Presented by:

Hey everyone.

Need a cheat sheet for the latest headlines in the auto industry? I’ve got you covered.

Stay informed quickly and easily by getting the Daily Dealer newsletter delivered straight to your inbox.

Want in? Vote below and we’ll take it from there:

— CDG

First time reading the CDG Newsletter?

Welcome to The Weekly, a roundup of the top five auto industry headlines of the week.

Arizona-based Courtesy Auto is going head-to-head with Carvana’s first franchise dealership

Carvana $CVNA ( ▲ 0.87% ) has moved into Courtesy Automotive Group’s backyard—acquiring a CDJR store in Casa Grande, just down the road from Courtesy’s East Mesa location.

The problem: With auction access, marketing clout, and in-house financing, Carvana can zero out front-end margins and make it back on the finance side—an advantage most family-owned dealers can’t match.

Courtesy CEO Scott Gruwell is countering with community roots, better delivery operations, and new financing partnerships to stay competitive against DTC players.

Big picture: Gruwell’s bigger concern isn’t just Carvana. It’s that OEMs might sign off on more of these partnerships without weighing the decades of investment dealers have made in facilities, service, and customer relationships.

Auto loan refinancing jumps 69% as borrowers lock in lower rates — study

Auto loan refinancing is surging—up 69% year-over-year in Q2, according to Experian.

Borrowers who refinanced cut their average rate from 10.45% to 8.45%, saving about $71 a month. But the biggest winners are prime borrowers working through credit unions, which now control 68% of the refi market.

Subprime borrowers, meanwhile, are getting left behind—representing 19% of outstanding balances but just 12% of refinancing activity.

Bottom line: Lower rates are fueling demand for refinancing, and more Fed cuts could keep the trend alive. For dealers, though, every refi risks delaying the customer’s next purchase.

A word from our partner:

Under-collected fees, upset customers, negative online reviews, buyback letters, and more.

DLR50™ is the solution for your out-of-state titling pains.

DLRdmv® understands the impact out-of-state deals have on your business, as they can impede your desk and damage CSI. That’s why they developed DLR50™, to modernize and streamline the entire process for you and your team.

CDG readers can schedule a short demo and receive 30 days of free DLR50 unlimited full-service access. Use code News30 at DLRdmv.com/CDG to get started.

DLRdmv®, The Dealer’s DMV™

Flagstaff Chevrolet builds technician pipeline with local college partnership

Mark Harris, owner of Flagstaff Chevrolet and Winslow Ford, just turned a closed body shop into a training center for Coconino Community College—giving northern Arizona a new pipeline of auto technicians.

Seven years in the making, the facility now offers full-time courses in A/C, transmissions, electronics, and engine repair.

Unlike past partnerships that gave students just a few hours a week, the center can operate 24/7.

Harris cut the lease in half, donated equipment, and rallied local contractors to help with renovations.

For him, it’s about more than solving a business challenge. It’s about restoring the flow of skilled workers that OEMs mostly stopped promoting years ago.

August U.S. auto sales uneven as SUVs, hybrids offset weaker segments

Automaker winners and losers in August (U.S. sales YoY):

Toyota: +14% (RAV4 +20%, Camry +14%, Lexus +12%)

Honda: +4.4% (Hybrids/EVs a record 36% of sales)

Hyundai: +12% (Best August ever, EVs +72%)

Kia: +10% (Telluride +19%, Carnival +29%)

Ford: +4% (Bronco +32%, hybrids +14.5%, EVs +19%)

Subaru: –2.9% (Crosstrek record, Outback/Ascent soft)

Mazda: –7.6% (CX-90 strong, CX-30/Mazda3 weak)

Volvo: –5.8% (EX30/EX90 up, XC40/S60 dragged)

Lincoln: –15% (Navigator the only gainer)

The takeaway: SUVs, crossovers, and hybrids continue to carry the market. Sedan-heavy lineups and premium brands lost some ground.

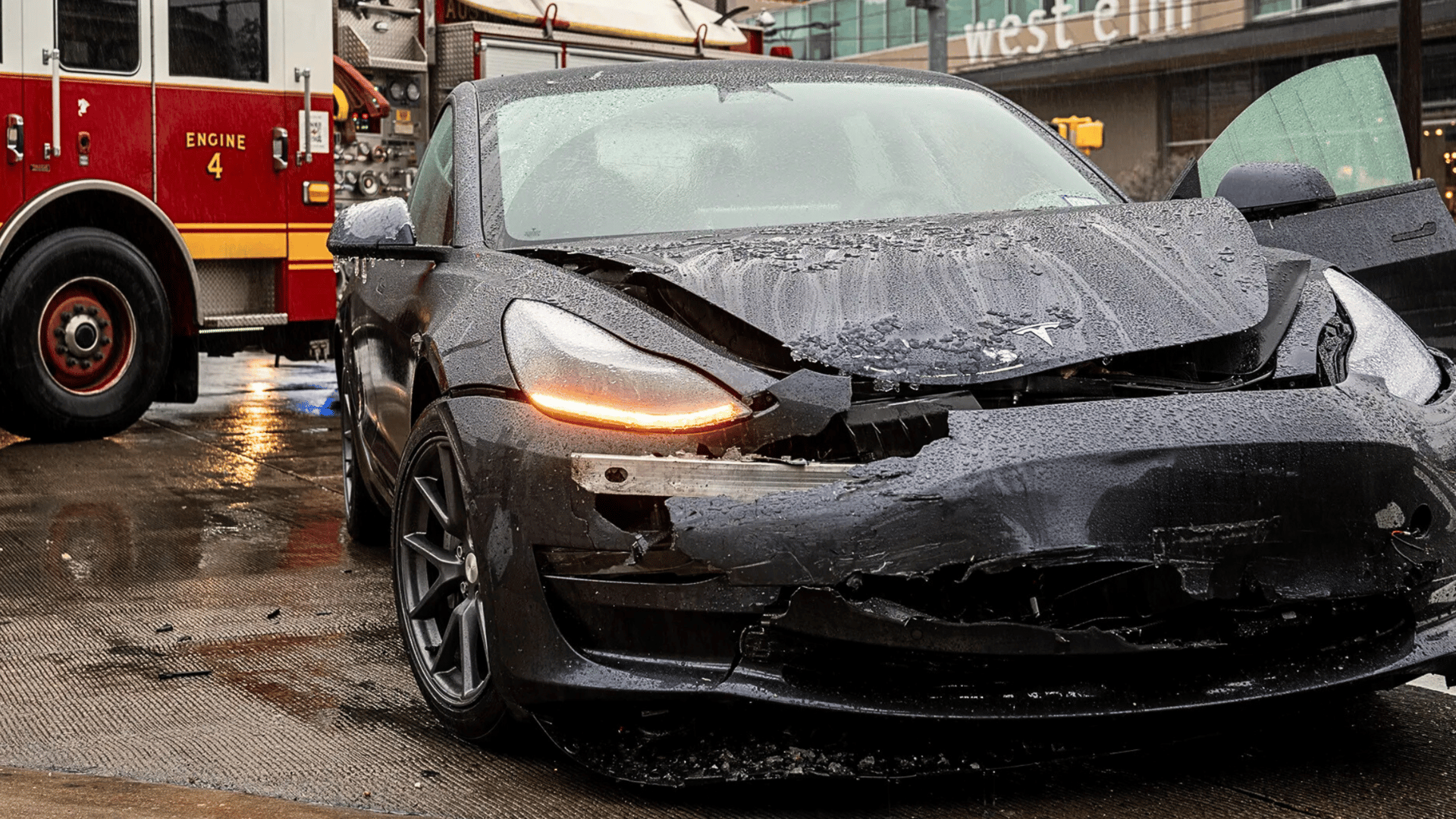

High repair costs push EV insurance rates up 16% in past year — study

EVs may be cheaper to charge, but they’re a lot more expensive to insure.

By the numbers: A new Insurify report shows EV premiums jumped 16% in the past year and now average 49% higher than gas cars—$4,058 vs. $2,732 annually.

EVs are 22% pricier to fix, and with transaction prices at $57,734 vs. $48,799 for gas-powered cars, insurers end paying more when cars are totaled.

The Tesla Model X and Model 3 top the charts for the most expensive EVs to insure likely due to the frequency of claims.

The punchline: Rising premiums pile onto already high EV costs just as federal tax credits are set to expire. Without stronger state incentives or lower-priced models, affordability will remain one of the segment’s biggest roadblocks.

Missed yesterday’s episode of Daily Dealer Live?

Presented by:

Sen. Moreno on Auto Sector Plan, Greenfield on Auto Retail VC, Murphy on OEM Futures

Featured guests:

U.S. Senator Bernie Moreno, (R-OH)

Steve Greenfield, General Partner of Automotive Ventures

John Murphy, Managing Director of Strategic Advisory at Haig Partners

Elon Musk could become a trillionaire under Tesla’s new pay package proposal