- Car Dealership Guy News

- Posts

- 🗑 Auctions overflowing with junk, EV deals and market share, Uptick in vehicle leasing

🗑 Auctions overflowing with junk, EV deals and market share, Uptick in vehicle leasing

Plus, always confirm vehicle availability...

Today’s topics:

🗑 Auctions overflowing with junk

📈 Uptick in vehicle leasing

🔋 EVs are gaining, but not everywhere

🚗 Shoppers corner: Always check vehicle availability

Reading time: ~2.5 min

Psssst… Hey you.

Will you take 2 seconds to subscribe to the CDG podcast so I climb the charts? It will mean the world to me 🙏

Apple, Spotify, Youtube… wherever you prefer.

Tweet at me afterwards to let me know you did it!

🗑 Auctions overflowing with junk

Auction buyers are seeing that the quality of inventory at auctions is still lacking. There is lots of junk, and buyers are getting exhausted trying to cherry-pick the “good” units without having to overbid. Dealerships have been adjusting their acquisition strategies leaning heavily on “street buys” (directly from consumers), using their service lane as well as digital acquisition channels.

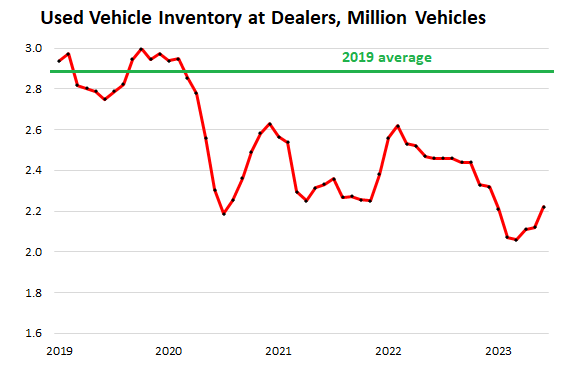

Inventory is also the tightest in the lower price segments: units priced under $10,000 are at 32 days supply, and the ones in the $35,000+ category are at 55 days. (Reminder: the days supply measures how many days it takes to sell a car at the current average daily sales rate). Despite tight inventories in the lowest priced segment, overall, prices have continued dropping and are almost 12% lower than a year ago.

Source: WolfStreet

Black Book’s report echoes the word from the street, noting that auction sellers are dropping their floor prices to move the inventory. We had one of the largest week-over-week price declines in compact cars and large trucks segments during the first week of August.

Source: Cox Automotive

Another message from the industry is that in the last 4 weeks sales have been slower in both, new and used segments. A slowdown is typical for July/August, although this time it is amplified by unusually hot weather across the country, vacation season, and high interest rates.

Weaker demand means accumulating supply: at the end of July there were 2.25 million unsold used vehicles on dealer lots, which is a new high for the year.

At the same time, Manheim reported that used car prices marginally increased in the first half of August. Why? This happens because dealerships are running on lean inventories to reduce their risk exposure and lower costs. However, when business shows signs of picking up, dealerships are panicking to resupply their lots, driving the prices up. This is the used car cycle I tweeted about:

My 30-second cheatsheet so you sound smart at the dinner table:

THE USED CAR CYCLE.

First, try to make sense of these 2 statements:

— 9 days ago, Blackbook reported that used car prices experienced the largest decrease since October.

— 9 hours ago, Manheim put out a report… twitter.com/i/web/status/1…

— CarDealershipGuy (@GuyDealership)

9:54 PM • Aug 17, 2023

We have opposing forces acting on the market. Used car supply is still very low, consumer credit is tight, high interest rates are driving floor plan costs up. While we see that prices are generally trending down, we are also seeing plenty of volatility, which will likely be with us for a while.

📈 Uptick in vehicle leasing

New car dealers are seeing an uptick in lease initiations. Faced with accumulating inventory, manufacturers turn to lease and finance incentives to help shoppers with affordability. Luxury brands are benefiting from the trend first.

During 2020-2021 residual values could not keep up with rapid increase in prices, which had a two-fold effect: a) consumers keeping their vehicles after leases since their market values were much higher than the residual values set at the time of lease initiations; b) leases were becoming less and less attractive because residual values were slow to catch up to prices, causing lease payments to be high. Wolf Street notes that lenders have not changed residual values much from 2021 levels, and this means they are betting that car prices will not significantly budge in the near future

Now, when wholesale prices are returning to more normal levels, lenders are cautiously opening up to leases still facing the headwinds of high interest rates, which makes payments unattractive.

Consumers who are cautious about potential rapid adoption of electric cars are more predisposed to leasing as a way to mitigate the risk of their cars becoming “irrelevant” due to the rapid pace of innovation in battery tech.

Together with Keyper Systems

Attention Dealers:

The industry-leading KEYper MX Key Management System allows you to:

Avoid losing keys by letting you know who took a car key, when, and why with a complete audit trail and reporting capabilities.

Prevent theft with a 16-gauge steel cabinet and high-security puck locks.

Make the demo and vehicle sales process seamless and simple with an easy-to-navigate user interface and bright LEDs indicating your car key when you open the cabinet to grab the key.

See real-time data in the palm of your hand, transfer keys in the field, and reserve keys for a customer appointment with the new mobile app, KEYper GO, designed to interact with the KEYper MX.

Take your dealership to the next level with the innovative key and asset management solutions.

Use the code CDG to get an exclusive, limited-time 25% off CarDealershipGuy discount.

🔋 EVs are gaining, but not everywhere

Talking to dealers about EVs, I hear that EVs are not easy to sell — Tesla being the exception. Coastal areas set EV penetration records, but rural areas, especially the ones with bad climate, are less interested. Some shoppers remain unconvinced by the environmental benefits of EVs. For others, it just doesn’t fit their lifestyle.

Some EVs have been especially slow to move off dealer lots, so manufacturers are throwing sweet deals. Here a few that I’ve seen:

Audi E-tron 10% off and 20K in rebates

BMW iX $9,900 lease credit and 2.6% interest rate

BMW i4 $7,500 lease credit

Mercedes EQS, 13% off MSRP and more on former loaners

Lucid Air can be leased for $800/month after their price drop and rebates

Volvo XC40 Recharge 11% discount, up to $10K in rebates

VW ID.4 has $2-$5K discount and $7.5K lease credit, leases for under $400/month

EV prices overall have been falling, with the average transaction price at $53,438, down from more than $61K in January. Plentiful inventory, better deals and growing consumer confidence in EV technology drove the market share of EVs to the highest to date, 9.26% of total sales in July, according to Wards Auto estimates. At the end of June, EV segment day’s supply was at 103 days, almost double that from the rest of the industry.

California is leading the EV trend, where Tesla just outsold Toyota in California selling 69K units, vs Toyota’s 67K. Tesla is not stopping there and just dropped the new “standard range” trim which is $10K cheaper than the next one. Working in the best traditions of a tech company, Tesla simply locked out some battery capacity via software to create the cheaper version.

Source: California Energy Commission

It is also notable that the newcomer, Rivian, sold 2,200 units, which is close to Land Rover’s territory with 2,900 cars sold.

🚗 Shopper Corner: Always confirm vehicle availability

Tip: when you call to check the availability of a vehicle on a dealer lot, ask to talk to a sales person and ask for a live walkthrough of the vehicle you are interested in via Facetime, Zoom, or some other teleconferencing app of your choice. Here’s why: when you make the first contact with a dealership, you will likely be speaking to a BDC (Business Development Center) representative, who’s performance is measured by the number of appointments scheduled and the number of people brought into the store.

Don’t fall victim to being lured into the store only to find out that the dealership does not have the car to sell you. There have been numerous occasions when a BDC manager assures a shopper that the vehicle of interest is in the showroom and makes an appointment to come see it. Guess what happens when the shopper makes a long trip to visit the dealership? The sales person shows up and says that unfortunately the vehicle has just been sold an hour ago (or was or was transferred, or is being repaired), but there are many other options they will be happy to show.

An upfront dealer would not do that. Instead they would inform you about the true status of the vehicle you are interested in and provide alternatives such as factory order the car you want, searching other storefronts or out of state dealers, doing a dealer-to-dealer trade, assisting with selecting a similar car, and so on.

Thank you for joining me again here on the CarDealershipGuy newsletter. See you soon!

Want to leave a review and tell me your thoughts about the newsletter? Reply to this email and let me know.

-CarDealershipGuy

Did you like this edition of the newsletter?Tell us what you think - we want to be the best. |

Reply