There were signs of auto credit loosening in October despite a dip in approval rates from the prior month, according to a new Cox Automotive report.

The details: Despite ongoing economic challenges and waves of layoffs at major auto finance companies, auto loan access improved last month as lenders invested in automation and streamlined operations to solidify market share.

Cox’s All-Loans Index edged up to 98.3 in October from 97.9 in September, marking a 0.4-point month-over-month increase and a 4.1% gain year-over-year.

The rise continues a broader trend of loosening credit conditions that began in late summer 2024.

However, loan approval rates fell to 72.6% in October, down 1.4% from September.

Via Cox Automotive

Yes but, the dip in approvals was offset by growth in subprime lending, longer loan terms, and reduced down payment requirements, collectively easing access for borrowers, according to Cox.

The share of loans to subprime borrowers increased 90 basis points (BPs) month over month (from 14.2% to 15.1%) and is up 240 BPs year over year.

The share of loans with terms greater than 72 months rose 70 BPs (from 26.8% to 27.5%) and is up 300 BPs year over year.

The average down payment percentage declined 20 BPs (from 13.5% to 13.3%) and is down 70 BPs year over year.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

Why it matters: When lenders loosen credit access, dealers often benefit from increased sales volume and higher gross profits in the short term, especially among subprime and near-prime customers. However, the true operational impact surfaces during the next purchase cycle, when many of these customers return to the dealership in a more precarious financial position.

Digging deeper: According to Cox, credit access eased across all lender channels. Captives led the way, with credit availability rising 2.1%, followed by banks (up 1.9%), as well as credit unions and finance companies (each up 1%).

Bottom line: Macroeconomic uncertainty is driving lenders to compete more aggressively for market share and lock in returns now, solidifying their positions ahead of a possible downturn.

A quick word from our partner

Want insider knowledge on the most up-to-date trends in auto retail?

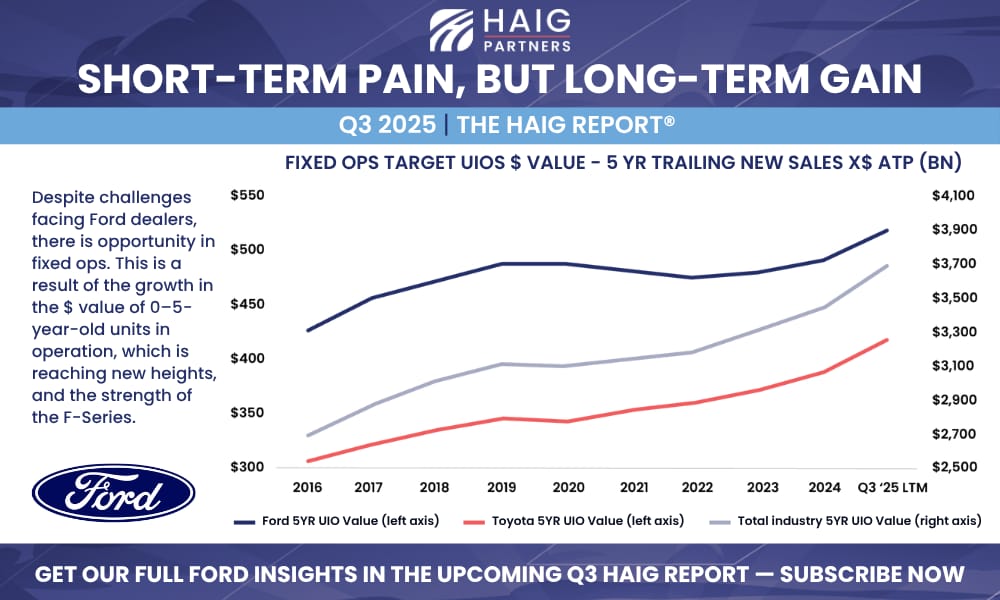

Here’s a sneak peek of what’s coming in the Q3 2025 Haig Report®—auto retail’s longest-published and most trusted quarterly report tracking trends and their impact on dealership values. Since 2014, the Haig Report® has delivered expert analysis on dealership performance, market activity, and franchise valuations, offering a clear view of opportunities and challenges in automotive retail.

Learn more in the full Q3 2025 Haig Report® by subscribing to receive it as soon as it’s released.