Presented by:

Hey everyone,

Coming at you this morning with three opportunities hitting the CDG Job Board right now:

Hertrich Family of Automobile Dealerships: Regional Performance Director (Delaware)

Greenway Automotive: General Manager (Tennessee)

Sport Chevrolet and Sport Cadillac: Service Manager (Maryland)

Check them out. It’s 100% free.

First time reading the CDG Newsletter?

Welcome to The Breakdown, an analysis of auto retail’s top trends, moves, and insights—in under 5 minutes.

Every dealer says people are their most valuable asset.

But some dealers do a better job at walking the talk than others.

Many have invested heavily in training programs and employee development over the past few years. Yet, churn still impacts this industry disproportionately.

So, we did what we do here at CDG and ran a survey to ask dealership employees what they really think.

And after digging deeper into the results, I uncovered three critical patterns into why certain pockets of employees are leaving dealerships...

Long hours are burning out staff, but flexible schedules are delivering results.

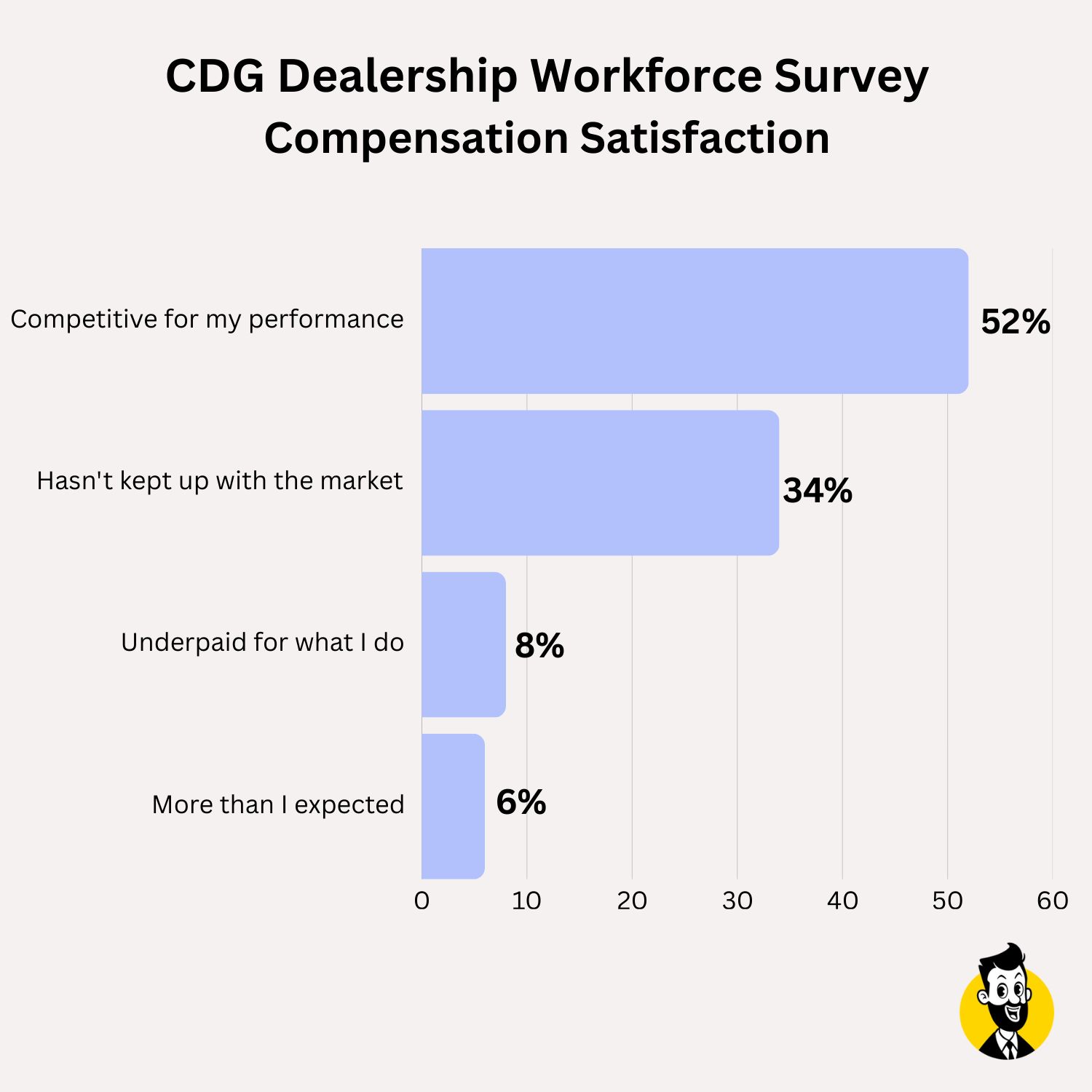

58% of the dealership employees who responded to our survey said they're paid competitively or better than expected. Yet, 20% of those same well-compensated people are planning to leave to their dealership within 12 months.

CDG Dealership Workforce Survey

So, we asked them what would make you stay?

The top answer: more compensation (I mean, obviously yea—who doesn’t want to make more money?)

But the second biggest motivator is a “more predictable schedule and work life balance.”

In fact, 22% of dealership employees cite long hours as their single worst gripe.

42.9% salespeople report excessive hours, with many working 60-hour weeks while seeing quality traffic for maybe 40 of those hours.

And service isn't much better. 27.3% of service managers are burning the candle at both ends.

Essentially, long hours are killing productivity and morale, not improving them.

Now, some dealers might be rolling their eyes while they read this. And I get it. A lot of operators and managers wear their 7-day work weeks like a badge of honor.

But big picture, dealerships forcing 60, 70, or even 80-hour weeks despite natural lulls and slow periods are paying premium labor costs for diminishing returns while burning out the people who actually drive revenue.

However, a few forward-thinking operations like Gateway Toyota tried something different with their service department: four-day work weeks with a three-team rotation. Over 65% of their techs opted in, and turnover dropped to under 10%.

Ed Roberts at Bozard Ford Lincoln told me he offers four-day work weeks too, but he's found that five-day schedules work just as well if dealerships offer different shift options. He runs multiple shifts (7-4, 9-6, and night shifts from 4pm-midnight) because different employees have different needs. Most prefer the earlier schedule to avoid rush hour.

For employees who want four-day weeks, Ed requires the same productivity as five-day schedules. They need to complete 100 hours per pay cycle with 125% productivity to maintain the compressed schedule. If performance drops, employees revert to five days.

The takeaway: These experiments are proof that flexibility has become the new employee retention growth hack.

A quick word from our partner

Stop flying blind.

Are you guessing how your dealership customer experience stacks up? Widewail’s Voice of the Customer Report gives you the most complete view of reputation performance in auto retail—built on over 2.7 million Google reviews from the first half of 2025.

Whether you want to benchmark your OEM’s reputation or uncover friction points in your sales and service experience, this report delivers the insights GMs need to stay ahead.

And new in the Q2 report: multi-year trending.

Right now, CDG newsletter subscribers get free access to the full Voice of the Customer Report for Q2 2025.

Go to widewail.com/voc-q2 to download the report free.

Employees are struggling with staffing shortages more than compensation.

64% of service managers report being understaffed—the highest shortage rate across dealership departments.

Now, dealers might be thinking well, no shit—there's a technician shortage, right? Wrong.

Ed claims that there is no technician shortage actually, but there is a shortage of developmental programs to create technicians.

So, he did something about it. Bozard created its own training initiative, Bozard Technical Institute (BTI), with a complete curriculum and vertically integrated training program.

But service is just the tip of the iceberg. Staffing shortages ranked as the number one pain point across all dealership roles (22%), even ahead of compensation complaints (16%).

CDG Dealership Workforce Survey

The toughest part is how tightly departments rely on each other. A shortfall in one area piles pressure on the next. Advisors overloaded with customers can’t keep technicians in sync, and sales teams stretched thin can’t convert shoppers into buyers.

The takeaway: Our industry needs to continue investing in training. The less training available, the less redundancy and cross-training potential in dealerships, which ultimately comes at the expense of both customers and employees.

Repetitive, low-value tasks are choking dealership productivity.

75% of dealership employees aren't concerned about AI taking their jobs.

But the 12% that are concerned are mostly BDC managers and administrative staff handling repetitive tasks.

Meanwhile, general managers and salespeople couldn't care less about AI threats because they see technology as operational leverage.

The real issue is too many employees spend their days on lower-value work like data entry, appointment scheduling, routine follow-ups, document processing. That’s time that could be spent with actual customers.

Which is exactly why Josh Clinton, General Manager of Cape Coral Chrysler Dodge Jeep Ram is betting big on AI efficiencies.

"I created a lead follow-up GPT. So, all you have to do on my salespeople side is take a PDF of the lead detail when you get a new lead. You upload it, it will spit back out an email template, custom tailored to the lead detail,” he told me on a recent episode of the CDG Podcast. “It will spit out a text template and then will also give you a phone script for any new lead."

Boom.

Instead of salespeople spending ~20 minutes crafting follow-up messages for each lead, they spend 2 minutes uploading a PDF and get personalized communication templates instantly.

Multiply that across hundreds of leads per month, and AI is helping to solve the time allocation problem that connects to everything we just covered.

The takeaway: The dealers who lean into automation are ditching the grunt work and giving their teams back time, focus, and energy.

When we put this all together…

Dealerships are running leaner, asking more from their people, and hoping compensation will paper over the cracks. But the data says otherwise. Even a chunk of well-paid employees are preparing to leave their dealerships.

Because when they say they’re burned out (running on empty, and buried in inefficiencies) they’re not bluffing.

They’re waiting for someone to fix it. And if their current dealership won’t, they’ll find one that will.

But the dealers boasting high retention rates today are the ones who stopped trying to outspend the problem, and are actually trying to fix what’s causing it in the first place.

What do you think? Would a 4-day work week last at your dealership/dealer group?

Missed Wednesday’s episode of Daily Dealer Live?

Presented by:

Mohawk Honda on becoming top-10 in CPO, Dealer Pay CEO on hidden payments costs

Featured guests:

Greg Johnson, General Manager of Mohawk Honda

Julie Douglas, CEO of Dealer Pay

This week on the

Remote deliveries are booming—so is fraud (here’s how to stay safe)

Shout out to MavSign for making this episode possible!

Stream now on:

"Fewer leads, more sales"—massive upsides, fatal flaws, and sobering reality of AI BDCs

Stream now on: