take:

The people who need this, are likely not qualified for it.

The people who don’t need it, are likely very qualified for it.

— CDG

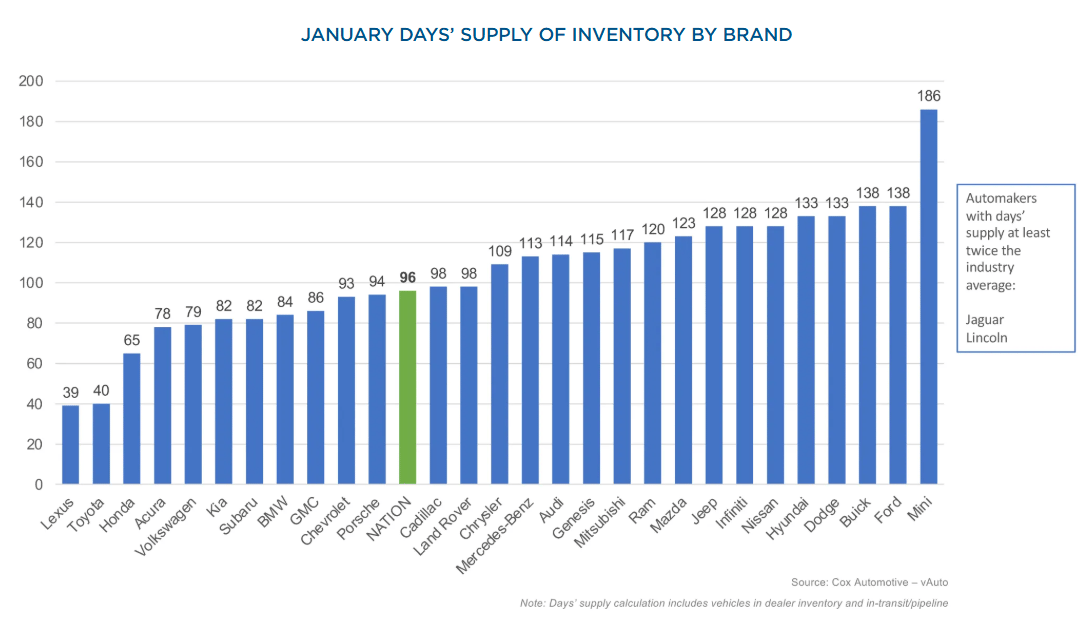

Stellantis is no longer leading the pack in most over-supplied brands:

While inventories for the automaker’s Chrysler, Ram, Jeep and Dodge brands are still higher than the nationwide average market days’ supply of 96—

Lower prices and more incentives are keeping supply in check.

Meanwhile, other brands—including Ford, Lincoln, Buick—are watching inventories rise…

Here’s new car availability (days’ supply) from least available to most:

(Data/graph source: Cox Automotive / Erin Keating)

1. Ford slashes stock bonuses as cost-cutting deepens

Ford is tightening its belt, and middle management is feeling it—stock bonuses are getting slashed in half this year.

But that’s just one piece of the cost-cutting puzzle. The automaker is trimming thousands of jobs in Europe, scaling back EV ambitions, and even asking suppliers to help lower costs.

With EV losses hitting $5.1 billion last year, Ford is leaning harder on gas-powered profits to stay afloat.

Bottom line: Cutting back on EV investments may stabilize the balance sheet for now, but it raises a bigger question—what does Ford’s long-term positioning look like? … (Go deeper: 2 min. read)

2. China’s high-tech EVs are eating Porsche’s lunch

Porsche is losing ground in China, with sales plunging 28% in 2024—its third straight year of decline.

The reason? A wave of homegrown EVs that match Porsche on innovation while massively undercutting it on price.

Xiaomi’s new SU7, a Taycan lookalike at half the cost, outsold Porsche’s total China deliveries in just nine months last year.

In response, Porsche is scaling back—closing nearly a third of its dealerships by 2026.

For years—Porsche thrived on its brand cachet, but high-tech, lower-cost players are proving that prestige alone may not be enough … (Go deeper: 3 min. read)

Ship Smarter. Pay Less. No Middlemen.

Tired of brokers driving up costs and slowing you down? Auto Hauler Exchange puts YOU in control.

Ship cars faster and cheaper with 5,000+ vetted carriers

Get cars delivered in just 5 days on average

Transparent pricing, no hidden fees, and real-time tracking

Move cars smarter. Move cars faster.

3. Trump’s EPA sends California emission waivers to Congress

The Trump administration is challenging California’s authority to set its own vehicle emissions standards, sending three key waivers—including its 2035 zero-emission mandate—to Congress for potential repeal.

If overturned, more than a dozen states following California’s lead would also lose the ability to enforce stricter pollution rules, forcing automakers to rethink billions in investments.

At the same time, the administration is scrutinizing the $7,500 EV tax credit, exploring ways to tighten eligibility and limit automaker access.

The real test? Whether automakers can absorb the costs of changing incentives and regulations. If they can adjust pricing and streamline production, mass-market EVs should remain competitive—but for brands relying on subsidies and premium pricing, 2025 could be a painful adjustment year … (Go deeper: 4 min. read)

Embattled EV maker Nikola files for Chapter 11 bankruptcy protection.

Rivian expects positive gross profit in Q4 earnings report despite nearly flat deliveries.

Trump is scrambling global automakers’ reliance on America.

Toyota steps in to support Michigan EV battery plant with $1.5B order after GM backs out.

Ford Credit CEO identifies tech, affordability as 2025 priorities.

Did you enjoy this edition of the Daily Dealer newsletter?

Thanks for reading everyone.

— CDG