A tug of war for a Dutch-headquartered chipmaker threatens to throw the auto industry into a tailspin that could halt vehicle production globally.

The details: The threat stems from the Dutch government's seizure of chipmaker Nexperia from China after the country moved to prevent the company and its subcontractors from exporting certain products from China—prompting Beijing to take retaliatory measures that have disrupted semiconductor supplies, reports Automotive Manufacturing Solutions (AMS).

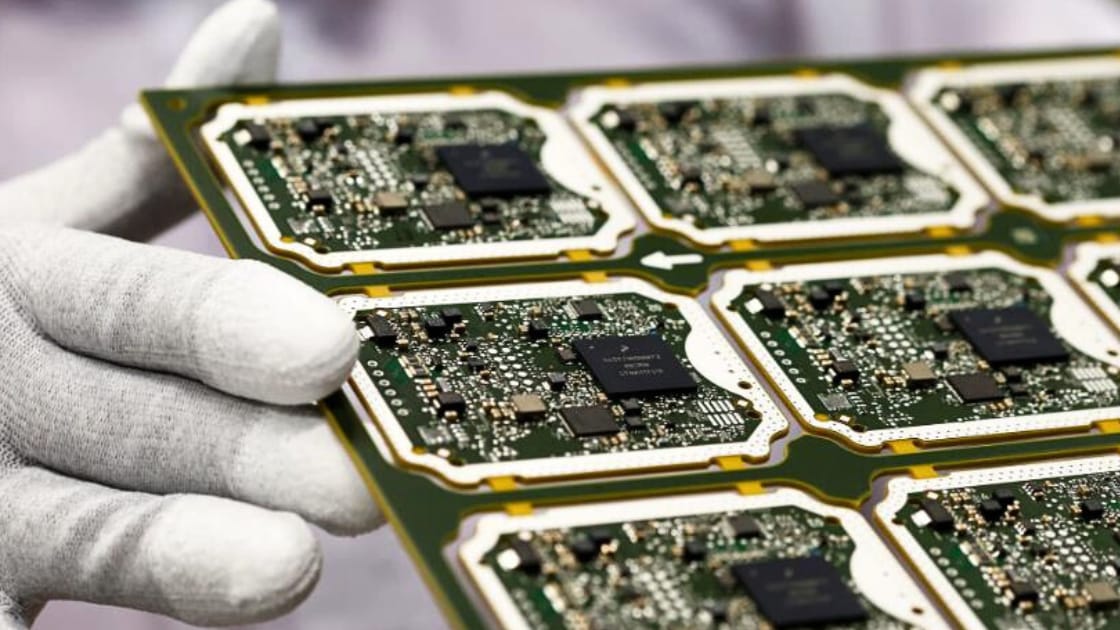

Nexperia produces hundreds of millions of chips used for switching and amplifying electronic signals that perform vital functions in vehicles.

These chips operate everything from switches to steering wheel controls, embedded in the electrical systems and power management units used by vehicles.

Nexperia's products are also embedded within preassembled components supplied by tier 1 manufacturers such as Bosch and Denso.

Automakers and their tier 1 suppliers were informed by Nexperia on October 10, that the company could no longer guarantee delivery of its chips, with reports that U.S. auto plants could start feeling the impact to production as soon as November, per AMS.

What they’re saying: “If the shipment of automotive chips doesn't resume quickly, it's going to disrupt auto production in the U.S. and many other countries and have a spillover effect in other industries,” said John Bozzella, President & CEO, Alliance for Automotive Innovation, (which represents many automakers like GM, Toyota, Ford, Volkswagen, and Hyundai).

John Bozzella

Why it matters: The Nexperia seizure underscores how fragile the global automotive supply chain remains, especially for semiconductor components essential to nearly every modern vehicle. Even a brief disruption could ripple through assembly plants worldwide, halting production lines and tightening inventory for dealers already managing thin margins and fluctuating supply.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

No-BS insights, built for car dealers. Free, fast, and trusted by 55,000+ car dealers.

Between the lines: Several automakers, including Volkswagen and Stellantis, are already trying to mitigate the damage to their operations amid mounting concerns about the impact on vehicle production.

A shortage of chips totaling just a 0.10% of total semiconductor content can “render entire vehicle architectures inoperable,” reports AMS.

Suppliers must obtain certification for replacement components—a process that can take weeks to months under normal circumstances.

Also worth noting: The chip fallout over Nexperia comes amid the U.S. and Beijing’s ongoing tensions over tariffs and high-value exports from China, with trade agreement talks between the two countries scheduled to resume later this week.

Bottom line: If the Nexperia disruption persists, U.S. dealers could soon face familiar supply constraints reminiscent of the post-pandemic chip shortage era—limited vehicle availability, reduced incentives, and upward pressure on prices. Production slowdowns at automakers would ripple through inventory pipelines, tightening supply and forcing dealers to manage leaner lots heading into year-end.

A quick word from our partner

What the Top 10% of Dealers Know - And Do Differently

Get inside conversations with dealers who are finding 77 extra used cars a month, improving CSI above 90%, and building 4.8-star reputations that drive sales.

Hosted by Sam D’Arc from Car Dealership Guy and brought to you by Digital Air Strike, the team and technology behind smarter communication and stronger customer relationships for auto dealerships.

Watch the Dealer-to-Dealer Video Series free at Ultimate20Group.com