Presented by:

Hey everyone,

We just updated CDG’s Dealership Buy/SellTracker, covering acquisitions from the beginning of the year to today.

Bookmark it to stay up to date on the movers and shakers shaping the retail auto industry. 100% free to read.

— CDG

First time reading the CDG Newsletter?

Welcome to the Market Pulse—your no-fluff cheatsheet to auto retail, built to help dealers price right, stock smart, and stay ahead.

New vehicle spending is hitting records: But mostly because monthly payments just hit $742 and incentives dropped to 6.1% of MSRP. Sales volume only rose 4.1%.

Used vehicle prices are stabilizing: June sales hit 1.46M, and dealers have about 45 days of supply. Retail prices are sitting between $24K and $25K, flat vs recent months.

Local pricing and stocking strategies are winning: Dealers seeing success are aligning inventory and payment offers to what buyers in their ZIP code can afford.

(Source: Cox Automotive / KBB / St. Louis Fed / Experian)

New car buyers are spending record amounts while facing higher prices and shrinking deals.

U.S. consumers are on pace to spend $49.8B on new vehicles this month, the highest July total on record, per J.D. Power.

But that record is mostly inflation:

The average monthly payment just hit $742, a July high.

Incentives fell to 6.1% of MSRP, meaning fewer discounts.

Actual sales volume is only up 4.1% YoY.

Oh, and monthly payments have risen 45–60% since 2015, pushing average spend from 9–10% of household income to 13–14%.

Location also matters, because in 2024, Texas and Florida each sold over 1M new vehicles, while Midwestern states like Ohio, Michigan, and Indiana moved less than half that.

NOTE TO DEALERS:

When sales volume climbs but affordability gets worse, using ZIP codes and local trends to match inventory and price points offers an edge.

Do what makes sense for your ZIP, dial in what’s moving, what’s not, and experiment with messaging.

Think: “Get your RAV4 before prices quietly climb.”

Used car prices are holding, but a small swing in supply could shift retail pricing by September.

In June, U.S. dealers sold 1.46 million used vehicles, per Cox Automotive. That’s down slightly from May, but still up year over year.

Meanwhile, inventory is holding steady at around 45 days of supply, normal for this time of year.

That’s keeping retail prices flat, with most used cars selling between $24K and $25K.

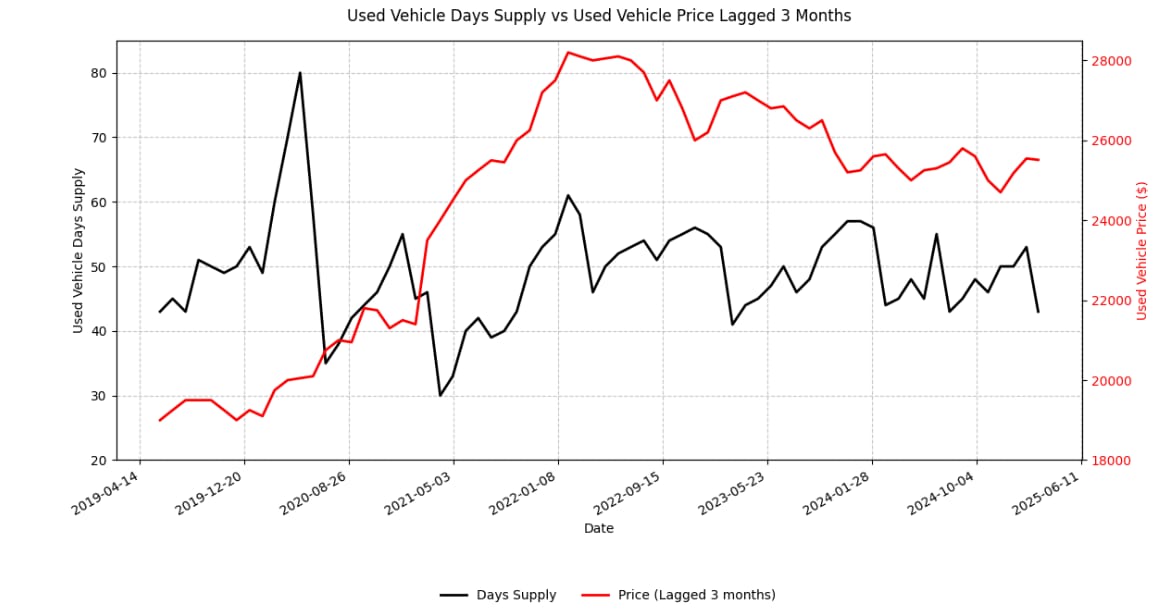

But that kind of stability doesn’t always last, because retail pricing typically shifts about 90 days after inventory moves, which you can track in the chart below:

CDG analysis via Joe Cecala

Take 2021, when prices jumped three months after supply dropped. And 2022, when prices fell three months after supply piled up.

WHY IT MATTERS:

If the number of used cars on dealer lots rises enough to add 5 to 7 days’ worth of inventory, retail prices could start dropping by September or October.

And if supply tightens instead, prices are more likely to hold or climb heading into Q4 (my gut tells me this is the more likely scenario).

A quick word from our partner

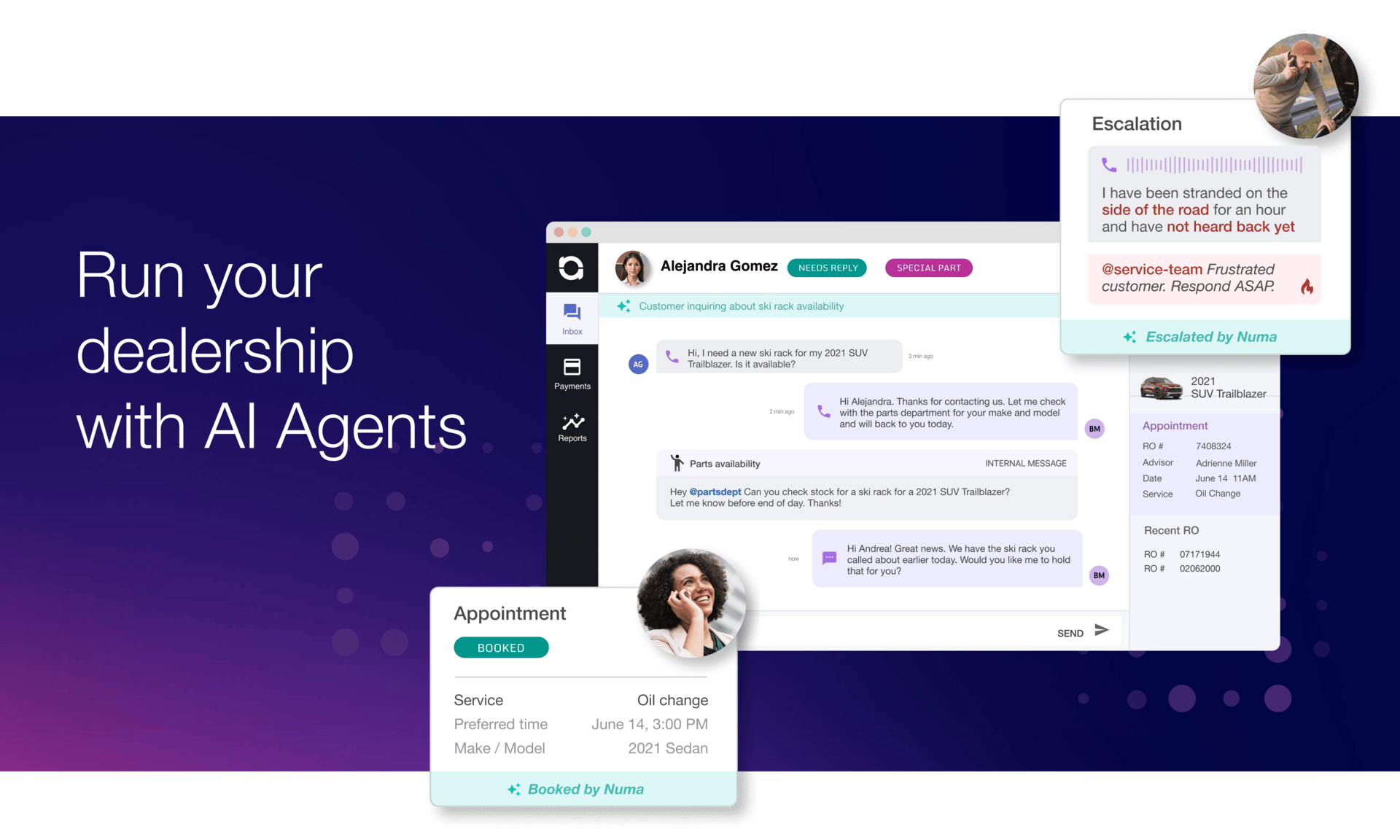

Boost CSI. Maximize revenue. Elevate dealership performance with AI.

In the world of dealerships, service is everything — but it’s also where everything breaks down.

Missed calls, unreturned voicemails, and long hold times are the top drivers of low CSI scores, poor customer retention, and millions in lost revenue each year.

Enter Numa — an AI communication platform for dealerships.

Get complete visibility into all service interactions and address communication breakdowns with powerful AI Agents that:

Capture and handle 100% of missed calls

Automate appointment booking

Deliver proactive customer updates

Record, analyze, and score every call

Eliminate manual tasks and operational workflows

Special offer for CDG readers: Try Numa risk-free with a 30-day satisfaction or money-back guarantee.

Used prices are steady. New-car spend is climbing.

But what’s really driving results is ZIP code-specific strategies, not national trends.

That’s exactly what Sean Christofferson, sales manager at a Subaru store in the Midwest, is focused on right now. Chasing what sells in his own backyard.

“We are seeing the increase [in] demand on the sub $25K category, so I am trying to source cars I can buy for $20K and under.”

Sean Christofferson

To do that, he’s dialed in his sourcing:

66% of inventory is under $25K; 30% is under $20K

Targets clean-title cars under 10 years old for easier financing

Greenlights recons if he sees $1K+ in profit, even on rough units

Pays up to 115% cost-to-market on service-lane trades with clean history

Avoids CPO-eligible units, skips Florida and west of the Rockies, and spends 3+ hours/day on auction filters

Meanwhile, Randy Carlton, GM of Volvo Cars Bellevue, is seeing the opposite of what Sean’s facing.

In his affluent Seattle-area market, he said layoffs in tech and government are pushing even $300K–$500K income households to rethink what they spend on a car.

They’re still shopping premium, but only if the monthly payment makes sense.

That’s where Volvo’s lease rates and finance specials come in. In many cases, monthly payments on new cars are matching or beating CPOs, and his leads are moving accordingly.

To keep inventory moving, he’s leaning hard into new-car turns, clean trades under $50K, and street buys under $30K.

“I came from domestic car land with a new car mentality. Sell lots of new and take in clean trades. I shifted when I took over Volvo, and it worked because new cars were slow. Now I’m shifting based on demand.”

Randy Carlton

Two markets and two very different plays.

New car buyers are spending more than ever, but not because they’re getting more car. Payments are up. Incentives are down. And used prices are one small swing in supply away from moving hard in either direction.

But these dynamics are largely out of dealers’ control. What they can control, is how well their inventory, pricing, and messaging match what their local customers actually want—and can afford.

Tell us about your local market. What are car shoppers actually buying?

Let us know in the poll at the bottom.

Missed yesterday’s episode of Daily Dealer Live?

Presented by:

Manheim on Auction Changes, Easterns on Ad Best Practices, Fox on Tech Blunders

Featured guests:

Joe Kichler, Senior Vice President, Digital and Supply Chain at Cox Automotive

Joel Bassam, President of Easterns Automotive Group

Yuriy Demidko, Senior VP / Chief Information Officer at Fox Motors