- Car Dealership Guy News

- Posts

- 📣 UAW Strike: Impacts on the car market

📣 UAW Strike: Impacts on the car market

Plus, why older cars are a problem for lenders.

Today’s topics:

📣 UAW Strike: Impacts on the car market

💼 Older cars — a problem for lenders?

👛 Shoppers Corner: is this lease a good deal?

Reading time: ~3.5 min

📣 UAW Strike: Impacts on the car market

The UAW strike topic is on everyone’s mind, but the strike has not materially affected car prices… yet. Here’s why: the strike has been focused on a few assembly plants and warehouses. In August, the automakers increased their inventories and most were enjoying 50 to 60 day supply. So far, the healthy supply mitigated the immediate impact on dealers. In fact, the strike may even help clear out some models that were piling up, and manufacturers won’t have to use cash and financing incentives to push old inventory.

Profitable pickup trucks remained in production since the strikes started. But now, about a month later, UAW is expanding its strikes to Ford's Kentucky Truck Plant, adding another 8,700 workers to picket lines.

Where the strike has started to hurt is existing GM / Stellantis customers who need vehicle repairs. A little known fact is that service parts are the one area where auto manufacturers rarely lose money. But dealerships are now starting to lose access to parts deliveries. (Some prudent dealers managed to over-ordered parts last month in anticipation of these issues).

Auto body repair shops are still dealing with lingering supply chain issues caused by the pandemic in 2020. A prolonged strike could worsen the situation. Some shop owners are switching to using third-party parts suppliers and junk yards to fill in the gaps.

There are other macro effects to consider. The strike will certainly affect the Big Three’s (GM, Ford, Stellantis) transition to EVs. Declining profits may result in cuts to research and development, while Chinese manufacturers may find ways to introduce low-cost EVs into the US market. Competing with them on the price will be a slow death for the domestic auto industry. Unions will certainly not win if American industry is squeezed by the arrival of cheap EVs from China.

Speaking of EVs, one interesting observation hit my inbox from a follower who happens to be a Ford dealer:

Ford trying to stimulate EV sales by training dealers on better 'talking points' 🤔

— CarDealershipGuy (@GuyDealership)

4:08 PM • Oct 10, 2023

If the strike expands it will play into the hands of Asian and European car manufacturers, but only if they can fill the gap in production. After all: no inventory = no sales. In any case, lower inventory across all makes will push new car prices up. Cash and financing Incentives may dry up as well. Even though KBB reports that new car Incentives just hit a 24-month high, most incentives are for luxury vehicles.

In the last few years we saw that the automotive supply chain is a complicated and fragile network. It has been slowly recovering from the pandemic and can be easily disrupted upstream and downstream by longer-term effects of the strike.

Reduced new car inventory caused by the strikes may create tailwinds for used car dealerships, especially the large ones that can leverage efficient cost structures and advanced technology platforms. Stabilizing used car prices and improved affordability allows these dealerships to sustain their profitability. They can source the inventory directly from consumers without relying on manufacturer trade-in programs. The latest data from Carmax shows that last quarter the company sourced most of its inventory directly from consumers trading in their cars.

💼 Why older cars are a problem for lenders?

Today’s used car shoppers have to buy cars more than twice as old for the same money as they did in 2019, according to ISeeCars. For example, for $23,000 you could have bought a 3-year-old used car in 2019, but today $23,000 won’t even buy a 6-year-old car. Given that the average car is driven between 10,000 and 15,000 miles a year, these cars are not only more than twice as old, but have between 40,000 and 100,000+ more miles.

The chart shows how older vehicles are now dominating the market.

There are several implications for lenders here:

How is no one talking about this?

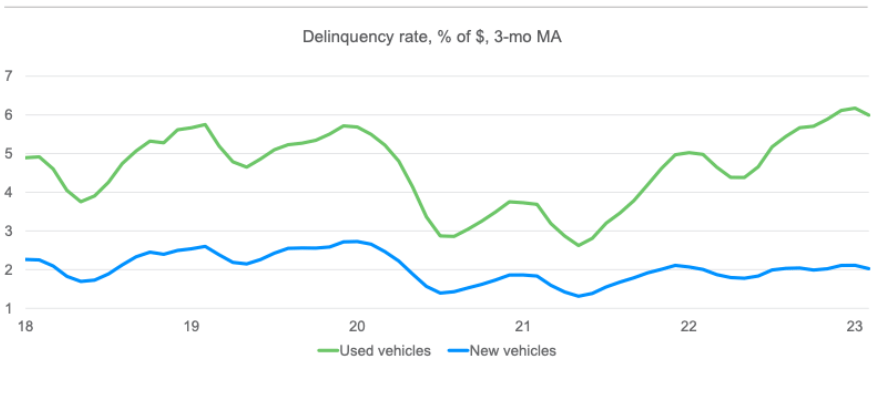

Auto loan delinquencies have risen past pre-COVID levels.

Not a crisis but concerning trend.

(via Experian)

— CarDealershipGuy (@GuyDealership)

11:45 AM • Oct 8, 2023

Older vehicles are less dependable and thus are riskier assets for lenders. The age of a vehicle at the time of purchase has been correlated to the likelihood of defaulting on a auto loan. Older cars are more susceptible to breakdowns and do not come with warranties, so when borrowers face unexpected repair expenses, there’s a higher chance that they will default on their loans.

The delinquency rate for used cars has been trending higher than that of used cars.

Diverging delinquency rates for new and used car loans (Equifax data)

The situation has been amplified by the increased cost of ownership. Rapidly rising increase in prices of parts, repair labor, and insurance costs make it challenging for borrowers to make payments on their car loans.

Raising prices of maintenance and insurance (FICO)

Another factor contributing to lenders’ risk is declining used car values. A lot of shoppers who took out loans in 2021 and early 2022 are now underwater on their loans.

Finally, some lenders failed to implement stricter credit policies in time and have no choice than to aggressively scale down their auto lending portfolio to weather the storm. Loans with terms of 70 months, inflated credit scores, lenient assessments of the ability to pay means that some lenders are facing a rough road ahead.

Moody’s analysts predict significant expected losses on current portfolios, particularly on the older used vehicles.

It is not surprising to see the spike in rejections for consumers. The rejection rate for auto loans reached 14.2%, which is the highest level since the Federal Reserve Bank of New York began keeping track in 2013. Rejections are up from a rate of 9.1% in February.

Together with Keyper Systems

Attention Dealers:

The industry-leading KEYper MX Key Management System allows you to:

Avoid losing keys by letting you know who took a car key, when, and why with a complete audit trail and reporting capabilities.

Prevent theft with a 16-gauge steel cabinet and high-security puck locks.

Make the demo and vehicle sales process seamless and simple with an easy-to-navigate user interface and bright LEDs indicating your car key when you open the cabinet to grab the key.

See real-time data in the palm of your hand, transfer keys in the field, and reserve keys for a customer appointment with the new mobile app, KEYper GO, designed to interact with the KEYper MX.

Take your dealership to the next level with the innovative key and asset management solutions.

Use the code CDG to get an exclusive, limited-time 25% off CarDealershipGuy discount.

👛 Shoppers Corner

Look at the ad above (this isn’t a sponsored post, just sharing for context).

You’ve likely seen thousands of these in your lifetime. But is this lease deal too good to be true? There have been a few ads advertising special lease deals, such as ‘23 Chevy Equinox for $169 per month or ‘24 Chevy Trax at $94 per month. These deals seem to be great, but is there a catch? Let’s dig in:

1. Typically these leases are calculated on a very basic, low MSRP model, with no options. Realistically, such units are unicorns that are almost never ordered by dealerships because they are impossible to move: everyone wants heated seats, larger screens, nicer wheels, safety tech, etc.

2. These lease deals are calculated with all possible discounts. You are not likely to qualify for all of them: you must currently lease a Chevrolet (or have a non-GM lease in the household), you should be a first responder or a healthcare worker, a student or a recent grad, military, or an educator… and have an active GM credit card, and live in a certain region.

3. Lease payments are calculated with a significant downpayment. While it does reduce the monthly payment, it is a bit misleading because if you were to spread the down payment over the term of the lease, you will end up with an effectively much higher monthly payment.

4. These low payments are typically given for a low mileage allowance of 7,500 or 10,000 miles per year, with high fees for excess mileage.

5. To qualify for such a lease, you should excellent credit history.

I’ll state the obvious: if something looks too good to be true, it probably is. (Doh!) Always read the fine print.

Thank you for joining me again here on the CarDealershipGuy newsletter. See you soon!

Want to leave a review and tell me your thoughts about the newsletter? Reply to this email and let me know.

-CarDealershipGuy

Did you like this edition of the newsletter?Tell us what you think - we want to be the best. |

Reply