Presented by:

Hey everyone,

Our 2025 Automotive Dealership Compensation Report—collected from 1,000+ recruiting conversations for all major roles in the dealership went live on Friday!

Inside are real pay ranges for top roles across 25th - 90th percentiles, plus elite performer premiums and actionable strategies to apply this data to your store today.

100% free to download. Read it now.

— CDG

First time reading the CDG Newsletter?

Welcome to the Market Pulse—your no-fluff cheatsheet to auto retail, built to help dealers price right, stock smart, and stay ahead.

Warranty payouts are rising: Auto parts suppliers covered $2B in repairs last year (↑ 3% YoY) and set aside nearly $4.7B more for future claims (↑ 6%).

That’s because OEMs are offloading more warranty costs to suppliers: When those suppliers push back, dealers get stuck waiting for reimbursement, while covering labor, parts, and time upfront.

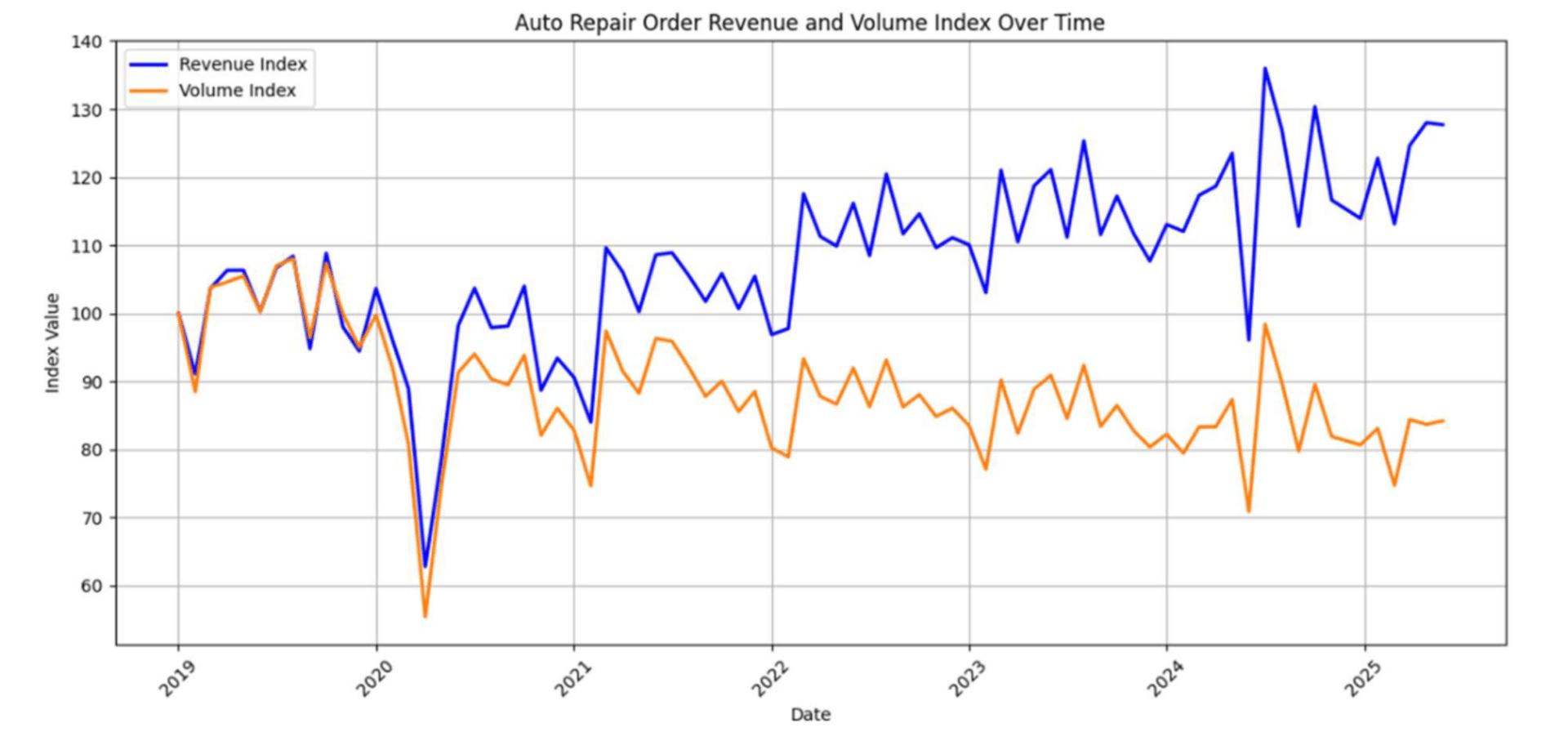

Meanwhile, service revenue is climbing, but not from more repair orders (ROs): The Xtime Service Revenue Index is up in 2025, but volume is flat. That means higher costs per RO, not more work.

(Source: Warranty Weekly / Xtime / Cox Automotive)

OEMs are pushing more warranty costs to parts suppliers, and it’s slowing dealer reimbursements.

In 2024, U.S. auto part makers—especially those building engines, transmissions, and drivetrains—paid $2B in warranty claims and set aside another $4.7B for future repairs.

Why: Because OEMs are now asking these suppliers to cover more of the repair costs under warranty.

That’s a shift from how it used to work, when OEMs often just paid the claim themselves.

WHY IT MATTERS:

When suppliers and OEMs dispute who pays what, reimbursement to the dealer can slow down or shrink.

While those two are sorting it out, dealerships are still doing the work. Like diagnosing the issue, fixing the car, and covering labor costs.

The result: More time with vehicles sitting on-site, more money tied up per job, and more risk that the warranty claim is reduced or denied.

Warranty repairs are getting more expensive, even when volume isn’t growing.

In 2025, service departments aren’t necessarily seeing more customers. But they are charging more per job, according to Cox Automotive’s Xtime data.

Index sourced via Xtime/Cox Automotive

That usually means the repairs themselves are getting pricier—think newer cars with more sensors, software, and expensive parts. And that labor is taking longer, and the components are costing more.

WHY IT MATTERS:

If the job is warranty-covered, the OEM pays you back—but only up to a point. And when the repair takes too long or parts are hard to source, your store may be stuck covering the extra time or cost just to keep the customer satisfied.

That can eat into profit fast, especially on complex tech-driven jobs where the payout doesn’t match the work.

A quick word from our partner

Every customer has unique driving habits, service histories, and maintenance needs.

That’s why dealers are ditching one-size-fits-all marketing and relying on Impel's Service AI Agent for individualized service outreach.

Delivers personalized engagement across 100+ touchpoints

Tailors outreach based on VIN-specific intervals, sales and service history, and individual driving behavior

It's like having a vehicle concierge customers can interact with

Messy DMS data doesn't hold this agent back either. Impel AI captures zero-party data, helping you update records for more effective marketing.

You don't need dozens of tools to boost customer lifetime value. You need one AI Operating System.

Request a personalized consultation at go.impel.ai/CDG today!

The best defense right now is airtight warranty ops.

Here’s how top fixed ops leaders are protecting gross and avoiding chargebacks.

Do: Know your OEM’s warranty policies inside and out.

Brad Barley, ASE Master Tech and independent claims inspector, says most losses come from misinterpreting policy, not parts shortages, but techs unclear on what qualifies or how to document it.

That’s why he recommends making two moves:

Apply to have your warranty labor rate and parts pricing match your customer-paid rates, if the OEM allows it.

And when it comes to admin, look into hiring “a retired technician who's good with paperwork or an SM for your warranty administrator.”

“They know the technical side and can be invaluable when it comes to navigating complicated claims.”

Brad Barley

Do: Track repair time and make it visible.

At Bozard Ford Lincoln, time-to-complete is a tracked stat that even breaks ties for Technician of the Month, according to COO Ed Roberts.

Why: Because time is margin. And when everyone knows who’s fastest, it drives urgency.

COO Ed Roberts says their top techs also work in pairs.

“All the most successful techs, who turn the most hours, are the ones who operate in a two-man team. They drew the conclusions amongst themselves, that to be a superpower in the shop, you gotta partner up with someone.”

Ed Roberts

Do: Use apprentices for repeat warranty jobs, then quality check with experienced techs.

Michael Hall, service director at Honda of Lake Jackson, says that repetitive warranty repairs are a perfect fit for apprentices.

“One way to lower expenses is to have an apprentice train to perform these warranty jobs. When the job is completed, a qualified tech inspects the work. In many cases, this will lower the labor expense and raise the gross profit for that particular warranty job.”

Michael Hall

This also frees up top producers for complex customer-paid repairs or diagnostic hours.

Do: Negotiate your rates and review your payment timeline.

Brian Bradley, service manager at Superior Honda and Acura of Omaha, told us he’s seen warranty volume surge this year.

“My dealerships have had a massive uptick since the beginning of the year (like 60-80%), while our customer pay is decreasing because of our obligation to the manufacturer.”

Brian Bradley

So to protect margin, Bradley partnered with Armatus to renegotiate labor rates, and now carries “close to 80% gross profit with warranty repairs.”

Not a vendor pitch.

Just a reminder: If the work’s increasing, the pay rate (if possible) should be too.

Warranty margin is thinning, and tariffs could blow it wide open.

Because repairs aren’t getting cheaper. And support isn’t getting faster.

That’s the math every store should be watching right now.

Have a tactic, workaround, or pain point?

Drop it in the poll at the bottom, and we’ll build a follow-up.

Missed yesterday’s episode of Daily Dealer Live?

Presented by:

Dealerships vs Tesla: Who wins and loses with Alex Lawrence, Don Hall, Michael Oz

Featured guests:

Alex Lawrence, CEO of EV Auto

Don Hall, President of The Virginia Automobile Dealer Association

Michael Oz, Owner of DriveOz.com