- Car Dealership Guy News

- Posts

- An unsustainable truth about EVs?

An unsustainable truth about EVs?

And a new look for CDG

Hey, everyone. I’m changing things up a bit around here (and no, that doesn’t mean I’m changing my POV on G-Wagons 😊). There are now more than 50K people reading this newsletter, and my goal is to improve your experience reading it. You can expect the same deep industry insights, big ideas, and trend-spotting — just with a slightly new look and on a more regular basis.

I do all of this for you, so please hit reply and share your feedback on this new format. See you at the bottom.

Was this email forwarded to you? Subscribe here to get weekly insights on the auto industry and what makes it tick.

Today’s Biggest News

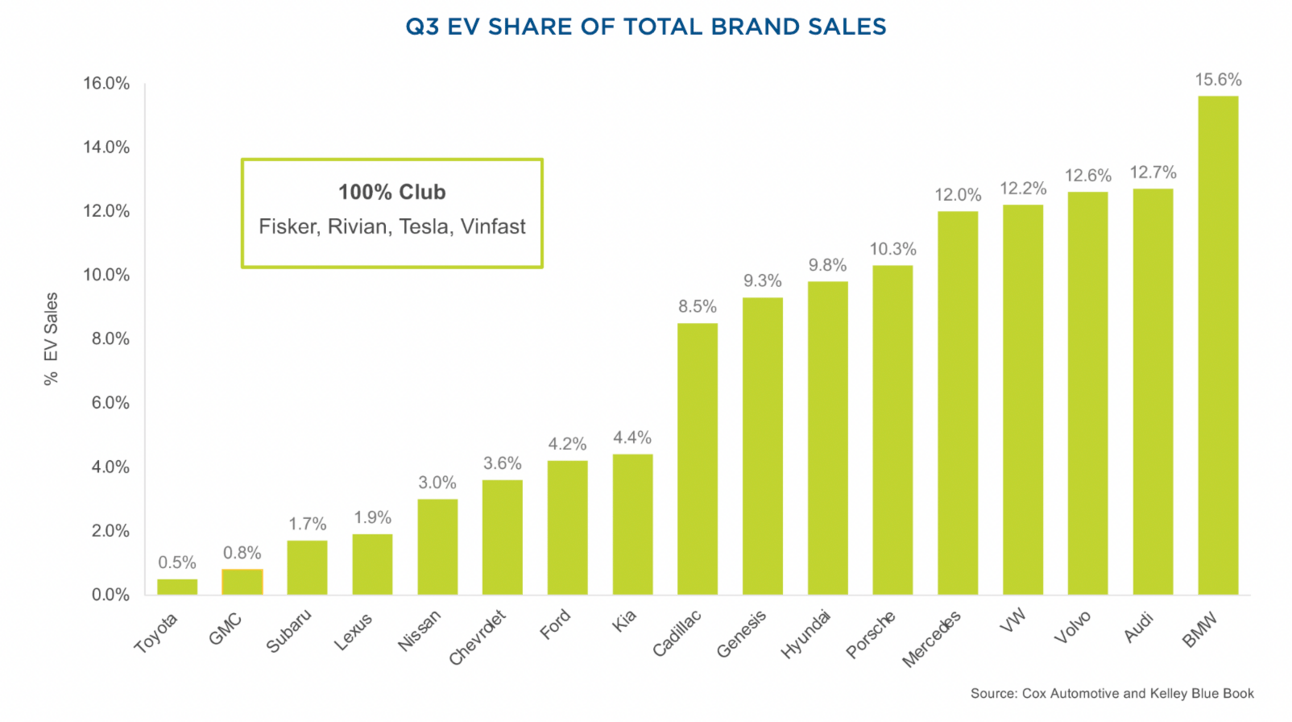

EV Sales Hit a Record… But Are Things *Really* Sustainable?

For the first time ever, EV sales in the U.S. jumped past 300,000 in Q3 to tally a 13th straight quarter of growth. Q3 marked a 49.8% increase in EV sales from a year earlier, according to Cox Automotive.

Breaking down the stats:

EV sales accounted for 7.9% of total industry sales in Q3, which is a record and a significant increase from last year.

50% of those third-quarter EV sales were c/o Tesla (but FYI, that’s Tesla’s smallest market share on record).

Volvo, Nissan, Mercedes, and Hyundai delivered increases north of 200%, thanks in large part to new products hitting lots (there were 14 new EV models on the market in Q3).

Via Cox Automotive

All signs point to an auto industry that’s shifting shapes. But there’s more to this transformation than meets the eye. Digging in deeper —

Reality check 1: Even with all those records, the pace of EV sales growth has slowed. The buyers who really wanted EVs (even at a premium) have already purchased them, and now dealers are trying to sell to a more hesitant group.

Reality check 2: A huge chunk of consumers aren’t used to paying north of $40K for a new car, especially given higher interest rates. The average price of a battery-powered vehicle was $50,683 in September. Pair that pricing reality with some range anxiety and you might understand why sales of hybrids—not EVs—are way outpacing last year’s numbers.

Reality check 3: Auto companies have announced more than $110 billion in EV-related investments in the U.S. since 2018. But the prices they can charge for those EVs (see above) to make good on their massive investments in tech and manufacturing are headed in the wrong direction. And the strikes don’t help.

Via the WSJ

Still, worth noting: The demand for EVs in the U.S. is shifting…but it’s still significant. Just take China, which has been cut out of U.S. EV manufacturing. But Chinese battery makers are chasing deals with U.S. free-trade partners South Korea and Morocco, according to the WSJ. They’re taking the long way into America’s EV market to capitalize on an industrial policy that heavily favors widespread EV adoption…even if it’s slow going for a bit.

Bottom line: While growth in the EVs space is still considerable, recent slowdowns suggest it may be time to temper expectations and invest in a future that includes a more smoothed out transition from combustibles to batteries.

Non-Car News (That Matters for Car People)

IN REGULATION:

The Federal Trade Commission wants to ban ‘unnecessary’ fees (for all industries—not just cars). In a new proposal, the FTC shared plans to ban businesses from charging hidden and/or misleading fees—that would require them to show the full price of whatever they’re selling upfront. It would hit ticketing, hotels, apartment rentals…a ton of industries across the economy.

But…maybe not car dealers. Why? The FTC is close to finalizing part of the so-called Motor Vehicle Dealers Trade Regulation Rule (aka the Vehicle Shopping Rule) which also deals with superfluous fees and misleading ads. That regulation would cover the auto industry, meaning Dealers would be excluded from the FTC’s proposed rule changes.

The case for banning fees in car buying: increase competition for American manufacturers and lower prices for American buyers.

The case against banning fees in car buying: Existing proposals are “overly broad,” according to NADA (National Automobile Dealers Association). New rules (whether from the FTC or other proposals) would add unnecessary costs, paperwork, and complexity to the car buying process.

Bottom line: Banning hidden fees feels like a win for consumers, but the FTC still has to decide what that ban might mean for dealers. I’ll be keeping a close eye on this.

IN VENTURE CAPITAL:

Venture capital investment has been slowing down across the board. For the first three quarters of this year, global funding reached $221 billion. Which is a lot of money…but a remarkable 42% decline from the same period last year.

Automotive tech and retail startups haven’t been immune to this slowdown. But our industry has had an interesting approach to filling the gap left by risk-averse VCs…dealers are now becoming investors, according to Automotive News.

For example:

The data management and digital marketing services startup Orbee just raised $4 million in venture funding from several dealerships: Flow Automotive, Pohanka Automotive Group, Holman, Mills Automotive Group, Qvale Auto Group, and Basil Family Dealerships.

Holman led a funding round for Vincue (which is a dealership technology platform focused on marketing and inventory management), and some dealers hopped in on the round as well.

Bottom line: Many dealers have effectively launched their own startups in getting their businesses off the ground. And having equity in new startups that can help streamline their operations with tech that gives them a competitive edge is a no brainer. But most importantly? Plenty of dealers simply have money to invest following the post-Covid boom times.

The Backlot

Strike update: UAW leadership said it won’t wait until Fridays to announce new strikes, instead calling out plants “when we need to, where we need to, with little notice.” This comes after the UAW expanded its strike to one of Ford’s most lucrative plants (the Kentucky Truck Plant) last week. FYI, GM and Ford report earnings next week.

New car prices were down 3.4% from the start of the year in September to $47,899. Higher inventory and some significant incentives have weighed prices down.

A follow-up: New car incentives hit a 24-month high.

Toyota will show an EV sports car and crossover at the Japan Mobility Show later this month. It’s been playing a bit of catch-up with other EV-hungry manufacturers, and this might be a big showing.

Jeffrey Brown, CEO of Ally Bank, is stepping down to become the president of Hendrick Automotive Group. TBH: I’m not sold on this strategy of execs switching sides.

Porsche delivered 242,722 vehicles in the first nine months of the year, up 10% annually. Europe was to thank for 51,742 of those—a 23% jump from this time last year.

Thanks for reading the new and (hopefully) improved CDG newsletter. Remember to share any feedback with me and my team by hitting reply (do it!).

-CarDealershipGuy

Did you like this edition of the newsletter?Tell us what you think - we want to be the best. |

Reply