Presented by:

Hey everyone,

Hiring and keeping the best talent starts with the right compensation.

So, CDG Recruiting crunched the numbers from 1,000+ convos and 400+ placements to give you real salary benchmarks for GMs, GSMs, Controllers, Fixed Ops, and more.

Download the free 2025 Automotive Dealership Compensation Report now for the insights you need to stay competitive.

First time reading the CDG Newsletter?

Welcome to The Breakdown, an analysis of auto retail’s top trends, moves, and insights—in under 5 minutes.

Every year when summer rolls around, the theme of season is typically incentives, incentives, incentives.

But 2025 has been anything but typical.

This year, many auto manufacturers are pre-gaming tariff pain by pulling back on incentives before they're potentially forced to jack up sticker prices later. Meanwhile, dealers are stuck playing bank, therapist, and magician to keep deals alive.

Here are three dynamics shaping the incentive landscape that explain what I mean...

Automakers are trimming vehicle incentives ahead of expected price hikes.

"We were increasing incentives in Q1, but Q2, we did see them drop as expected," Tyson Jominy, vice president of data and analytics at J.D. Power told me.

The damage:

In Q1, incentives increased $150/unit year-over-year ($2,900+). However, by Q2, they crashed to $2,700/unit (J.D. Power)

But May was particularly brutal. VW, Mazda, Land Rover, Volvo, and BMW all chopped incentives by 10%+. And Chrysler, Jeep, Ram followed with notable cuts. (Cox Automotive)

Also in Q2, 0% interest finance deals made up just 0.9% of new car loans—the lowest share on record since 2004. (Edmunds)

"Typically, at this time we would start to see incentives ramping up as it is the summer selling season. So, we are seeing a decline and it is bucking the seasonality trend," Jominy said.

But the kicker is, real tariff pain probably won't hit until Q4. JD Power expects transaction prices to spike 4% by year-end. But OEMs aren't waiting—they're pulling support now to protect margins later (minus Ford of course).

The exception: EVs incentives hit a record 14.8% of the average transaction price. But it's a fire sale. President Trump is axing the $7,500 credit after September 30.

Which means...

A quick word from our partner

Let’s be honest—promises don’t close deals. Performance does.

If your tools aren’t delivering real results, it’s time to upgrade.

CarNow helps dealerships connect, convert, and close more leads with a fully integrated retail platform. One store jumped from a 3% to a 30% close rate in just a month after switching to CarNow. From Chat & Messaging to ReConnect’s assisted follow-up, everything works—and it works together.

Right now, CarNow is offering a free performance consultation to show how much more you could be getting out of your current traffic.

But this offer won’t last forever—book your consult to see the difference real performance can make.

Dealers are offsetting incentive cuts by customizing deals around what customers can actually afford.

With OEM support fading, affordability pressures are landing squarely on dealers' desks.

Alex Perdikis, owner of Koons Motors told me trade appraisals happen first now. When a customer with a Fiesta wants an Expedition, his team digs deep up front into current payments, life changes, and income.

Alex Perdikis

The customer might have twins on the way or just got a promotion. But if they're paying $299/month for a Fiesta and think a $90,000 Expedition costs $500/month, they need to have that conversation before the test drive.

Because the alternative sucks. Showing someone a truck they can’t afford, then trying to walk them back to a cheaper model doesn't work. This isn't a unique strategy to Koons, but it's an effective one.

Meanwhile, dealer and entrepreneur Paul Sansone, Jr. straight up built his own financing ecosystem by rolling out a lease-to-own program.

Paul Sansone, Jr.

The mechanics: Credit-challenged customers pick a car and lock in today's purchase price.

They then enter a prepaid month-to-month lease with higher than typical payments (stick with me here).

The key is Sansone holds back half of each payment—half goes toward the lease, and the other half accumulates as the customer's future down payment.

Usually, after 24 months, they've built up thousands in funds without having to save on their own, and they're ready to transition into more traditional financing.

And throughout the process, customers work with credit coaches and every payment reports to the bureaus. Scores typically jump 50-100 points within a year.

For Sansone, the benefits are massive. He earns profit on the initial lease spread. And when customers convert to traditional financing, he captures finance reserves. But the best part is, these customers usually turn into lifelong clients.

But there is some good news on the affordability front...

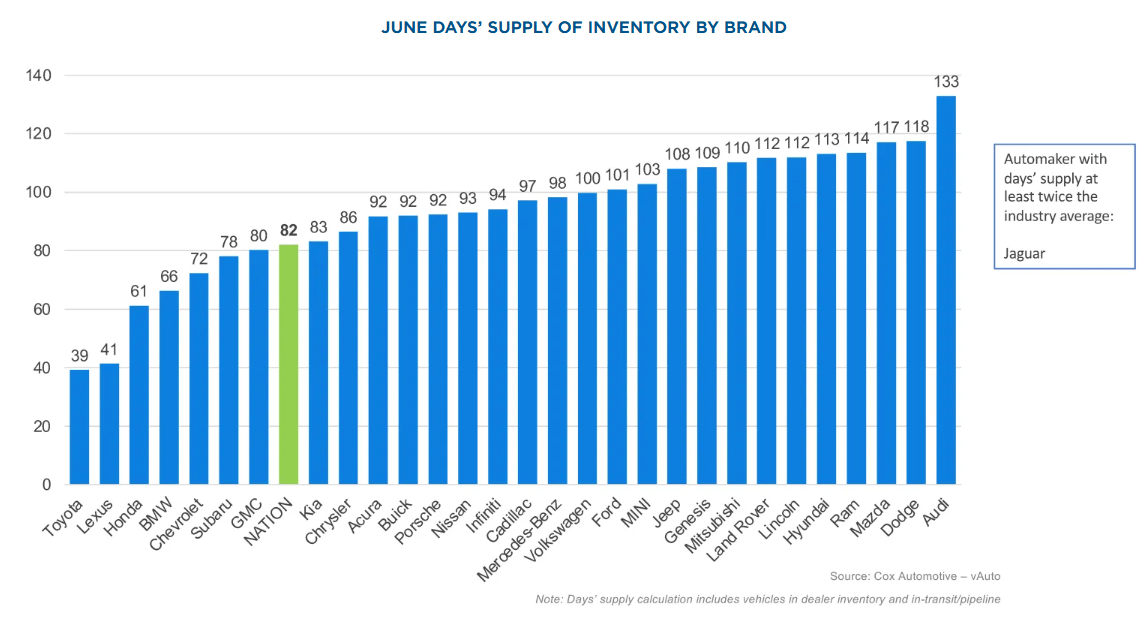

This standoff over incentives will likely break down as inventory keeps stacking up.

Imported vehicles keep rolling in, despite the tariff concerns, and with 90-100 days of aging inventory, dealers are stuck with rising floor plan costs.

Via Cox Automotive

But here's the problem, it's become a game of chicken.

"Automakers likely still feel they are in a war for market share, no one wants to blink first," Cox Automotive’s executive analyst Erin Keating told me.

OEMs want to protect margins while dealers manage the affordability gap. But inventory doesn't lie.

"We've never been in a history that sits by and says, let's just let it age," Keating said. "If sales continue to plateau, I think we'll see incentives come back."

The pressure keeps building. Inventory is stacking up. Sales are slowing down. Model Year 2026 launches are out of whack, and year-end targets are looming.

My bet? Something breaks by fall.

Big picture: Incentives will likely stay suppressed through summer, but by Q4, the math stops working.

Rising inventory will force manufacturers to choose between market share and margins. Expect the incentive spigot to reopen in the next few months, first with targeted programs on slow movers, then broader support as competition ramps up.

What are you seeing out there in the market right now?

Missed yesterday’s episode of Daily Dealer Live?

Presented by

@Farzyness on DTC cars, Bozard on mobile service ROI, OPENLANE on used market

Featured guests:

Ed Roberts, COO of Bozard Ford Lincoln

Justin Zane, SVP at OPENLANE

Farzad Mesbahi, Content Creator, Ex-Tesla

This week on the

The auto retail crystal ball—what shipping trends reveal (and how dealers can win)

Shout out to DLRdmv, ActivEngage, and Auto Hauler Exchange for making this episode possible!

Stream now on:

“Innovate or evaporate”– how small dealer groups can win in ultra-competitive markets

Shout out to CDK Global, OPENLANE, and Nomad Content Studio for making this episode possible!

Stream now on: